Tritax Big Box REIT plc Director/PDMR Shareholding (2310S)

07 Marzo 2019 - 10:57AM

UK Regulatory

TIDMBBOX

RNS Number : 2310S

Tritax Big Box REIT plc

07 March 2019

7 March 2019

TRITAX BIG BOX REIT PLC

(the "Company")

PDMR SHAREHOLDING AMENDMENT

Further to the PDMR shareholding announcement on 18 February

2019, the Company has been notified by Richard Laing, a

Non-Executive Director of the Company, that he has since been

advised by the nominee company through which his wife's interests

in the Company's ordinary shares (the "Ordinary Shares") are held

(the "Nominee"), that Mrs Laing was allocated 12,440 Ordinary

Shares by the Nominee pursuant to its participation in the

Company's pre-emptive offer of Ordinary Shares which closed on

Friday, 8 February 2019 (the "Open Offer").

Therefore, the total number of Ordinary Shares acquired by Mr

Laing and his connected persons pursuant to the Open Offer was

12,440, not 6,733 as previously notified. The total beneficial

holding of Mr Laing (and/or his connected persons) is, therefore,

45,828 Ordinary Shares, representing 0.003% of the Company's

current issued share capital, rather than 40,121 Ordinary Shares.

All other details remain the same.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Tritax Group via Maitland below

Colin Godfrey (Partner, Fund Manager)

Maitland (Communications Adviser) Tel: 020 7379 5151

James Benjamin tritax-maitland@maitland.co.uk

Jefferies International Limited Tel: 020 7029 8000

Gary Gould

Stuart Klein

Akur Limited Tel: 020 7493 3631

Anthony Richardson

Tom Frost

Siobhan Sergeant

The Company's LEI is: 213800L6X88MIYPVR714

NOTES:

Tritax Big Box REIT plc is the only listed vehicle dedicated to

investing in very large logistics warehouse assets ("Big Boxes") in

the UK and is committed to delivering attractive and sustainable

returns for shareholders. Investing in and actively managing

existing built investments, land suitable for Big Box development

and pre-let forward funded developments, the Company focuses on

well-located, modern Big Box logistics assets, typically greater

than 500,000 sq ft (measured by floor area, c. 69% of the Company's

existing logistics facilities including forward funded developments

are in excess of 500,000 sq ft), let to institutional-grade tenants

on long-term leases (typically at least 12 years in length) with

upward-only rent reviews and geographic and tenant diversification

throughout the UK. The Company seeks to exploit the significant

opportunity in this sub-sector of the UK logistics market owing to

strong tenant demand and limited supply of Big Boxes.

The Company is a real estate investment trust to which Part 12

of the UK Corporation Tax Act 2010 applies ("REIT"), is listed on

the premium segment of the Official List of the UK Financial

Conduct Authority and is a constituent of the FTSE 250, FTSE

EPRA/NAREIT and MSCI indices.

Further information on Tritax Big Box REIT is available at

www.tritaxbigbox.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DSHQDLFBKXFEBBE

(END) Dow Jones Newswires

March 07, 2019 11:57 ET (16:57 GMT)

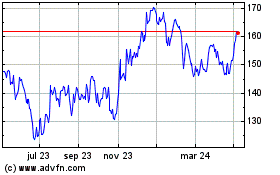

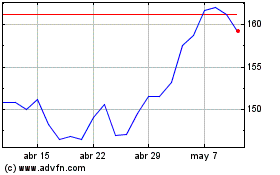

Tritax Big Box Reit (LSE:BBOX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tritax Big Box Reit (LSE:BBOX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024