Pound Retreats As U.K. Inflation Slows To Two-year Low

13 Febrero 2019 - 12:17AM

RTTF2

The pound trimmed its early gains against its major counterparts

in the European session on Wednesday, as U.K. consumer inflation

slowed to a two-year low in January, below the Bank of England's

target of 2 percent.

Data from the Office for National Statistics showed that the

consumer price index rose 1.8 percent year-on-year following a 2.1

percent increase in December. Economists had expected 2 percent

inflation.

Headline inflation was the slowest since January 2017, when

prices rose at the same pace.

Core inflation was steady at 1.9 percent at the start of the

year, in line with economists' expectations.

ONS data also showed that input price inflation eased to 2.9

percent from a revised 3.2 percent. In contrast, economists had

expected a faster rate of 3.8 percent.

The core input price inflation slowed to 4.6 percent from 4.7

percent. Output price inflation eased to 2.1 percent from a revised

2.4 percent in December, which was slightly slower than the 2.2

percent economists had predicted.

The core output price inflation was steady at 2.4 percent in

January.

Another report from ONS showed that UK house price inflation

slowed to 2.5 percent in December from 2.7 percent in November, in

line with economists' expectations.

The latest house price growth figure was the lowest since July

2013, when it was 2.3 percent.

The currency was higher against its most major counterparts in

the Asian session, excepting the euro.

The pound fell to 1.2882 against the greenback, down from a

2-day high of 1.2923 hit at 1:45 am ET. The pair was worth 1.2890

at yesterday's close. On the downside, 1.27 is likely seen as the

next support level for the pound.

Pulling away from an 8-day high of 142.96 hit at 1:00 am ET, the

pound retreated to 142.58 against the yen. If the pound falls

further, 140.00 is possibly seen as its next support level.

Data from the Bank of Japan showed that Japan producer prices

fell 0.6 percent on month in January - unchanged from the December

reading but well shy of expectations for a decline of 0.2

percent.

On a yearly basis, producer prices climbed 0.6 percent - again

missing forecasts for 1.0 percent and down from 1.5 percent in the

previous month.

Having climbed to 1.2999 against the Swiss franc at 2:45 am ET,

the pound reversed direction and moved down to 1.2955. The next

possible support for the pound is seen around the 1.27 region.

The U.K. currency eased back to 0.8791 against the euro, just

short of few pips from a 6-day low of 0.8793 hit at 7:00 pm ET. The

pound is seen finding support around the 0.89 mark.

Data from Eurostat showed that Eurozone industrial production

decreased for a second straight month and at a faster-than-expected

pace in December, but the fall was less severe than the previous

month's decline.

Industrial production fell 0.9 percent from November, when it

decreased 1.7 percent. Economists had expected a 0.4 percent

decline.

Looking ahead, U.S. consumer price index for January and monthly

budget statement for December are scheduled for release in the New

York session.

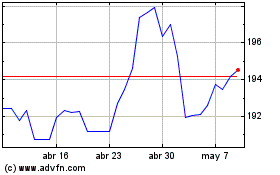

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024