German Factory Orders Decline Again Signaling Sluggish Start To 2019

05 Febrero 2019 - 9:38PM

RTTF2

Germany's factory orders unexpectedly decreased for a second

straight month in December and at a faster pace, on the back of

weak demand from abroad, suggesting that the slowdown in the

manufacturing continued and the sector likely had a sluggish start

to this year.

Manufacturing orders decreased a calendar and seasonally

adjusted 1.6 percent from the previous month, preliminary data from

the Federal Statistical Office showed on Wednesday, while they were

forecast to rise 0.3 percent.

The latest fall was the most since June, when orders shrunk 3.6

percent.

"The decline in orders in December indicates that the drought in

the industry is continuing for the time being," the economy

ministry said.

"The latest sentiment indicators also point to a subdued

industrial economy at the beginning of the year."

The monthly decline for November was revised to 0.2 percent from

1 percent reported initially.

Domestic orders decreased 0.6 percent and foreign orders fell

2.3 percent in December on the previous month. Demand from the euro

area grew 3.2 percent, while that from other countries declined 5.5

percent.

Orders for intermediate goods fell 1.2 percent and those for

capital goods decreased 2.5 percent. In contrast, demand for

capital goods grew 4.2 percent, largely driven by foreign

demand.

Excluding major bookings, factory orders climbed a 3.5 percent

from the previous month, signaling that the current situation was

not so depressing.

Compared to the same month a year ago, factory orders decreased

a working-day adjusted 7 percent in December following a 3.4

percent slump in November, which was revised from 4.3 percent.

Economists had expected a 6.7 percent decline.

In the fourth quarter of 2018, factory orders grew 0.3 percent,

the economy ministry said. Capital goods orders grew 2.8 percent,

as the automobile industry started making progress in tackling the

WLTP problem.

The automobile industry logged a 10.2 percent increase in demand

in the fourth quarter, while mechanical engineering and the

chemical industry registered declines of 0.4 percent and 1.9

percent, respectively.

"The inventory build-up in recent months, as well as the recent

drops in order books, suggest that any rebound of industrial

activity in Germany will be slow and sluggish," ING economist

Carsten Brzeski said.

"Looking ahead, we still expect the bottleneck in the German

automotive industry to be resolved in the coming months," he

added.

Germany likely avoided a technical recession in the fourth

quarter, the economy ministry has said. Average annual growth

slowed to a five-year low of 1.5 percent in 2018.

The latest purchasing managers' survey from IHS Markit showed

that the manufacturing sector shrunk in January, marking the

weakest level in 50 months.

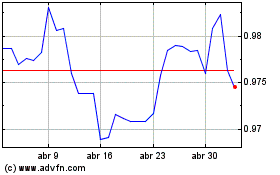

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

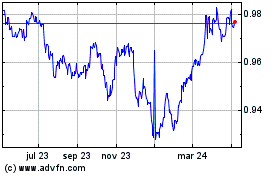

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024