Lloyds Banking Group Delivers on Share Buyback Hopes -- Earnings Review

20 Febrero 2019 - 4:43AM

Noticias Dow Jones

By Adam Clark

Lloyds Banking Group PLC (LLOY.LN) reported its fourth-quarter

and 2018 results Wednesday. Here's what we watched:

REVENUE: Lloyds matched analyst expectations for net income of

17.8 billion pounds ($23.1 billion).

PROFIT: Lloyds' pretax profit of GBP5.96 billion fell short of

analyst expectations of GBP6.4 billion, partly due to a further

GBP200 million charge for claims of missold payment-protection

insurance. Underlying profit of GBP8.1 billion matched

expectations.

WHAT WE WATCHED:

-CAPITAL RETURN: Lloyds satisfied investor hopes with a share

buyback of GBP1.75 billion, larger than consensus expectations.

Added to an annual dividend of 3.21 pence a share, Lloyds is

looking to hand up to GBP4 billion back to shareholders, up 26%

from 2017.

-NET INTEREST MARGIN: Despite tough competition in the U.K.

mortgage market, Lloyds improved its net interest margin to 2.93%

for 2018, from 2.86% the prior year, and kept its guidance to

broadly maintain the margin in the near-term.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

February 20, 2019 05:28 ET (10:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

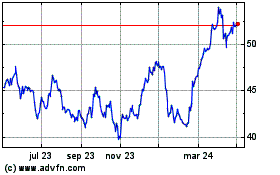

Lloyds Banking (LSE:LLOY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

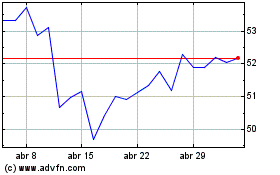

Lloyds Banking (LSE:LLOY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024