By Bradley Olson

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 2, 2019).

HOUSTON -- The world's largest Western oil companies shrugged

off a 38% plunge in oil prices during the final months of 2018 to

post some of their biggest annual profits in years.

Strong fourth-quarter earnings Friday by Exxon Mobil Corp. and

Chevron Corp., following similar results by Royal Dutch Shell PLC

on Thursday, proved the extent to which the oil giants have

transformed amid lower crude prices.

The top five generated more profits last year, when crude prices

averaged just $71 a barrel, than in 2014, when global crude sold

for an average of almost $100 a barrel.

Including estimates for BP PLC and Total SA, which report next

week, they are set to post 2018 profits of about $84 billion,

according to FactSet data. That is about $10 billion more than four

years ago.

The companies are seeing benefits from a more disciplined

strategy focused on returns and profitability over growing

production, a demand from many investors who have been disappointed

by lackluster performance in recent years. Exxon and Chevron stock

prices rallied by more than 3%. Shell's U.S.-denominated shares

rose by more than 4% Thursday, the most in three months Chevron's

board authorized a $25 billion share repurchase program after the

company bought back $1 billion in stock in the fourth quarter, a

signal to investors that returns continue to be a top priority.

Collectively, the companies have restructured their businesses,

sold off assets and positioned themselves to thrive even when crude

prices swing up and down wildly.

Exxon, Chevron, BP and Shell are also turning to U.S. shale

drilling in the booming Permian Basin in West Texas and New Mexico,

where it is possible to increase production without a

multibillion-dollar project that could take at least a decade to

make money.

Despite the fall in prices at the end of the fourth quarter,

Exxon still generated $6 billion in net income in the period --

lower than the year before, which was boosted by the U.S. tax

overhaul, but still better than analysts had expected. Chevron said

net income was $3.73 billion, up 19% from the same time a year

ago.

"These companies have figured out how to operate in this new

environment, and they have adjusted well" to lower prices, said

Brian Youngberg, an analyst at Edward Jones in St. Louis.

"The key going forward will be maintaining discipline. This is

now a low-growth industry, so you've got to invest well," he

added.

Exxon and Chevron stock prices rallied by more than 3%. Shell's

U.S.-denominated shares rose by more than 4% Thursday, the most in

three months. Chevron's board authorized a $25 billion share

repurchase program after the company bought back $1 billion in

stock in the fourth quarter, a signal to investors that returns

continue to be a top priority.

Shell, Exxon and Chevron shares have rallied. Chevron's board

authorized a $25 billion share repurchase program, signaling to

investors that returns continue to be a priority.

On Thursday, Shell said it nearly doubled profits in 2018 from

the previous year, posting net income of about $23 billion.

Production at Exxon rose above 4 million barrels a day of oil

and gas for the first time since early 2017.

Exxon Chief Executive Darren Woods has embarked on a $230

billion plan to revitalize the oil giant, targeting drilling

opportunities around the world that he has said are the most

attractive he's seen in decades. Those include shale wells in West

Texas, natural gas export facilities in Papua New Guinea, a string

of giant discoveries in the South American nation of Guyana and

developments in Mozambique and Brazil.

While many analysts consider those projects to be extremely

attractive, they aren't set to pay off in a big way for a few more

years.

Exxon's shares fell about 15% in 2018, including dividends, the

worst performance for the company in at least 20 years, according

to FactSet data.

Mr. Woods said the company's ability to produce massive amounts

of oil and gas while also having the logistics and refining

capability to process barrels into fuel and other products was a

critical bulwark in 2018.

"The price environment in 2018 was unpredictable, which once

again demonstrated the value of our integrated business model," Mr.

Woods said. That vertical integration "allowed us to avoid the

impact of market dislocations and thus capture the full value of

our barrels," he added.

Mr. Woods also signaled that Exxon is set to step up asset sales

in its exploration and production business, which he plans to

reorganize into three new companies beginning in April.

The company recorded a $429 million impairment charge in the

quarter, much of which was from assets in North America "with

limited development potential." Total revenue and other income rose

8.1% to $72 billion.

Chevron Chief Executive Mike Wirth said the company has been in

discussions with U.S. officials related to its operations in

Venezuela and believes they will continue operating in a safe and

stable way for the foreseeable future. Chevron was among the

companies that received an exemption from U.S. sanctions imposed

this week against Venezuela's oil industry.

The exemption is set to expire in later this year, but it is

possible several companies may continue to receive waivers,

according to analysts.

Chevron plans to continue buying back significant quantities of

shares, and the company is set to purchase a Texas refinery. That

will allow the company to step up how much light crude it can

process as it ramps up production in the Permian Basin. Like Exxon,

Chevron nearly doubled its output in the region in 2018.

"We continue to maintain our commitment to capital discipline,"

Mr. Wirth said. "We intend to win in any environment."

Total revenues at Chevron rose 13% to $42 billion, and

production of oil and gas rose 7% to the equivalent of 2.93 million

barrels a day.

Excluding asset sales, the company said it expects production to

grow by 4% to 7% in 2019.

Allison Prang and Kimberly Chin contributed to this article.

Write to Bradley Olson at Bradley.Olson@wsj.com

(END) Dow Jones Newswires

February 02, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

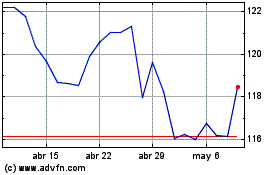

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

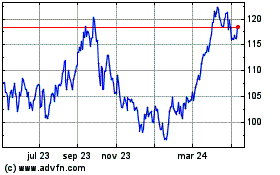

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024