Is It Calm or Complacency in Italian Markets?

11 Febrero 2019 - 4:59AM

Noticias Dow Jones

By Alex Frangos and James Willhite

Markets early Monday gave a big shrug to news over the weekend

that Italy's top officials were taking aim at the country's central

bank, which plays a big role in keeping Italy's financial system

safe.

Italian government bond yields were in line with where they

traded Friday, with the 10-year government bond yielding around

2.9%. Italian bank stocks traded slightly higher, with Intesa

Sanpaolo and UniCredit both up slightly.

The news from The Wall Street Journal's Giovanni Legorano over

the weekend:

ROME-Italy's populist government launched an unprecedented

attack on the country's central bank over the weekend, saying its

top brass should be replaced because it had failed to supervise

effectively the country's troubled banking sector.

However, investors may think the attack lacks teeth. As the

story notes:

Under the Bank of Italy's rules, the central bank chooses its

own top appointees, though the government must endorse the bank's

nominee. Final approval rests with President Sergio Mattarella--a

respected figure in Italy's establishment and another bete noire of

the League and 5 Star Movement.

But markets also have a history of ignoring Italy's politics

until they don't.

Write to Alex Frangos and James Willhite at alex.frangos@wsj.com

and james.willhite@wsj.com

(END) Dow Jones Newswires

February 11, 2019 05:44 ET (10:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

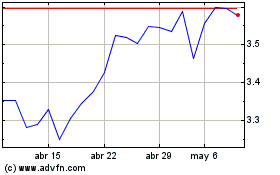

Intesa Sanpaolo (BIT:ISP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

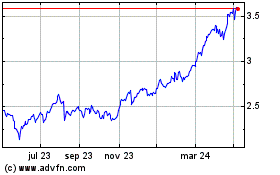

Intesa Sanpaolo (BIT:ISP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024