New Zealand Dollar Spikes Up After RBNZ Holds Rate Steady

12 Febrero 2019 - 8:15PM

RTTF2

The New Zealand dollar climbed against its major counterparts in

the Asian session on Wednesday, after the Reserve Bank of New

Zealand left its interest rate unchanged and affirmed that its next

move in rate could be either "up or down."

The central bank maintained its Official Cash Rate at the record

low of 1.75 percent for the 15th straight meeting.

The decision was in line with expectations following a 0.25

percent rate cut in November 2016.

GDP growth is expected to pick up through 2019 and the OCR is

expected to be unchanged through this year and into 2020, RBNZ

Governor Adrian Orr noted.

He added that the direction of the next move could be up or

down.

"We will keep the OCR at an expansionary level for a

considerable period to contribute to maximizing sustainable

employment and maintaining low and stable inflation," Orr said.

Further underpinning sentiment was rising risk appetite, as

Asian shares rose following the overnight rally on Wall Street amid

optimism about U.S.-China trade talks and the surge in crude oil

prices.

Sentiment lifted up after U.S. President Donald Trump said he is

open to extending a March 1 deadline to raise tariffs on Chinese

products if the U.S. and China are close to reaching a trade

deal.

The kiwi spiked up to a weekly high of 1.0397 against the

aussie, following a decline to 1.0544 at 6:45 pm ET. The next

possible resistance for the kiwi is seen around the 1.02

region.

The New Zealand currency firmed to 0.6852 against the greenback,

its strongest since February 6. On the upside, the kiwi is likely

to find resistance around the 0.70 level.

The kiwi that ended Tuesday's trading at 74.41 against the yen

advanced to a weekly high of 75.81. Next key resistance for the

kiwi is seen around the 77.00 region.

Data from the Bank of Japan showed that Japan producer prices

fell 0.6 percent on month in January - unchanged from the December

reading but well shy of expectations for a decline of 0.2

percent.

On a yearly basis, producer prices climbed 0.6 percent - again

missing forecasts for 1.0 percent and down from 1.5 percent in the

previous month.

The kiwi appreciated to a weekly high of 1.6545 against the

euro, from a low of 1.6836 touched at 7:45 pm ET. If the kiwi rises

further, 1.64 is possibly seen as its next resistance level.

Looking ahead, U.K. CPI, PPI and house price index for January

and Eurozone industrial production for December are due in the

European session.

In the New York session, U.S. consumer price index for January

and monthly budget statement for December are scheduled for

release.

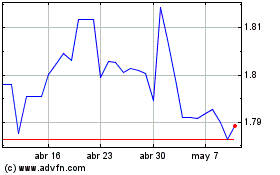

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024