Yen Climbs Amid Risk Aversion

06 Febrero 2019 - 1:17AM

RTTF2

The Japanese yen strengthened against its major counterparts in

the European session on Wednesday amid risk aversion, as earnings

updates proved to be a mixed bag and U.S. President Donald Trump's

state of the union address failed to offer any plans to end an

ongoing trade war with China.

His address made no mention of the longest government shutdown

in history, though he urged Democrats and Republicans to find a

compromise by a February 15 deadline.

Trump renewed his call for a wall on the southern U.S. border

saying it is needed to stem illegal immigration and smuggled drugs.

Trump also did not have anything significant on U.S-China trade

front.

Speaking to the Parliamentary Committee, the Bank of Japan

governor Haruhiko Kuroda told that Japan is among several advanced

economies that have seen inflation dampened by sliding oil

prices.

Expansion of monetary base money alone won't have an impact on

the economy, he told.

The yen dropped against its most major counterparts in the Asian

session amid risk appetite, as Asian shares rose following positive

cues from Wall Street overnight.

The yen climbed to 5-day highs of 124.82 against the euro and

109.51 against the franc, reversing from its early lows of 125.45

and 110.05, respectively. The yen is seen finding resistance around

122.00 against the euro and 107.00 against the franc.

The yen appreciated to a 4-day high of 109.56 against the

greenback, from a 4-day low of 110.05 hit at 9:00 pm ET. If the yen

rises further, 108.00 is possibly seen as its next resistance

level.

The yen strengthened to a 5-day high of 83.06 against the

loonie, 8-day high of 78.06 against the aussie and a 6-day high of

75.01 against the kiwi, from its early lows of 83.79 and 79.66, and

a 1-1/2-month low of 75.92, respectively. The next possible

resistance for the yen is seen around 82.00 against the loonie,

77.00 against the aussie and 74.00 against the kiwi.

On the flip side, the yen retreated to 142.28 against the pound,

from a 2-week high of 141.76 seen at 2:30 am ET. The yen is poised

to target support around the 144.00 level.

Looking ahead, U.S. trade data for November, Canada building

permits for December and Ivey PMI for January are scheduled for

release in the New York session.

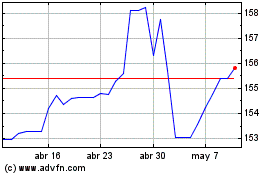

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024