Lloyds Bank Missed 2018 Profit Expectations; Plans GBP1.75 Billion Share Buyback

20 Febrero 2019 - 1:53AM

Noticias Dow Jones

By Adam Clark

Lloyds Banking Group PLC's (LLOY.LN) 2018 profit missed analyst

expectations but the U.K. lender set out plans for a major share

buyback and brought forward its cost-cutting targets.

The U.K.'s largest domestic bank said Wednesday that it made a

pretax profit of 5.96 billion pounds ($7.73 billion), up from

GBP5.28 billion in 2017. Analysts had forecast Lloyds to make a

pretax profit of GBP6.4 billion.

Lloyds' net income of GBP17.77 billion matched analyst

expectations, rising 2% from the prior year. The bank's net

interest margin, the difference between the money it earns on

lending and pays out on deposits, rose to 2.93%.

Lloyds proposed a share buyback of up to GBP1.75 billion. The

lender also proposed a final dividend of 2.14 pence a share,

bringing its total dividend for 2018 to 3.21 pence a share.

Lloyds' common equity Tier 1 capital ratio--a measure of a

bank's financial strength--stood at 13.9% at the end of the year,

after pro forma adjustments for dividends and share buybacks.

For 2019, Lloyds said it continues to expect an increased return

on tangible equity of between 14% and 15%, and a net interest

margin of 2.90%. The bank also said its operating costs are now

expected to be less than GBP8 billion in 2019, a year ahead of its

original target.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

February 20, 2019 02:38 ET (07:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

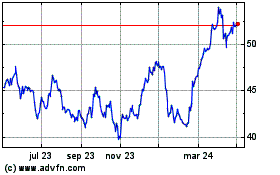

Lloyds Banking (LSE:LLOY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

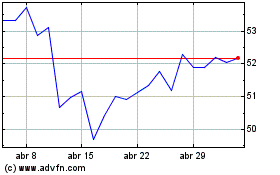

Lloyds Banking (LSE:LLOY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024