TIDMHSBA

RNS Number : 0816S

HSBC Holdings PLC

06 March 2019

Shareholder information

Page

Fourth interim dividend for 2018 310

----

Interim dividends for 2019 310

----

2018 Annual General Meeting 311

----

Earnings releases and interim

results 311

----

Shareholder enquiries and communications 311

----

Stock symbols 312

----

Investor relations 312

----

Where more information about

HSBC is available 312

----

Cautionary statement regarding

forward-looking statements 314

----

Certain defined terms 315

------------------------------------------ ----

Abbreviations 316

------------------------------------------ ----

A glossary of terms used in this Annual Report and Accounts can

be found in

the Investors section of www.hsbc.com.

Fourth interim dividend for 2018

The Directors have declared a fourth interim dividend for 2018

of $0.21 per ordinary share. Information on the scrip dividend

scheme and currencies in which shareholders may elect to have the

cash dividend paid will be sent to shareholders on or about 6 March

2019. The timetable for the dividend is:

Footnotes

19 February

Announcement 2019

Shares quoted ex-dividend in London, Hong Kong, Paris

and Bermuda and American Depositary Shares ('ADS') quoted

ex-dividend 21 February

in New York 2019

------------

22 February

Record date - London, Hong Kong, New York, Paris, Bermuda 1 2019

------------

Mailing of Annual Report and Accounts 2018 and/or Strategic

Report 2018 and dividend documentation 6 March 2019

------------

Final date for receipt by registrars of forms of election,

Investor Centre electronic instructions and revocations 21 March

of standing instructions for scrip dividends 2019

------------

Exchange rate determined for payment of dividends in sterling 25 March

and Hong Kong dollars 2019

Payment date: dividend warrants, new share certificates

or transaction advices and notional tax vouchers mailed

and shares credited to stock accounts in CREST 8 April 2019

-------------------------------------------------------------- ---------- ------------

1 Removals to and from the Overseas Branch register of

shareholders in Hong Kong will not be permitted on this date.

Interim dividends for 2019

The Board has adopted a policy of paying quarterly interim

dividends on ordinary shares. Under this policy it is intended to

have a pattern of three equal interim dividends with a variable

fourth interim dividend. It is envisaged that the first interim

dividend in respect of 2019 will be $0.10 per ordinary share.

Dividends are declared in US dollars and, at the election of the

shareholder, paid in cash in one of, or in a combination of, US

dollars, pounds sterling and Hong Kong dollars, or, subject to the

Board's determination that a scrip dividend is to be offered in

respect of that dividend, may be satisfied in whole or in part by

the issue of new shares in lieu of a cash dividend.

Other equity instruments

Additional tier 1 capital - contingent convertible

securities

HSBC continues to issue contingent convertible securities that

are included in its capital base as fully CRD IV-compliant

additional tier 1 capital securities on an end point basis. These

securities are marketed principally and subsequently allotted to

corporate investors and fund managers. The net proceeds of the

issuances are used for HSBC's general corporate purposes and to

further strengthen its capital base to meet requirements under CRD

IV. These securities bear a fixed rate of interest until their

initial call dates. After the initial call dates, if they are not

redeemed, the securities will bear interest at rates fixed

periodically in advance for five-year periods based on credit

spreads, fixed at issuance, above prevailing market rates. Interest

on the contingent convertible securities will be due and payable

only at the sole discretion of HSBC, and HSBC has sole and absolute

discretion at all times to cancel for any reason (in whole or part)

any interest payment that would otherwise be payable on any payment

date. Distributions will not be paid if they are prohibited under

UK banking regulations or if the company has insufficient reserves

or fails to meet the solvency conditions defined in the securities'

terms.

The contingent convertible securities are undated and are

repayable at the option of HSBC in whole at the initial call date

or on any fifth anniversary after this date. In addition, the

securities are repayable at the option of HSBC in whole for certain

regulatory or tax reasons. Any repayments require the prior consent

of the PRA. These securities rank pari passu with HSBC's dollar and

sterling preference shares and therefore rank ahead of ordinary

shares. The contingent convertible securities will be converted

into fully paid ordinary shares of HSBC at a predetermined price,

should HSBC's consolidated end point CET1 ratio fall below 7.0%.

Therefore, in accordance with the terms of the securities, if the

end point CET1 ratio breaches the 7.0% trigger, the securities will

convert into ordinary shares at fixed contractual conversion prices

in the issuance currencies of the relevant securities, equivalent

to GBP2.70 at the prevailing rate of exchange on the issuance date,

subject to anti-dilution adjustments.

Additional tier 1 capital instruments issued during 2018

Issue Market

Nominal price price Net price Issue date

$m % % %

------- ------ ------ --------- ------------

$2,350m 6.250% perpetual subordinated 23 March

contingent convertible securities 2,350 100.00 93.80 100.00 2018

----------------------------------------- ------- ------ ------ --------- ------------

$1,800m 6.500% perpetual subordinated 23 March

contingent convertible securities 1,800 100.00 91.75 100.00 2018

----------------------------------------- ------- ------ ------ --------- ------------

SGD750m 5.000% perpetual subordinated 24 September

contingent convertible securities 550 100.00 100.29 100.00 2018

----------------------------------------- ------- ------ ------ --------- ------------

GBP1,000m 5.875% perpetual subordinated 28 September

contingent convertible securities 1,301 100.00 95.89 100.00 2018

----------------------------------------- ------- ------ ------ --------- ------------

2018 Annual General Meeting

All resolutions considered at the 2018 Annual General Meeting

held at 11.00am on 20 April 2018 at the Queen Elizabeth II

Conference Centre, London SW1P 3EE were passed on a poll.

