TIDMNAR

RNS Number : 2357S

Northamber PLC

08 March 2019

Northamber PLC

("Northamber" or the "Company")

Interim Report for the Six months to 31 December 2018

Chairman's Statement

Results

Having reported a strong and encouraging performance for the

full year to June 2018, it is disappointing to report that the

commercial sector upon which our B2B offering is focussed has been

negatively impacted by the widespread Brexit malaise hanging over

us all. Back in September 2018, I did highlight the difficulties of

forecasting future performance but as ever we have worked hard to

maximise our opportunities and exert influence over those factors

we do have in our control.

In the first half we have seen revenues fall from GBP31.7

million to GBP24.2 million for the comparative period last year,

although this has reflected our planned refocusing of our core

business case and it is worth noting that revenues in the second

half of the year ended 30 June 2018 were GBP26.5 million. What I am

pleased to report is that the trend of improvement in the Gross

Profit margin has continued, increasing from 7.6% to 8.4% in the

first half, alongside lower overheads including distribution

costs.

Frustratingly, a supplier for a significant new product area

breached our contract during the first half which results in lost

sales and contribution. We took swift legal action against this

supplier, and a related party, which could result in a settlement

in our favour. The matter has yet to be concluded, but has so far

resulted in an interim award judgement in our favour of GBP431,000

plus costs. More importantly, we have secured replacement vendors

and those results will start coming on stream during the second

half of our financial year.

Partly as a result of the event reported immediately above, at

the pre-tax level we made a loss of GBP353,000 compared with a

GBP201,000 loss in the comparative period a year ago. As stated, we

nonetheless gained improvement in our gross margins, whilst

continued proactive cost monitoring resulted in overhead economies

in both Distribution and Administration compared with the

comparative period last year, with a comparative saving of

GBP113,000 for the period.

Financial position

Maintaining our prudence in financial matters, our working

capital management is reflected in the Net Current Assets ratio

which at 2.6 times (2018: 2.0 times) is a healthy improvement.

Free Cash was GBP2.9 million at 31 December 2018 compared with

GBP2.2 million at 31 December 2017. With Fixed Assets at book value

at GBP7.8 million, including two unencumbered freehold properties

whose value is, in the Board's strong view, in excess of book, the

Company's overall financial position is sound.

Net Assets at 61.9p per share are considerably in excess of the

average price of the ordinary shares throughout the period.

Board

I am very pleased to highlight that Colin Thompson has recently

joined the board as a non-executive director and who will support

my own role. Colin originally joined the Company in 1982 and was a

board director from September 1991 until January 1999. He was

instrumental in the design, construction and effective efficiencies

of all our IT and logistics systems.

Dividend

As in previous years, your board has had regard to the strength

of our debt free, tangible asset strong balance sheet and is

proposing the interim dividend be 0.1p, at a total cost of only

GBP27,357. The dividend will be paid on 13th May 2019 to

shareholders on the register as at 12th April 2019.

Staff

We continue to invest in our evolving business model with added

skills based services and which are heavily reliant on our staff to

achieve our business case evolution and I am very grateful to all

of our staff for their continued support and flexibility.

Outlook

My comments in previous statements, especially those made in

recent years, have tended to be cautionary, which by and large has

been borne out in actual outcomes.

As regards the current underlying trading position, the state of

the economy at large, the extremely and damaging fluid Brexit

scenario, and the associated effects on our own sector offers,

offer no greater incentive for optimism now than they have in the

past. Our continued focus on the new higher margin value categories

continues to be an area we are confident and excited about, and

where we see our future opportunities.

