By Kejal Vyas and Bradley Olson

CARACAS, Venezuela -- Venezuelan crude exports are declining

sharply as new U.S. sanctions push the country's oil industry

closer to collapse, threatening a bigger impact on global markets

than many experts anticipated, people familiar with the matter

say.

Oil storage is filling up in the country as President Nicolás

Maduro's regime struggles to line up buyers for the crude shipments

that make up his government's only real source of income. The U.S.

restrictions, aimed at redirecting crude revenue to opposition

leader Juan Guaidó, are making it difficult for the Maduro regime

to secure payment for the oil.

Production is also dropping due to labor problems, including

mass defections of workers struggling to survive hyperinflation and

delayed payments, as well as shortages of the imported oil

byproducts Venezuela needs to dilute its tar-like heavy crude to

push it through pipes to export terminals, the people say.

Tankers carrying products linked to Russia's PAO Lukoil, Spain's

Repsol SA and U.S. oil giant Chevron Corp. have been delayed,

halted or redirected in the past week as payment problems cloud

trade with Venezuela, according to people familiar with the

movements.

"This is an absolute disaster," said Luis Hernández, an oil

union leader. "There's almost no way to move the oil."

Venezuela oil czar Manuel Quevedo said his government is

demanding advance payment for oil shipments in light of the

sanctions, and is also looking for new buyers away from the U.S.,

without specifying where.

"This is going to have an impact on world oil markets," Mr.

Quevedo said on a pro-government television program Sunday, calling

the U.S. sanctions robbery. "This aggression will not go

unnoticed," he said.

Satellite images accessed through shipping tracking website

FleetMon over the weekend showed several dozen ships that normally

carry oil and oil byproducts idling in waters off Maracaibo, the

country's oil capital, providing visual evidence of the slowdown in

oil-related imports and exports. Several of the tankers had carried

cargoes to Corpus Christi, Texas, and New York in recent weeks,

according to FleetMon data.

Venezuelan authorities loyal to Mr. Maduro halted one oil

shipment scheduled to leave Maracaibo for the U.S. last Tuesday

over fears that proceeds would end up in the hands of Mr. Guaidó,

one person said. The ship was carrying crude from a field tapped

through a joint venture involving Chevron and state oil company

Petróleos de Venezuela, or PdVSA.

A Chevron spokeswoman declined to comment. Lukoil and Repsol

didn't return requests for comment.

The sanctions already appear to be affecting Venezuela's oil

production, people inside and outside the country said, though

estimates differed on the extent.

Oil union officials and people closely tracking the operations

of PdVSA said backlogs in exports had pushed oil production to well

below one million barrels a day, a more-than 10% drop from

December, and less than half what the country was producing 18

months ago.

Consultancy Wood Mackenzie Ltd. pegged production at 1.1 million

barrels a day.

Still, even some outside monitors are seeing big dropoffs.

Genscape, an analytics firm that monitors oil production worldwide

by tracking oilfield flares, estimated that on Thursday alone,

Venezuela output fell by around 60,000 barrels a day.

"That kind of decline is not out of the question largely due to

the challenges of sustaining production and the geopolitical impact

of redirecting the flow of crude and other products," said J.

Alexander Blackman, an executive at U.S. energy company Standard

Delta LLC.

It is unclear whether the production falloff will last. Much of

it depends on whether the U.S. gambit to target PdVSA will succeed

in ousting Mr. Maduro and putting oil revenue in the hands of the

country's opposition.

China and Russia continue to support Mr. Maduro and may be

capable of reversing the initial impact on the country's exports

and production, some analysts said.

Tens of thousands of Venezuelans took to the streets of Caracas

on Saturday to support Mr. Guaidó, whom the U.S. and other

countries have recognized as the country's interim president. But

Mr. Maduro's authoritarian government shows no immediate signs of

relinquishing power.

A prolonged standoff threatens to further batter the economy of

the once affluent country, which has been struggling for years with

food shortages, high rates of violent crime and the world's highest

inflation. The nation relies on petrodollars to import the vast

majority of its food supply as well as the blending components it

needs to produce gasoline, a crude reality for a country that sits

atop the world's biggest oil reserves. Oil workers and diplomats

say the country could run out of fuel supplies within a week,

including the diesel used for a large part of national power

generation, unless the government finds a solution to the

bottlenecks.

"This is fast turning into a war economy," said Evanán Romero, a

former deputy energy minister.

At least initially, the sanctions appear to be having a far more

significant impact on Venezuela's output than the Trump

administration anticipated. Treasury Secretary Steven Mnuchin said

last week that the U.S. was allowing certain companies to continue

making transactions with Venezuela for a limited period of time "to

minimize any immediate disruptions."

The sanctions allowed for a grace period until April for some

transactions, and extended licenses allowing some companies to

continue operations through the summer. But they call for payments

to Venezuela to be held in interest-bearing accounts until they can

be transferred to Mr. Guaidó's regime, a move that has all but

blocked business as Mr. Maduro's government remains in power.

Chevron, which has received an extended license to continue

working with PdVSA, said it has remained in close consultation with

the U.S. to ensure it is in compliance.

"The U.S. government has been very interested in engaging with

us to understand our position on the ground," Chevron Chief

Executive Mike Wirth said Friday. "For the foreseeable future, we

feel like we can maintain a good, stable operation and a safe

operation on the ground in Venezuela."

But the U.S. rules limiting the import of lighter oil and

products to dilute Venezuelan oil will make developing the

country's resources challenging, according to Wood Mackenzie. It

predicts Venezuelan production could fall to 900,000 barrels a

day.

Francisco Monaldi, a Venezuela energy expert at Rice University,

said the sanctions could cause the country's oil production to be

cut nearly in half over the next year and a half.

"If this lasts very long," Mr. Monaldi said, "it will definitely

have a very significant effect on the Venezuelan oil industry that

is already in a very precarious situation."

--Rebecca Elliott and Benoit Faucon contributed to this

article.

Write to Kejal Vyas at kejal.vyas@wsj.com and Bradley Olson at

Bradley.Olson@wsj.com

(END) Dow Jones Newswires

February 04, 2019 12:51 ET (17:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

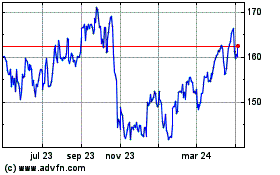

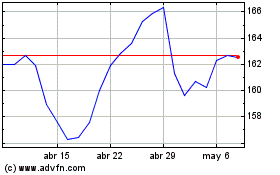

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024