Earnings releases and interim results

Earnings releases are expected to be issued on or around 3 May

2019 and 28 October 2019. The interim results for the six months to

30 June 2019 are expected to be issued on 5 August 2019.

Shareholder enquiries and communications

Enquiries

Any enquiries relating to shareholdings on the share register

(for example, transfers of shares, changes of name or address, lost

share certificates or dividend cheques) should be sent to the

Registrars at the address given below. The Registrars offer an

online facility, Investor Centre, which enables shareholders to

manage their shareholding electronically.

Hong Kong Overseas Branch Bermuda Overseas Branch

Principal Register: Register: Register:

Computershare Investor Computershare Hong Kong Investors Relations

Services PLC Investor Team

The Pavilions Services Limited HSBC Bank Bermuda Limited

Rooms 1712-1716, 17th

Bridgwater Road Floor 37 Front Street

Bristol BS99 6ZZ Hopewell Centre Hamilton HM 11

United Kingdom 183 Queen's Road East Bermuda

Telephone: +44 (0) 370 Telephone: +1 441 299

702 0137 Hong Kong 6737

Telephone: +852 2862 Email:

Email via website: 8555 hbbm.shareholder.services@hsbc.bm

www.investorcentre.co.uk/contactus Email: hsbc.ecom@computershare.com.hk

Investor Centre: Investor Centre: Investor Centre:

www.investorcentre.co.uk www.investorcentre.com/hk www.investorcentre.com/bm

Any enquiries relating to ADSs should be sent to the

depositary:

The Bank of New York Mellon

Shareowner Services

PO Box 505000

Louisville, KY 40233-5000

USA

Telephone (US): +1 877 283 5786

Telephone (International): +1

201 680 6825

Email: shrrelations@cpushareownerservices.com

Website: www.mybnymdr.com

Any enquiries relating to shares held through Euroclear France,

the settlement and central depositary system for NYSE Euronext

Paris, should be sent to the paying agent:

CACEIS Corporate Trust

14, rue Rouget de Lisle

92130 Issy-Les-Moulineaux

France

Telephone: +33 1 57 78 34 28

Email: ct-service-ost@caceis.com

Website: www.caceis.com

If you have elected to receive general shareholder

communications directly from HSBC Holdings, it is important to

remember that your main contact for all matters relating to your

investment remains the registered shareholder, or custodian or

broker, who administers the investment on your behalf. Therefore

any changes or queries relating to your personal details and

holding (including any administration of it) must continue to be

directed to your existing contact at your investment manager or

custodian or broker. HSBC Holdings cannot guarantee dealing with

matters directed to it in error.

Shareholders who wish to receive a hard copy should contact

HSBC's Registrars. Please visit

www.hsbc.com/investors/investor-contacts for further information.

You can also download an online version of the report from

www.hsbc.com.

Electronic communications

Shareholders may at any time choose to receive corporate

communications in printed form or to receive notifications of their

availability on HSBC's website. To receive notifications of the

availability of a corporate communication on HSBC's website by

email, or revoke or amend an instruction to receive such

notifications by email, go to www.hsbc.com/ecomms. If you provide

an email address to receive electronic communications from HSBC, we

will also send notifications of your dividend entitlements by

email. If you received a notification of the availability of this

document on HSBC's website and would like to receive a printed

copy, or if you would like to receive future corporate

communications in printed form, please write or send an email

(quoting your shareholder reference number) to the appropriate

Registrars at the address given above. Printed copies will be

provided without charge.

Chinese translation

A Chinese translation of this Annual Report and Accounts 2018

will be available upon request after 6 March 2019 from the

Registrars:

Computershare Hong Kong Investor Computershare Investor Services

Services Limited PLC

Rooms 1712-1716, 17th Floor The Pavilions

Hopewell Centre Bridgwater Road

183 Queen's Road East Bristol BS99 6ZZ

Hong Kong United Kingdom

Please also contact the Registrars if you wish to receive

Chinese translations of future documents, or if you have received a

Chinese translation of this document and do not wish to receive

them in future.

Stock symbols

HSBC Holdings ordinary shares trade under the following stock

symbols:

London Stock Exchange HSBA* Euronext Paris HSB

Hong Kong Stock Exchange 5 Bermuda Stock Exchange HSBC.BH

New York Stock Exchange

(ADS) HSBC

*HSBC's Primary market

Investor relations

Enquiries relating to HSBC's strategy or operations may be

directed to:

Richard O'Connor, Global Head of Hugh Pye, Head of Investor Relations,

Investor Relations Asia-Pacific

HSBC Holdings plc The Hongkong and Shanghai Banking

8 Canada Square Corporation Limited

London E14 5HQ 1 Queen's Road Central

United Kingdom Hong Kong

Telephone: +44 (0) 20 7991 6590 Telephone: 852 2822 4908

Email: investorrelations@hsbc.com Email: investorrelations@hsbc.com.hk

Where more information about HSBC is available

This

Annual Report and Accounts 2018

, and other information on HSBC, may be downloaded from HSBC's

website: www.hsbc.com.

Reports, statements and information that HSBC Holdings files

with the Securities and Exchange Commission are available at

www.sec.gov. Investors can also request hard copies of these

documents upon payment of a duplicating fee by writing to the SEC

at the Office of Investor Education and Advocacy, 100 F Street

N.E., Washington, DC 20549-0213 or by emailing PublicInfo@sec.gov.

