Pound Falls Amid Risk Aversion, BoE Tenreyro's Remarks

07 Marzo 2019 - 12:53AM

RTTF2

The pound dropped against its major counterparts in the European

session on Thursday, amid risk aversion on continued worries over

global growth and trade as well as remarks from a Bank of England

policymaker suggesting the possibility of loosening of monetary

policy in the event of a disorderly Brexit.

Investors looked ahead to the ECB meeting later today for

signals whether it would add fresh stimulus into the economy.

Speaking in Glasgow, BoE rate-setter Silvana Tenreyro remarked

that the central bank is more likely to reduce interest rates

instead of raising them in the event of a no-deal Brexit.

"In my judgement, a situation where the negative demand effects

outweigh those other effects is more likely, which would

necessitate a loosening in policy," Tenreyro said.

The latest round of Brexit negotiations ended without a

breakthrough on Wednesday.

EU officials have reportedly given the U.K. government 48 hours

to table fresh concrete proposals to change the backstop in order

to break the Brexit deadlock.

Figures from the Lloyds Bank subsidiary Halifax and IHS Markit

showed that UK house price inflation accelerated more-than-expected

in February to its highest level in six months.

The house price index rose 2.8 percent year-on-year following a

0.8 percent increase in January. Economists had forecast 1 percent

growth in house prices.

The currency was higher against its key counterparts in the

Asian session.

The pound declined to 1.3151 against the greenback, from a 2-day

high of 1.3185 hit at 9:30 pm ET. Next key support for the pound is

seen around the 1.30 mark.

The U.K. currency reversed from an early high of 147.28 against

the yen, reaching as low as 146.84. The pound is seen finding

support around the 144.00 level.

Having risen to a 3-day high of 1.3244 against the Swiss franc

at 10:00 pm ET, the pound retreated with the pair trading at

1.3208. If the pound slides further, 1.30 is likely seen as its

next support level.

The pound slipped to 0.8603 against the euro, after rising to

0.8575 at 9:45 pm ET. The next possible support for the pound is

seen around the 0.88 region.

Data from Eurostat showed that Eurozone's economic growth in the

fourth quarter of 2018 matched its earlier estimates and employment

gains were also unrevised.

Gross domestic product grew 0.2 percent from the third quarter,

when the economy expanded 0.1 percent, revised from 0.2 percent

reported earlier.

In today's events, at 7:45 am ET, the European Central Bank

announces its decision on interest rates. Economists expect the

refi rate and the marginal lending facility rate to be kept at 0.00

percent and 0.25 percent, respectively.

In the New York session, Canada building permits for January,

U.S. weekly jobless claims for the week ended March 2 and consumer

credit for January are scheduled for release.

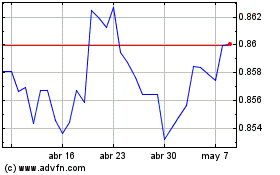

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Mar 2024 a Abr 2024

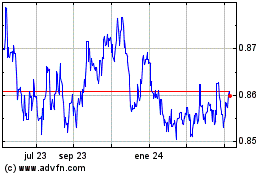

Euro vs Sterling (FX:EURGBP)

Gráfica de Divisa

De Abr 2023 a Abr 2024