Imperial Oil Rolls Back U.S.-Bound Exports, Citing Surge in Cost

01 Febrero 2019 - 8:05PM

Noticias Dow Jones

By Vipal Monga

Exxon Mobil Corp.'s Canadian unit Imperial Oil Ltd. is scaling

back the amount of U.S.-bound oil it ships by rail from the

province of Alberta to nearly zero this month.

The company shipped an average of roughly 90,000 barrels a day

by rail to U.S. refineries in January, Imperial Chief Executive

Richard Kruger said during a conference call Friday. A recent surge

in the price of western Canadian heavy crude -- fueled by an

Alberta-mandated production cut unveiled in December -- means it

has become too expensive to ship that oil on trains, Mr. Kruger

said.

The move represents about 2% of the 3.54 million daily average

barrels Canada exported to the U.S. for the week ending Jan. 25,

according to data from the U.S. Energy Information

Administration.

According to a transcript of the call, Mr. Kruger said the

decision to largely halt the crude-by-rail shipments is "a very

tangible example of what we believe is ill-advised, ill-informed

negative consequence of this curtailment order."

Moving a barrel from terminals in Alberta to the U.S. Gulf Coast

costs Imperial between $15 and $20 by rail, Mr. Kruger said. That

price tag exceeds the premium of U.S. crude to Canadian, which was

at $9.95 a barrel earlier this week, according to S&P Global

Platts. That puts shippers at risk of missing out on profits even

after Canadian prices rose.

In October, the discount on western Canadian crude relative to

the U.S. benchmark hit a decade high of more than $50 a barrel.

In response to rising inventories in the province, created by

limited pipeline capacity, the government of oil-rich Alberta cut

local crude production by 8.75%, or the equivalent of 325,000

barrels a day.

Since the output cut was unveiled, the benchmark price for a

barrel of western Canadian crude climbed to $46 this week from

$22.

Canada is the fourth-largest oil producer in the world, with the

bulk of output in Alberta. Alberta's move to cut production was

criticized by

large oil producers in the province, such as Imperial and Suncor Energy Inc., as an unwarranted interference in free markets.

Imperial's decision is "absolutely a big deal," said Mike Walls,

an analyst with data firm Genscape. He added the move will cause

the inventory drawdown in Alberta to slow, and put downward

pressure on western Canadian crude prices.

Imperial's announcement comes as demand for heavy crude is

increasing in the Gulf Coast. The U.S. government's decision to

sanction Venezuela's oil producer Petróleos de Venezuela SA, or

PdVSA, is expected to deplete the supply of those crude grades.

Alberta Premier Rachel Notley said this week her government

would allow slightly more production in February and March, the

equivalent of 75,000 a barrels a day, because of the runup in the

price of western Canada crude.

Mr. Walls said Imperial's announcement effectively neutralizes

Alberta's announcement this week.

Write to Vipal Monga at vipal.monga@wsj.com

(END) Dow Jones Newswires

February 01, 2019 20:50 ET (01:50 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

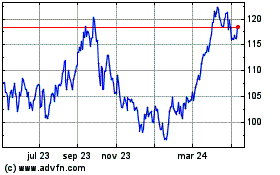

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

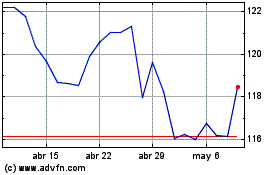

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024