Investors should call the Commission at (1) 202 551 8090 if they

require further assistance. Investors may also obtain the reports

and other information that HSBC Holdings files at www.nyse.com

(telephone number (1) 212 656 3000).

HM Treasury has transposed the requirements set out under CRD IV

and issued the Capital Requirements Country-by-Country Reporting

Regulations 2013. The legislation requires HSBC Holdings to publish

additional information in respect of the year ended 31 December

2018 by 31 December 2019. This information will be available on

HSBC's website: www.hsbc.com/tax.

Taxation of shares and dividends

Taxation - UK residents

The following is a summary, under current law and the current

published practice of UK HM Revenue and Customer ("HMRC"), of

certain UK tax considerations that are likely to be material to the

ownership and disposition of HSBC Holdings ordinary shares. The

summary does not purport to be a comprehensive description of all

the tax considerations that may be relevant to a holder of shares.

In particular, the summary deals with shareholders who are resident

solely in the UK for UK tax purposes and only with holders who hold

the shares as investments and who are the beneficial owners of the

shares, and does not address the tax treatment of certain classes

of holders such as dealers in securities. Holders and prospective

purchasers should consult their own advisers regarding the tax

consequences of an investment in shares in light of their

particular circumstances, including the effect of any national,

state or local laws.

Taxation of dividends

Currently, no tax is withheld from dividends paid by HSBC

Holdings.

UK resident individuals

UK resident individuals are generally entitled to a tax-free

annual allowance in respect of dividends received. The amount of

the allowance for the tax year beginning 6 April 2018 is GBP2,000.

To the extent that dividend income received by an individual in the

relevant tax year does not exceed the allowance, a nil tax rate

will apply. Dividend income in excess of this allowance will be

taxed at 7.5% for basic rate taxpayers, 32.5% for higher rate

taxpayers and 38.1% for additional rate taxpayers.

UK resident companies

Shareholders that are within the charge to UK corporation tax

should generally be entitled to an exemption from UK corporation

tax on any dividends received from HSBC Holdings. However, the

exemptions are not comprehensive and are subject to anti-avoidance

rules.

If the conditions for exemption are not met or cease to be

satisfied, or a shareholder within the charge to UK corporation tax

elects for an otherwise exempt dividend to be taxable, the

shareholder will be subject to UK corporation tax on dividends

received from HSBC Holdings at the rate of corporation tax

applicable to that shareholder.

Scrip dividends

Information on the taxation consequences of the HSBC Holdings

scrip dividends offered in lieu of the 2017 fourth interim dividend

and the first, second and third interim dividends for 2018 was set

out in the Secretary's letters to shareholders of 7 March, 31 May,

29 August and 24 October 2018. In no case was the difference

between the cash dividend forgone and the market value of the scrip

dividend in excess of 15% of the market value. Accordingly, for

individual shareholders, the amount of the dividend income

chargeable to tax, and the acquisition price of the HSBC Holdings

ordinary shares for UK capital gains tax purposes, was the cash

dividend forgone.

Taxation of capital gains

The computation of the capital gains tax liability arising on

disposals of shares in HSBC Holdings by shareholders subject to UK

tax on capital gains can be complex, partly depending on whether,

for example, the shares were purchased since April 1991, acquired

in 1991 in exchange for shares in The Hongkong and Shanghai Banking

Corporation Limited, or acquired subsequent to 1991 in exchange for

shares in other companies.

For capital gains tax purposes, the acquisition cost for

ordinary shares is adjusted to take account of subsequent rights

and capitalisation issues. Any capital gain arising on a disposal

of shares in HSBC Holdings by a UK company may also be adjusted to

take account of indexation allowance if the shares were acquired

before 1 January 2018, although the level of indexation allowance

that is given in calculating the gain would be frozen at the value

that would apply to the disposal of assets acquired on or after 1

January 2018. If in doubt, shareholders are recommended to consult

their professional advisers.

Stamp duty and stamp duty reserve tax

Transfers of shares by a written instrument of transfer

generally will be subject to UK stamp duty at the rate of 0.5% of

the consideration paid for the transfer (rounded up to the next

GBP5), and such stamp duty is generally payable by the transferee.

An agreement to transfer shares, or any interest therein, normally

will give rise to a charge to stamp duty reserve tax at the rate of

0.5% of the consideration. However, provided an instrument of

transfer of the shares is executed pursuant to the agreement and

duly stamped before the date on which the stamp duty reserve tax

becomes payable, under the current published practice of HMRC it

will not be necessary to pay the stamp duty reserve tax, nor to

apply for such tax to be cancelled. Stamp duty reserve tax is

generally payable by the transferee.

Paperless transfers of shares within CREST, the UK's paperless

share transfer system, are liable to stamp duty reserve tax at the

rate of 0.5% of the consideration. In CREST transactions, the tax

is calculated and payment made automatically. Deposits of shares

into CREST generally will not be subject to stamp duty reserve tax,

unless the transfer into CREST is itself for consideration.

Following the case HSBC pursued before the European Court of

Justice (Case C-569/07 HSBC Holdings plc and Vidacos Nominees Ltd v

The Commissioners for HM Revenue & Customs) and a subsequent

case in relation to depositary receipts, HMRC accepts that the

charge to stamp duty reserve tax at 1.5% on the issue of shares

(and transfers integral to capital raising) to a depositary receipt

issuer or a clearance service is incompatible with European Union

law, and will not be imposed.

At Autumn Budget 2017, the UK government announced that it will

continue its policy of not charging a 1.5% stamp duty and stamp

duty reserve tax on issues of shares to overseas clearance services

and depositary receipt issuers following the UK's departure from

the European Union, although no further confirmations or assurances

have been given since then.