D.M. Phillips

Chairman

8th March 2019

For more information please contact:

Northamber plc 020 8296 7000

David Phillips, Chairman

Cantor Fitzgerald Europe (Nominated Adviser

& Broker) 020 7894 7000

Phil Davies / Michael Boot

Consolidated Statement of Comprehensive Income

6 months to 31 December 2018

6 months 6 months Year

Ended Ended Ended

31.12.18 31.12.17 30.06.18

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Revenue 24,234 31,659 58,136

Cost of sales (22,197) (29,239) (53,589)

---------- ------------ ---------

Gross Profit 2,037 2,420 4,547

Distribution cost (1,392) (1,471) (2,850)

Administrative expenses (1,142) (1,176) (2,276)

---------- ------------ ---------

(Loss) from operations (497) (227) (579)

Investment revenue 144 26 90

---------- ------------ ---------

(Loss) before tax (353) (201) (489)

Tax credit/(charge) - - -

---------- ------------ ---------

Loss and total comprehensive

income

for the period (353) (201) (489)

---------- ------------ ---------

Basic and diluted (loss)

per ordinary share (1.28)p (0.71)p (1.74)p

Consolidated Statement of Financial

Position

As at 31 December 2018

As at As at As at

31.12.18 31.12.17 30.06.18

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Non current assets

Property, plant and equipment 7,799 7,953 7,894

---------- ---------- ---------

Current assets

Inventories 4,193 5,953 3,378

Trade and other receivables 7,662 12,005 8,145

Cash and cash equivalents 2,931 2,247 5,067

14,786 20,205 16,590

---------- ---------- ---------

Total assets 22,585 28,158 24,484

---------- ---------- ---------

Current liabilities

Trade and other payables (5,643) (10,294) (6,964)

---------- ---------- ---------

Total liabilities (5,643) (10,294) (6,964)

---------- ---------- ---------

Net assets 16,942 17,864 17,520

---------- ---------- ---------

Equity

Share capital 273 281 281

Share premium account 5,734 5,734 5,734

Capital redemption reserve

fund 1,513 1,505 1,505

Retained earnings 9,422 10,344 10,000

Equity shareholders' funds 16,942 17,864 17,520

---------- ---------- ---------

Company Statement of Financial Position

As at 31 December 2018

As at As at As at

31.12.18 31.12.17 30.06.18

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Non current assets

Property, plant and equipment 1,783 1,864 1,841

Investments 6,588 6,588 6,588

---------- ---------- ---------

8,371 8,452 8,429

Current assets

Inventories 4,193 5,953 3,378

Trade and other receivables 7,665 12,005 8,145

Cash and cash equivalents 2,871 2,210 5,034

14,729 20,168 16,557

---------- ---------- ---------

Total assets 23,100 28,620 24,986

---------- ---------- ---------

Current liabilities

Trade and other payables (9,442) (13,515) (10,486)

---------- ---------- ---------

Total liabilities (9,442) (13,515) (10,486)

---------- ---------- ---------

Net assets 13,658 15,105 14,500

---------- ---------- ---------

Equity

Share capital 273 281 281

Share premium account 5,734 5,734 5,734

Capital redemption reserve

fund 1,513 1,505 1,505

Retained earnings 6,138 7,585 6,980

Equity shareholders' funds 13,658 15,105 14,500

---------- ---------- ---------

Consolidated Statement of Changes

in Equity

As at 31 December 2018

Share Capital

Share premium redemption Retained Total

capital account reserve earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Period to 31 December

2017

Unaudited

Balance at 1 July 2017 281 5,734 1,505 10,545 18,065

Dividends - - - - -

Loss and total comprehensive

loss for the period - - - (201) (201)

---------- --------- --------------------- -----------

Balance at 31 December

2017 281 5,734 1,505 10,344 17,864

---------- --------- --------------------- ----------- --------

Period to 31 December

2018

Unaudited

Balance at 1 July 2018 281 5,734 1,505 10,000 17,520

Dividends - - - - -

Purchase of own Shares

for cancellation (8) - 8 (225) (225)

Loss and total comprehensive - - - (353) (353)

loss for the period

---------- --------- --------------------- -----------

Balance at 31 December

2018 273 5,734 1,513 9,422 16,942

---------- --------- --------------------- ----------- --------

Year to 30 June 2018

Audited

Balance at 1 July 2017 281 5,734 1,505 10,545 18,065

Dividends - - - (56) (56)

Transactions with owners - - - (56) (56)

Loss and total comprehensive

loss for the period - - - (489) (489)

---------- --------- --------------------- -----------

Balance at 30 June

2018 281 5,734 1,505 10,000 17,520

---------- --------- --------------------- ----------- --------

Company Statement of Changes in Equity

As at 31 December 2018

Share Capital

Share premium redemption Retained Total

capital account reserve earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Period to 31 December

