GlaxoSmithKline 4Q Profit Soars; Sees Declining Adjusted EPS in 2019

06 Febrero 2019 - 6:58AM

Noticias Dow Jones

By Carlo Martuscelli

GlaxoSmithKline PLC (GSK.LN) said Wednesday that fourth-quarter

profit before tax more than tripled, but guided for a fall in

adjusted earnings per share in the year ahead on the impact of

generic competition.

The company said pretax profit for the three months ended Dec.

31 was 1.37 billion pounds ($1.79 billion), compared with GBP442

million the previous-year period, missing analysts' estimates of

GBP1.90 billion based on a FactSet consensus forecast. The gain on

the year earlier can be attributed to a charge it booked in 2017

relating to U.S. tax reform.

Turnover rose 7.3% to GBP8.20 billion--ahead of the GBP7.97

billion predicted by analysts.

The company said that sales from its pharmaceuticals division

increased 6% in the quarter, with growth in all therapy areas. HIV

drugs were its fastest growing segment in the division, with sales

up 10% on the year earlier. Vaccines sales grew by 22%--driven by

its shingles vaccine Shingrix. The medicine was in high demand in

2018 and Glaxo has previously reported shortages, forcing it to

ration doses.

The U.K. pharmaceutical said that in the year ahead it expects

adjusted EPS to fall between 5% and 9% at constant exchange rates.

The decline reflects the recent decision by the U.S. Food and Drug

Administration to approve a generic competitor to its Advair

respiratory drug. Glaxo said that the recent acquisition of

cancer-specialist Tesaro also will weigh on its results.

It declared a dividend of 23 pence for the quarter, unchanged

from the previous-year period. The company said it expects to

declare a full-year dividend of 80 pence per share in 2019--in line

with the year before.

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

February 06, 2019 07:43 ET (12:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

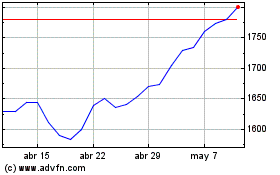

Gsk (LSE:GSK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

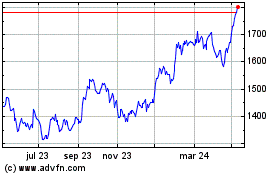

Gsk (LSE:GSK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024