Taxation - US residents

The following is a summary, under current law, of the principal

UK tax and US federal income tax considerations that are likely to

be material to the ownership and disposition of shares or American

Depositary Shares ('ADSs') by a holder that is a US holder, as

defined below, and who is not resident in the UK for UK tax

purposes.

The summary does not purport to be a comprehensive description

of all of the tax considerations that may be relevant to a holder

of shares or ADSs. In particular, the summary deals only with US

holders that hold shares or ADSs as capital assets, and does not

address the tax treatment of holders that are subject to special

tax rules, such as banks, tax-exempt entities, insurance companies,

dealers in securities or currencies, persons that hold shares or

ADSs as part of an integrated investment (including a 'straddle' or

'hedge') comprised of a share or ADS and one or more other

positions, and persons that own, directly or indirectly, 10% or

more (by vote or value) of the stock of HSBC Holdings. This

discussion is based on laws, treaties, judicial decisions and

regulatory interpretations in effect on the date hereof, all of

which are subject to change.

For the purposes of this discussion, a 'US holder' is a

beneficial holder that is a citizen or resident of the United

States, a US domestic corporation or otherwise is subject to US

federal income taxes on a net income basis in respect thereof.

Holders and prospective purchasers should consult their own

advisers regarding the tax consequences of an investment in shares

or ADSs in light of their particular circumstances, including the

effect of any national, state or local laws.

Any US federal tax advice included in this Annual Report and

Accounts 2018 is for informational purposes only; it was not

intended or written to be used, and cannot be used, for the purpose

of avoiding US federal tax penalties.

Taxation of dividends

Currently, no tax is withheld from dividends paid by HSBC

Holdings. For US tax purposes, a US holder must include cash

dividends paid on the shares or ADSs in ordinary income on the date

that such holder or the ADS depositary receives them, translating

dividends paid in UK pounds sterling into US dollars using the

exchange rate in effect on the date of receipt. A US holder that

elects to receive shares in lieu of a cash dividend must include in

ordinary income the fair market value of such shares on the

dividend payment date, and the tax basis of those shares will equal

such fair market value.

Subject to certain exceptions for positions that are held for

less than 61 days, and subject to a foreign corporation being

considered a 'qualified foreign corporation' (which includes not

being classified for US federal income tax purposes as a passive

foreign investment company), certain dividends ('qualified

dividends') received by an individual US holder generally will be

subject to US taxation at preferential rates. Based on the

company's audited financial statements and relevant market and

shareholder data, HSBC Holdings was not and does not anticipate

being classified as a passive foreign investment company.

Accordingly, dividends paid on the shares or ADSs generally should

be treated as qualified dividends.

Taxation of capital gains

Gains realised by a US holder on the sale or other disposition

of shares or ADSs normally will not be subject to UK taxation

unless at the time of the sale or other disposition the holder

carries on a trade, profession or vocation in the UK through a

branch or agency or permanent establishment and the shares or ADSs

are or have been used, held or acquired for the purposes of such

trade, profession, vocation, branch or agency or permanent

establishment. Such gains will be included in income for US tax

purposes, and will be long-term capital gains if the shares or ADSs

were held for more than one year. A long-term capital gain realised

by an individual US holder generally will be subject to US tax at

preferential rates.

Inheritance tax

Shares or ADSs held by an individual whose domicile is

determined to be the US for the purposes of the United

States-United Kingdom Double Taxation Convention relating to estate

and gift taxes (the 'Estate Tax Treaty') and who is not for such

purposes a national of the UK will not, provided any US federal

estate or gift tax chargeable has been paid, be subject to UK

inheritance tax on the individual's death or on a lifetime transfer

of shares or ADSs except in certain cases where the shares or ADSs

(i) are comprised in a settlement (unless, at the time of the

settlement, the settlor was domiciled in the US and was not a

national of the UK), (ii) are part of the business property of a UK

permanent establishment of an enterprise, or (iii) pertain to a UK

fixed base of an individual used for the performance of independent

personal services. In such cases, the Estate Tax Treaty generally

provides a credit against US federal tax liability for the amount

of any tax paid in the UK in a case where the shares or ADSs are

subject to both UK inheritance tax and to US federal estate or gift

tax.

Stamp duty and stamp duty reserve tax - ADSs

If shares are transferred to a clearance service or American

Depositary Receipt ('ADR') issuer (which will include a transfer of

shares to the Depositary) under the current published HMRC

practice, UK stamp duty and/or stamp duty reserve tax will be

payable. The stamp duty or stamp duty reserve tax is generally

payable on the consideration for the transfer and is payable at the

aggregate rate of 1.5%.

The amount of stamp duty reserve tax payable on such a transfer

will be reduced by any stamp duty paid in connection with the same

transfer.

No stamp duty will be payable on the transfer of, or agreement

to transfer, an ADS, provided that the ADR and any separate

instrument of transfer or written agreement to transfer remain at

all times outside the UK, and provided further that any such

transfer or written agreement to transfer is not executed in the

UK. No stamp duty reserve tax will be payable on a transfer of, or

agreement to transfer, an ADS effected by the transfer of an

ADR.

US backup withholding tax and information reporting

Distributions made on shares or ADSs and proceeds from the sale

of shares or ADSs that are paid within the US, or through certain

financial intermediaries to US holders, are subject to information

reporting and may be subject to a US 'backup' withholding tax.

