Euro Falls After Eurozone Growth Outlook Downgrade

07 Febrero 2019 - 12:54AM

RTTF2

The euro fell sharply against its major opponents in the

European session on Thursday, after the European Commission slashed

Eurozone growth forecast amid rising uncertainty regarding trade

policies, particularly between the US and China.

The euro area GDP growth forecast was cut to 1.3 percent for

2019, from previous estimate of 1.9 percent.

For 2020, Eurozone growth outlook was revised down to 1.6

percent, from 1.7 percent estimated in autumn forecast.

The EU GDP growth forecast was also trimmed to 1.5 percent for

2019 and 1.7 percent for 2020, from 1.9 percent and 1.8 percent,

respectively.

The EC said that the downgrade reflected external factors, such

as trade tensions and the slowdown in emerging markets, notably in

China.

Preliminary figures from the Federal Statistical Office showed

that Germany's industrial production decreased for a fourth

consecutive month in December, defying expectations for an

increase.

Industrial production fell a calendar and seasonally-adjusted

0.4 percent from November, when it decreased 1.3 percent, revised

from 1.9 percent. Economists had expected a 0.8 percent

increase.

The currency was trading mixed against its major counterparts in

the Asian session. While it fell against the pound and the yen, it

held steady against the greenback and the franc.

The euro declined to near a 2-week low of 1.1332 against the

greenback, from a high of 1.1369 hit at 6:15 pm ET. The next

possible support for the euro is seen around the 1.11 level.

The single currency dropped to a 6-day low of 124.48 against the

yen and a 9-day low of 1.1358 against the franc, reversing from its

early highs of 125.07 and 1.1394, respectively. If the euro falls

further, 122.00 and 1.12 are likely seen as its next support levels

against the yen and the franc, respectively.

Following more than a 2-week high of 1.6843 seen at 12:30 am ET,

the euro reversed direction and pulled back to 1.6763 against the

kiwi. The euro is seen finding support around the 1.66 level.

The euro edged down to 1.5001 against the loonie and 1.5945

against the aussie, moving away from an early 6-day high of 1.5048

and a 2-week high of 1.6015, respectively. The euro is poised to

test support around 1.48 against the loonie and 1.57 against the

aussie.

The euro pared gains to 0.8777 against the pound, from a high of

0.8799 hit at 3:00 am ET. Further downtrend may take the euro to a

support around the 0.86 region.

Looking ahead, at 7:00 am ET, the Bank of England announces its

decision on interest rate. Economists expect the benchmark rate to

remain at 0.75 percent and asset purchase facility at GBP 435

billion.

In the New York session, U.S. weekly jobless claims for the week

ended February 2 and consumer credit for December are due.

At 9:30 am ET, Federal Reserve Governor Richard Clarida will

deliver a speech about the neutral interest rate at the Czech

National Bank conference in Prague.

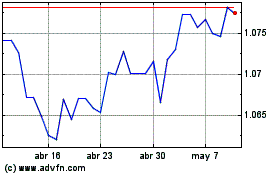

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024