Alamos Gold Receives Operating Permit for Kirazlı Project

01 Marzo 2019 - 10:33AM

Alamos Gold Inc. (

TSX:AGI;

NYSE:AGI) (“Alamos” or the “Company”) today reported it

has been granted the Operating Permit from the Turkish Department

of Energy and Natural Resources allowing for the start of

earthworks on the open pit area of the Kirazlı project.

As disclosed in January 2019, the Company expects to spend $75

million in 2019 on completing work on the water reservoir and

ramping up major construction activities and earthworks. The

remaining $60 million of Kirazlı’s total initial capital budget of

$152 million will be spent in 2020 with initial production expected

by the end of 2020.

As outlined in the 2017 feasibility study, Kirazlı has a 44%

after-tax internal rate of return and is expected to produce over

100,000 ounces of gold during its first full year of production at

mine-site all-in sustaining costs of less than $400 per

ounce. This is expected to bring consolidated production to

over 600,000 ounces per year, while significantly lowering the

Company’s cost profile.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Vice President, Technical

Services, has reviewed and approved the scientific and technical

information contained in this news release. Chris Bostwick is a

Qualified Person within the meaning of Canadian Securities

Administrator’s National Instrument 43-101. For further information

pertaining to the 2017 feasibility study, please see press release

titled “Alamos Gold Announces Positive Feasibility Study for

Kirazlı Project”, dated February 15, 2017, and the corresponding

technical report, both available under the Company's profile on

SEDAR at www.sedar.com and on the Alamos website at

www.alamosgold.com.

About Alamos

Alamos is a Canadian-based intermediate gold producer with

diversified production from four operating mines in North America.

This includes the Young-Davidson and Island Gold mines in northern

Ontario, Canada and the Mulatos and El Chanate mines in Sonora

State, Mexico. Additionally, the Company has a significant

portfolio of development stage projects in Canada, Mexico, Turkey,

and the United States. Alamos employs more than 1,700 people and is

committed to the highest standards of sustainable development. The

Company’s shares are traded on the TSX and NYSE under the symbol

“AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Scott K. ParsonsVice President, Investor

Relations(416) 368-9932 x 5439

All amounts are in United States dollars, unless otherwise

stated.

The TSX and NYSE have not reviewed and do not accept

responsibility for the adequacy or accuracy of this release.

Cautionary Note

This news release contains statements which are, or may deemed

to be, forward-looking information within the meaning of applicable

Canadian and U.S. securities laws (“forward-looking

statement(s)”). All statements in this news release, other

than statements of historical fact, which address events, results,

outcomes or developments that Alamos expects to occur are, or may

be deemed to be, forward-looking statements. Forward-looking

statements are generally, but not always, identified by the use of

forward-looking terminology such as "expects", “is expected”

"believes", "anticipates", "will", "intends", "estimates",

"forecast", "budget" or variations of such words and phrases and

similar expressions or statements that certain actions, events or

results ”may", "could", "would", "might" or "will" be taken, occur

or be achieved.

Forward-looking statements are necessarily based upon a number

of factors and assumptions that, while considered reasonable by

management at the time of making such statements, are inherently

subject to significant business, economic, legal, political and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements.

Such factors and assumptions underlying the forward-looking

statements in this news release include, but are not limited to:

development delays at the Kirazlı project, the speculative nature

of mineral exploration and development, including the risks of

obtaining and maintaining necessary licenses, permits and

authorizations for the Company’s development stage and operating

assets; changes to current estimates of mineral reserves and

resources; changes to production estimates (which assume accuracy

of projected ore grade, mining rates, recovery timing and recovery

rate estimates and may be impacted by unscheduled maintenance;

labour and contractor availability and other operating or technical

difficulties); fluctuations in the price of gold; changes in

foreign exchange rates (particularly the Canadian dollar, Turkish

Lira and U.S. dollar); the impact of inflation; any decision to

declare a dividend; employee and community relations; litigation

and administrative proceedings; disruptions affecting our Turkish

operations; expropriation or nationalization of property; inherent

risks and hazards associated with mining including environmental

hazards, industrial accidents, unusual or unexpected formations,

pressures and cave-ins; availability of and increased costs

associated with mining inputs and labour; contests over title to

properties; changes in national and local government legislation

(including tax legislation), controls or regulations; risk of loss

due to sabotage and civil disturbances; the impact of global

liquidity and credit availability and the values of assets and

liabilities based on projected future cash flows; and, risks

arising from holding derivative instruments.

Additional risk factors affecting the Company are set out in the

Company’s latest Form 40-F/ Annual Information Form and MD&A,

each under the heading “Risk Factors”, available on the SEDAR

website at www.sedar.com or on EDGAR at www.sec.gov., and should be

reviewed in conjunction with this . The foregoing should be

reviewed in news release. The Company disclaims any intention

or obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except as required by applicable law.

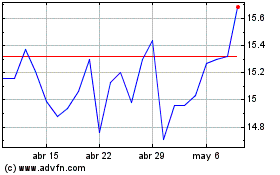

Alamos Gold (NYSE:AGI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

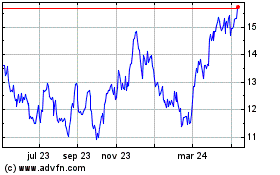

Alamos Gold (NYSE:AGI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024