General exceptions to this rule happen when the US holder:

establishes that it is a corporation (other than an S corporation)

or other exempt holder; or provides a correct taxpayer

identification number, certifies that no loss of exemption from

backup withholding has occurred and otherwise complies with the

applicable requirements of the backup withholding rules. Holders

that are not US taxpayers generally are not subject to information

reporting or backup withholding tax, but may be required to comply

with applicable certification procedures to establish that they are

not US taxpayers in order to avoid the application of such

information reporting requirements or backup withholding tax to

payments received within the US or through certain financial

intermediaries.

Cautionary statement regarding

forward-looking statements

The

Annual Report and Accounts 2018

contains certain forward-looking statements with respect to

HSBC's financial condition, results of operations and business,

including the strategic priorities and 2020 financial, investment

and capital targets described herein.

Statements that are not historical facts, including statements

about HSBC's beliefs and expectations, are forward-looking

statements. Words such as 'expects', 'targets', 'anticipates',

'intends', 'plans', 'believes', 'seeks', 'estimates', 'potential'

and 'reasonably possible', variations of these words and similar

expressions are intended to identify forward-looking statements.

These statements are based on current plans, estimates and

projections, and therefore undue reliance should not be placed on

them. Forward-looking statements speak only as of the date they are

made. HSBC makes no commitment to revise or update any

forward-looking statements to reflect events or circumstances

occurring or existing after the date of any forward-looking

statements.

Written and/or oral forward-looking statements may also be made

in the periodic reports to the US Securities and Exchange

Commission, summary financial statements to shareholders, proxy

statements, offering circulars and prospectuses, press releases and

other written materials, and in oral statements made by HSBC's

Directors, officers or employees to third parties, including

financial analysts.

Forward-looking statements involve inherent risks and

uncertainties. Readers are cautioned that a number of factors could

cause actual results to differ, in some instances materially, from

those anticipated or implied in any forward-looking statement.

These include, but are not limited to:

-- Changes in general economic conditions in the markets in

which we operate, such as continuing or deepening recessions and

fluctuations in employment beyond those factored into consensus

forecasts; changes in foreign exchange rates and interest rates,

including the accounting impact resulting from financial reporting

in respect of hyperinflationary economies; volatility in equity

markets; lack of liquidity in wholesale funding markets;

illiquidity and downward price pressure in national real estate

markets; adverse changes in central banks' policies with respect to

the provision of liquidity support to financial markets; heightened

market concerns over sovereign creditworthiness in over-indebted

countries; adverse changes in the funding status of public or

private defined benefit pensions; and consumer perception as to the

continuing availability of credit and price competition in the

market segments we serve; and deviations from the market and

economic assumptions that form the basis for our ECL

measurements;

-- Changes in government policy and regulation, including the

monetary, interest rate and other policies of central banks and

other regulatory authorities; initiatives to change the size, scope

of activities and interconnectedness of financial institutions in

connection with the implementation of stricter regulation of

financial institutions in key markets worldwide; revised capital

and liquidity benchmarks which could serve to deleverage bank

balance sheets and lower returns available from the current

business model and portfolio mix; imposition of levies or taxes

designed to change business mix and risk appetite; the practices,

pricing or responsibilities of financial institutions serving their

consumer markets; expropriation, nationalisation, confiscation of

assets and changes in legislation relating to foreign ownership;

changes in bankruptcy legislation in the principal markets in which

we operate and the consequences thereof; general changes in

government policy that may significantly influence investor

decisions; extraordinary government actions as a result of current

market turmoil; other unfavourable political or diplomatic

developments producing social instability or legal uncertainty

which in turn may affect demand for our products and services; the

costs, effects and outcomes of product regulatory reviews, actions

or litigation, including any additional compliance requirements;

and the effects of competition in the markets where we operate

including increased competition from non-bank financial services

companies, including securities firms.

-- Factors specific to HSBC, including our success in adequately

identifying the risks we face, such as the incidence of loan losses

or delinquency, and managing those risks (through account

management, hedging and other techniques). Effective risk

management depends on, among other things, our ability through

stress testing and other techniques to prepare for events that

cannot be captured by the statistical models it uses; and our

success in addressing operational, legal and regulatory, and

litigation challenges; and other risks and uncertainties we

identify in 'top and emerging risks' on pages 69 to 73.

Certain defined terms

Unless the context requires otherwise, 'HSBC Holdings' means

HSBC Holdings plc and 'HSBC', the 'Group', 'we', 'us' and 'our'

refer to HSBC Holdings together with its subsidiaries. Within this

document the Hong Kong Special Administrative Region of the

People's Republic of China is referred to as 'Hong Kong'. When used

in the terms 'shareholders' equity' and 'total shareholders'

equity', 'shareholders' means holders of HSBC Holdings ordinary

shares and those preference shares and capital securities issued by

HSBC Holdings classified as equity. The abbreviations '$m', '$bn'

and '$tn' represent millions, billions (thousands of millions) and

trillions of US dollars, respectively.

