Oil Search Pushes Ahead With Projects to Double Output

18 Febrero 2019 - 11:58PM

Noticias Dow Jones

By Robb M. Stewart

MELBOURNE, Australia--Oil Search Ltd. (OSH.AU) Managing Director

Peter Botten has committed to stewarding growth projects that could

double the oil and gas company's production in the coming years

before looking to step down from the Papua New Guinea-focused

company he has helmed for more than two decades.

Oil Search and bigger partners Exxon Mobil Corp. (XOM) and Total

SA (TOT) are working on plans to sharply increase Papua New

Guinea's gas-export capacity, building three new liquefied natural

gas production lines on Exxon's existing infrastructure footprint.

The company is also drilling in Alaska's North Slope, seeking to

bolster the estimated oil reserve for its Pikka project.

Mr. Botten in an interview with The Wall Street Journal said he

has told Oil Search's board he would remain managing director at

least until there was a clear view to final investment decisions on

the projects, which could double the company's output from the

mid-2020s.

Since late 1994, Mr. Botten has run the Port Moresby-based

company which operates all of Papua New Guinea's oil fields and has

a 29% interest in the PNG LNG gas-export venture operated by Exxon

that came on stream in 2014. He has been an central figure in talks

between Papua New Guinea's government and the partners in the two

LNG ventures that are negotiating sharing infrastructure on their

projects.

A critical gas agreement for the Total-led Papua LNG project is

due to be signed by the end of March between the companies and the

government, and a similar deal for the expansion of the P'nyang

field that would supply an additional production line for the PNG

LNG project is targeted for soon after, Mr. Botten said.

The agreements would allow the companies to move into the

engineering and design phase on the projects, which together could

produce an additional 8 million metric tons a year of the fuel, and

to then ramp-up marketing efforts to sell cargoes.

Good interest had already been received from potential LNG

buyers, Mr. Botten said.

"Under reasonable scenarios, we can handle financing (for each

of the projects) out of liquidity and cash flows," he said.

Oil Search, which on Tuesday reported a 13% rise in net profit

rose to US$341.2 million in 2018 as stronger oil and gas prices

more than offset a 17% fall in production with a devastating

earthquake in Papua New Guinea's Highlands region, ended last year

with US$601 million in cash and access to US$900 million in

untapped credit.

The company has forecast a return to pre-earthquake output

levels this year, with production costs about 15%-20% lower. It

affirmed a target set last month for production in 2019 of between

28 million and 31.5 million barrels of oil equivalent, up from 25.2

million last year.

Mr. Botten said that while several other LNG developments had

recently entered the engineering stage or made a final investment

decision, including Royal Dutch Shell PLC's (RDSA) investment

commitment last October on the Kitimat project in British Columbia,

there was still strong demand in Asia for fuel from Papua New

Guinea. The country benefits from its close location and the high

heating-value of the gas, and there was reassurance for buyers that

the expansion projects were being built on an existing

"brownfields" site, he said.

In Alaska, one year after completing a deal to buy stake in oil

fields in the North Slope, Mr. Botten said the company was pushing

ahead with a drilling campaign that has the potential to add 250

million barrels to the current estimate of 500 million barrels for

the Pikka project. Oil Search has an option to increase its control

over the Alaska assets, and Mr. Botten said talks continued to sell

part of the company's interest to a new partner.

-Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

February 19, 2019 00:43 ET (05:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

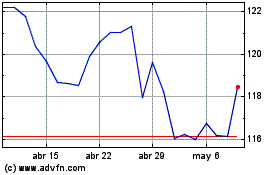

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

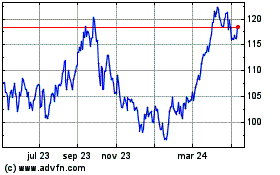

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024