TD Bank Earnings, Expenses Increase -- WSJ

01 Marzo 2019 - 2:02AM

Noticias Dow Jones

By Allison Prang and Vipal Monga

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 1, 2019).

Toronto-Dominion Bank's first-quarter profit rose more than 2%

from a year earlier, helped by its investment in TD Ameritrade and

a much smaller provision for income tax.

At the same time, noninterest expenses -- the provision for

credit losses and insurances claims and related expenses --

increased by at least 20% each. Expenses outpaced revenue

growth.

The bank recorded higher expenses after closing deals to buy a

loyalty program from Air Canada and Greystone Capital

Management.

Speaking in an interview, Riaz Ahmed, chief financial officer,

made note of recent changes in the competitive landscape. The U.S.

regional-banking market was shaken up early in February, when

BB&T Corp. agreed to buy SunTrust Banks Inc., creating a larger

competitor in the Southeastern U.S. TD wants to expand its presence

in the region, but the bank doesn't feel compelled to rush to match

the deal, Mr. Ahmed said.

"Sellers still have the expectation of high prices," he said.

"As our U.S. franchise has matured, we have become more selective

in looking for the right target."

TD's capital ratio was 12%, giving the bank some cushion that

can be put to use. Mr. Ahmed said bank executives were

"comfortable" when the ratio was "in the low 10s," but said having

more capital hasn't put more pressure on them to do deals.

In the latest quarter, the bank spent money building out trading

desks in New York, Singapore and London to beef up its presence as

a dealer in the U.S. dollar foreign-exchange market, Mr. Ahmed

said.

TD announced a 10% dividend increase to C$0.67 ($0.51) a

share.

Total revenue at TD rose 6.6% to C$10 billion ($7.6

billion).

Overall, net income rose 2.4% from the year-earlier quarter to

C$2.39 billion, with per-share earnings of C$1.27, up from C$1.24.

Analysts polled by Refinitiv were expecting C$1.49 a share.

TD's provision for income taxes fell 52% to C$503 million. Its

equity in net income of an investment in TD Ameritrade more than

doubled to C$322 million.

Earnings on an adjusted basis edged up to C$1.57 a share from

C$1.56 a share, although analysts were expecting C$1.72 a

share.

Write to Allison Prang at allison.prang@wsj.com and Vipal Monga

at vipal.monga@wsj.com

(END) Dow Jones Newswires

March 01, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

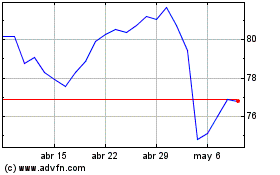

Toronto Dominion Bank (TSX:TD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Toronto Dominion Bank (TSX:TD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024