Abbreviations

Currencies

GBP British pound sterling

CA$ Canadian dollar

EUR Euro

HK$ Hong Kong dollar

MXN Mexican peso

RMB Chinese renminbi

---------------

SGD Singapore dollar

--------------- -----------------------------------------------

$ United States dollar

--------------- -----------------------------------------------

A

--------------- -----------------------------------------------

ABS(1) Asset-backed security

ADR American Depositary Receipt

ADS American Depositary Share

AFS Available for sale

AGM Annual General Meeting

AIEA Average interest-earning

assets

ALCM Asset, Liability and Capital

Management

ALCO Asset and Liability Management

Committee

AML Anti-money laundering

AML DPA Five-year deferred prosecution

agreement with the US Department

of Justice, entered into

in December 2012

--------------- -----------------------------------------------

ASEAN Association of Southeast

Asian Nations

AT1 Additional tier 1

B

--------------- -----------------------------------------------

Basel Basel Committee on Banking

Committee Supervision

Basel 2006 Basel Capital Accord

II(1)

Basel Basel Committee's reforms

III(1) to strengthen global capital

and liquidity rules

BIS Bank for International Settlements

BoCom Bank of Communications Co.,

Limited, one of China's

largest banks

BoE Bank of England

Bps(1) Basis points. One basis

point is equal to one-hundredth

of a percentage point

--------------- -----------------------------------------------

BSA Bank Secrecy Act (US)

BSM Balance Sheet Management

BVI British Virgin Islands

C

--------------- -----------------------------------------------

C&L Credit and Lending

--------------- -----------------------------------------------

CAPM Capital asset pricing model

CCAR Federal Reserve Comprehensive

Capital Analysis and Review

CDOs Collateralised debt obligations

CDS(1) Credit default swap

CEA Commodity Exchange Act (US)

CET1(1) Common equity tier 1

CGUs Cash-generating units

--------------- -----------------------------------------------

CMB Commercial Banking, a global

business

CMC Capital maintenance charge

CML(1) Consumer and Mortgage Lending

(US)

--------------- -----------------------------------------------

CODM Chief Operating Decision

Maker

--------------- -----------------------------------------------

COSO 2013 Committee of the Sponsors

of the Treadway Commission

(US)

CP(1) Commercial paper

CRD(1) Capital Requirements Directive

CRD IV Capital Requirements Regulation

and Directive

--------------- -----------------------------------------------

CRR(1) Customer risk rating

--------------- -----------------------------------------------

CSA Credit support annex

--------------- -----------------------------------------------

CVA(1) Credit valuation adjustment

--------------- -----------------------------------------------

D

--------------- -----------------------------------------------

DDOS Distributed denial of service

--------------- -----------------------------------------------

Deferred Awards of deferred shares

Shares define the number of HSBC

Holdings ordinary shares

to which the employee will

become entitled, generally

between one and seven years

from the date of the award,

and normally subject to

the individual remaining

in employment

--------------- -----------------------------------------------

Dodd-Frank Dodd-Frank Wall Street Reform

and Consumer Protection

Act (US)

DoJ US Department of Justice

DPD Days past due

DPF Discretionary participation

feature of insurance and

investment contracts

DVA(1) Debit valuation adjustment

E

--------------- -----------------------------------------------

EAD(1) Exposure at default

EBA European Banking Authority

EC European Commission

ECB European Central Bank

EEA European Economic Area

ECL Expected credit losses.

In the income statement,

ECL is recorded as a change

in expected credit losses

and other credit impairment

charges. In the balance

sheet, ECL is recorded as

an allowance for financial

instruments to which only

the impairment requirements

in IFRS 9 are applied.

-----------------------------------------------

EL(1) Expected loss

ESG Environmental, Social and

Governance

EU European Union

Euribor Euro interbank offered rate

EVE Economic value of equity

F

--------------- -----------------------------------------------

FCA Financial Conduct Authority

(UK)

FFVA Funding fair value adjustment

estimation methodology on

derivative contracts

--------------- -----------------------------------------------

FPA Fixed pay allowance

--------------- -----------------------------------------------

FRB Federal Reserve Board (US)

--------------- -----------------------------------------------

FRC Financial Reporting Council

--------------- -----------------------------------------------

FSB Financial Stability Board

--------------- -----------------------------------------------

FSCS Financial Services Compensation

Scheme

--------------- -----------------------------------------------

FSVC Financial System Vulnerabilities

Committee

FTE Full-time equivalent staff

FTSE Financial Times - Stock

Exchange index

FuM Funds under management

FVOCI(1) Fair value through other

comprehensive income

FVPL(1) Fair value through profit

or loss

FX DPA Three-year deferred prosecution

agreement with the US Department

of Justice, entered into

in January 2018

-----------------------------------------------

G

--------------- -----------------------------------------------

GAAP Generally accepted accounting

principles

GAC Group Audit Committee

GB&M Global Banking and Markets,

a global business

GDP Gross domestic product

--------------- -----------------------------------------------

GDPR General Data Protection

Regulation

GLCM Global Liquidity and Cash

Management

Global HSBC's capital markets services

Markets in Global Banking and Markets

--------------- -----------------------------------------------

GMB Group Management Board

GMP Guaranteed minimum pension

GPB Global Private Banking,

a global business

GPSP Group Performance Share

Plan

GRC Group Risk Committee

--------------- -----------------------------------------------

Group HSBC Holdings together with

its subsidiary undertakings

GSM The Group's Global Standards

Manual

GTRF Global Trade and Receivables

Finance

H

--------------- -----------------------------------------------

Hang Seng Hang Seng Bank Limited,

Bank one of Hong Kong's largest

banks

--------------- -----------------------------------------------

HKEx The Stock Exchange of Hong

Kong Limited

--------------- -----------------------------------------------

HKMA Hong Kong Monetary Authority

HMRC HM Revenue and Customs

HNAH HSBC North America Holdings

Inc.

Holdings HSBC Holdings Asset and

ALCO Liability Management Committee

Hong Kong Hong Kong Special Administrative

Region of the People's Republic

of China

HOST HSBC Operations Services

and Technology

HQLA High-quality liquid assets

HSBC HSBC Holdings together with

its subsidiary undertakings

HSBC Bank HSBC Bank plc

HSBC Bank HSBC Bank Middle East Limited

Middle

East

--------------- -----------------------------------------------

HSBC Bank HSBC Bank USA, N.A., HSBC's

USA retail bank

in the US

--------------- -----------------------------------------------

HSBC Canada The sub-group, HSBC Bank

Canada, HSBC Trust Company

Canada, HSBC Mortgage Corporation

Canada and HSBC Securities

Canada, consolidated for

liquidity purposes

HSBC Colombia HSBC Bank (Colombia) S.A.

HSBC Finance HSBC Finance Corporation,

the US consumer finance

company (formerly Household

International, Inc.)

HSBC France HSBC's French banking subsidiary,

formerly CCF S.A.

HSBC Holdings HSBC Holdings plc, the parent

company of HSBC

HSBC Private HSBC Private Bank (Suisse)

Bank (Suisse) SA, HSBC's private bank

in Switzerland

HSBC UK HSBC UK Bank plc

--------------- -----------------------------------------------

HSBC USA The sub-group, HSBC USA

Inc (the holding company

of HSBC Bank USA) and HSBC

Bank USA, consolidated for

liquidity purposes

HSI HSBC Securities (USA) Inc.

HSSL HSBC Securities Services

(Luxembourg)

HTIE HSBC International Trust

Services (Ireland) Limited

HTM Held to maturity

--------------- -----------------------------------------------

I

--------------- -----------------------------------------------

IAS International Accounting

Standards

IASB International Accounting

Standards Board

Ibor Interbank offered rate

-----------------------------------------------

ICAAP Internal capital adequacy

assessment process

IFRSs International Financial

Reporting Standards

ILAAP Individual liquidity adequacy

assessment process

IRB(1) Internal ratings-based

IRRBB Interest rate risk in the

banking book

ISDA International Swaps and

Derivatives Association

-----------------------------------------------

J

--------------- -----------------------------------------------

Jaws Adjusted jaws measures the

difference between the rates

of change in adjusted revenue

and adjusted operating expenses.

--------------- -----------------------------------------------

K

--------------- -----------------------------------------------

KMP Key Management Personnel

--------------- -----------------------------------------------

L

--------------- -----------------------------------------------

LCR Liquidity coverage ratio

LFRF Liquidity and funding risk

management framework

LGBT+ Lesbian, gay, bisexual and

transgender. The plus sign

denotes other non-mainstream

groups on the spectrums

of sexual orientation and

gender identity

LGD(1) Loss given default

Libor London interbank offered

rate

LICs Loan impairment charges

and other credit risk provisions

--------------- -----------------------------------------------

LMA Loan Markets Association

--------------- -----------------------------------------------

LTI Long-term incentive

--------------- -----------------------------------------------

LTV(1) Loan-to-value ratio

--------------- -----------------------------------------------

M

--------------- -----------------------------------------------

Mainland People's Republic of China

China excluding Hong Kong

Malachite Malachite Funding Limited,

a term-funding vehicle

Mazarin Mazarin Funding Limited,

an asset-backed CP conduit

MBS US mortgage-backed security

MENA Middle East and North Africa

MOCs Model Oversight Committees

Monoline Monoline insurance company

MRT(1) Material Risk Taker

--------------- -----------------------------------------------

N

--------------- -----------------------------------------------

NII Net interest income

NSFR Net stable funding ratio

NYSE New York Stock Exchange

O

--------------- -----------------------------------------------

OCC Office of the Comptroller

of the Currency (US)

OCI Other comprehensive income

OECD Organisation of Economic

Co-operation and Development

OFAC Office of Foreign Assets

Control

ORMF Operational risk management

framework

OTC(1) Over-the-counter

P

--------------- -----------------------------------------------

PD(1) Probability of default

--------------- -----------------------------------------------

Performance Awards of HSBC Holdings

shares(1) ordinary shares under employee

share plans that are subject

to corporate performance

conditions

Ping An Ping An Insurance (Group)

Company of China, Ltd, the

second-largest life insurer

in the PRC

POCI Purchased or originated

credit-impaired financial

assets

PBT Profit before tax

PIT Point-in-time

PPI Payment protection insurance

PRA Prudential Regulation Authority

(UK)

PRC People's Republic of China

Principal HSBC Bank (UK) Pension Scheme

plan

PVIF Present value of in-force

long-term insurance business

and long-term investment

contracts with DPF

PwC The member firms of the

PwC network, including PricewaterhouseCoopers

LLP

R

--------------- -----------------------------------------------

RAS Risk appetite statement

RBWM Retail Banking and Wealth

Management, a global business

Repo(1) Sale and repurchase transaction

Reverse Security purchased under

repo commitments to sell

--------------- -----------------------------------------------

RFB Ring-fenced bank

--------------- -----------------------------------------------

RFR Risk-free rate

--------------- -----------------------------------------------

RMM Risk Management Meeting

of the Group Management

Board

--------------- -----------------------------------------------

RNIV Risk not in VaR

RoE Return on equity

--------------- -----------------------------------------------

RoRWA Return on average risk-weighted

assets

--------------- -----------------------------------------------

RoTE Return on tangible equity

RWA(1) Risk-weighted asset

S

-----------------------------------------------

SAPS Self-administered pension

scheme

SDG United Nation's Sustainable

Development Goals

SE(1) Structured entity

SEC Securities and Exchange

Commission (US)

ServCo Separately incorporated

group group of service companies

planned in response to UK

ring-fencing proposals

SFR Stable funding ratio

Sibor Singapore interbank offered

rate

SIC Securities investment conduit

SID Senior Independent Director

SME Small- and medium-sized

enterprise

Solitaire Solitaire Funding Limited,

a special purpose entity

managed by HSBC

SPE(1) Special purpose entity

SPPI Solely payments of principal

and interest

SRI Socially responsible investment

T

--------------- -----------------------------------------------

T1 Tier 1

T2 Tier 2

--------------- -----------------------------------------------

TCFD(1) Task Force on Climate-related

Financial Disclosures

--------------- -----------------------------------------------

TLAC(1) Total loss-absorbing capacity

TSR(1) Total shareholder return

--------------- -----------------------------------------------

U

--------------- -----------------------------------------------

UAE United Arab Emirates

UK United Kingdom

--------------- -----------------------------------------------

UN United Nations

UN PRI United Nations Principles

of Responsible Investment

--------------- -----------------------------------------------

US United States of America

US run-off Includes our CML, vehicle

portfolio finance and Taxpayer Financial

Services businesses and

insurance, commercial, corporate

and treasury activities

in HSBC Finance on an IFRSs

management basis

--------------- -----------------------------------------------

V

--------------- -----------------------------------------------

VaR(1) Value at risk

VIU Value in use

--------------- -----------------------------------------------

1 A full definition is included in the glossary to the Annual

Report and Accounts 2018 which is available at

www.hsbc.com/investors.

HSBC Holdings plc

Incorporated in England on 1 January

1959 with

limited liability under the UK Companies

Act

Registered in England: number 617987

Registered Office and Group Head

Office

8 Canada Square

London E14 5HQ

United Kingdom

Telephone: 44 020 7991 8888

Facsimile: 44 020 7992 4880

Web: www.hsbc.com

Registrars

Principal Register

Computershare Investor Services

PLC

The Pavilions

Bridgwater Road

Bristol BS99 6ZZ

United Kingdom

Telephone: 44 0370 702 0137

Email: via website

Web: www.investorcentre.co.uk/contactus

Hong Kong Overseas Branch Register

Computershare Hong Kong Investor

Services

Limited

Rooms 1712-1716, 17th floor

Hopewell Centre

183 Queen's Road East

Hong Kong

Telephone: 852 2862 8555

Email: hsbc.ecom@computershare.com.hk

Web: www.investorcentre.com/hk

Bermuda Overseas Branch Register

Investor Relations Team

HSBC Bank Bermuda Limited

37 Front Street

Hamilton HM11

Bermuda

Telephone: 1 441 299 6737

Email: hbbm.shareholder.services@hsbc.bm

Web: www.investorcentre.com/bm

ADR Depositary

The Bank of New York Mellon

Shareowner Services

PO Box 505000

Louisville, KY 40233-5000

USA

Telephone (US): 1 877 283 5786

Telephone (International): 1 201

680 6825

Email: shrrelations@cpushareownerservices.com

Web: www.mybnymdr.com

Paying Agent (France)

CACEIS Corporate Trust

14, rue Rouget de Lisle

92130 Issy-Les-Moulineaux

France

Telephone: 33 1 57 78 34 28

Email: ct-service-ost@caceis.com

Web: www.caceis.com

Corporate Brokers

Goldman Sachs International

Peterborough Court

133 Fleet Street

London EC4A 2BB

United Kingdom

Credit Suisse Securities (Europe)

Limited

1 Cabot Square

London E14 4QT

United Kingdom

HSBC Bank plc

8 Canada Square

London E14 5HQ

United Kingdom

(c) Copyright HSBC Holdings plc 2019

All rights reserved

No part of this publication may be reproduced, stored in a

retrieval system, or transmitted, in any form or by any means,

electronic, mechanical, photocopying, recording, or otherwise,

without the prior written permission of HSBC Holdings plc.

Published by Global Finance, HSBC Holdings plc, London

Designed by Superunion (formerly Addison Group), London

(Strategic Report) and by Global Finance with Superunion (rest of

Annual Report and Accounts)

Photography

Highlights (pages 2 to 3): Lavender field in Provence, France.

Taken by Andrea A Attard, who works in our corporate treasury

solutions team in Malta

Our strategy (pages 10 to 13): Boat navigating off the coast of

Thailand. Taken by Joanna S Ellis, who supports with retail

customer due diligence and is based in India

Global businesses (pages 18 to 21): Hong Kong skyline at night.

Taken by John Oldham, who works in the legal team in the UK

How we do business (pages 22 to 23): Fish off Raja Ampat,

Indonesia, one of the world's most diverse marine regions. Taken by

Faith Li, who works in asset management in China

How we do business (pages 28 to 29): Thrunton Woods,

Northumberland. Taken by Ciara Jennings, who works in the UK's

digital technology team

Risk overview (pages 30 to 31): Raindrops on a peacock feather.

Taken by Noman Anwar, who works in communications in Bangladesh

Inside back cover: Crowds below an escalator in Incheon Airport,

South Korea. Taken by Michael Hu, who works in China's finance

team

Group Chairman and Group Chief Executive portraits: Taken by

Charles Best

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSEAKDKEFPNEFF

(END) Dow Jones Newswires

March 06, 2019 12:06 ET (17:06 GMT)

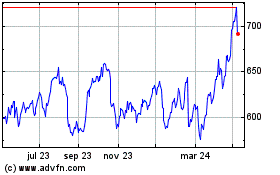

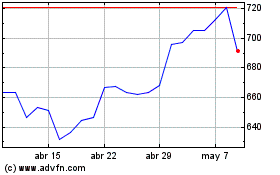

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024