2017

Unaudited

Balance at 1 July 2017 281 5,734 1,505 8,050 15,570

Dividends - - - - -

Loss and total comprehensive

loss for the period - - - (465) (465)

---------- --------- ------------------- ----------

Balance at 31 December

2017 281 5,734 1,505 7,585 15,105

---------- --------- ------------------- ---------- ---------

Period to 31 December

2018

Unaudited

Balance at 1 July 2018 281 5,734 1,505 6,980 14,500

Dividends - - - - -

Purchase of own shares

for cancellation (8) - 8 (225) (225)

Loss and total comprehensive

loss for the period - - - (617) (617)

---------- --------- ------------------- ----------

Balance at 31 December

2018 273 5,734 1,513 6,138 13,658

---------- --------- ------------------- ---------- ---------

Year to 30 June 2018

Audited

Balance at 1 July 2017 281 5,734 1,505 8,050 15,570

Dividends - - - (56) (56)

Transactions with owners - - - (56) (56)

Loss and total comprehensive

loss for the period - - - (1,014) (1,014)

---------- --------- ------------------- ----------

Balance at 30 June

2018 281 5,734 1,505 6,980 14,500

---------- --------- ------------------- ---------- ---------

Consolidated Statement of Cash

Flows

6 months to 31 December 2018

6 months 6 months Year

Ended ended Ended

31.12.18 31.12.17 30.06.18

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Cash from operating activities

Operating (loss) from

continuing operations (497) (227) (579)

Depreciation of property,

plant

and equipment 95 91 188

(Profit)/loss on disposal

of property, - - -

plant and equipment

-------------- ---------- -----------

Operating (loss) before changes

in

working capital (402) (136) (391)

(Increase)/decrease in inventories (815) (1,777) 798

(Increase)/decrease in trade

and

other receivables 483 (2,953) 907

Increase/(decrease) in trade

and

other payables (1,321) 2,134 (1,196)

-------------- ---------- -----------

Cash (used)/generated from

operations (2,055) (2,732) 118

Income taxes received/(paid) - - -

Net cash from operating activities (2,055) (2,732) 118

-------------- ---------- -----------

Cash flows from investing

activities

Interest received 144 26 90

Proceeds from disposal of

property,

plant and equipment - - -

Purchase of property, plant

and

Equipment - (19) (57)

Net cash from investing activities 144 7 33

-------------- ---------- -----------

Cash flows from financing

activities

Purchase of own shares for

cancellation (225) - -

Dividends paid to equity shareholders - - (56)

Net cash used in financing

activities (225) - (56)

-------------- ---------- -----------

Net (decrease)/increase in

cash and

cash equivalents (2,136) (2,725) 95

Cash and cash equivalents

at

beginning of period 5,067 4,972 4,972

-------------- ---------- -----------

Cash and cash equivalents at end

of period 2,931 2,247 5,067

-------------- ---------- -----------

Company Statement of Cash Flows

6 months to 31 December 2018

6 months 6 months Year

Ended Ended Ended

31.12.18 31.12.17 30.06.18

GBP'000 GBP'000 GBP'000

Unaudited Unaudited Audited

Cash from operating activities

Operating (loss) from

continuing operations (696) (491) (1,103)

Depreciation of property, plant

and equipment 58 55 115

(Profit)/loss on disposal of

property,

plant and equipment - - -

---------- ---------- --------------

Operating (loss) before changes

in

working capital (638) (436) (988)

(Increase)/decrease in inventories (815) (1,777) 798

(Increase)/decrease in trade

and

other receivables 480 (2,953) 907

Increase/(decrease) in trade

and

other payables (1,044) 2,435 (594)

---------- ---------- --------------

Cash (used)/generated from operations (2,017) (2,731) 123

Income taxes received/(paid) - - -

Net cash from operating activities (2,017) (2,731) 123

---------- ---------- --------------

Cash flows from investing activities

Interest received 79 26 90

Proceeds from disposal of property,

plant and equipment - - -

Purchase of property, plant

and

Equipment - (19) (57)

Net cash from investing activities 79 7 33

---------- ---------- --------------

Cash flows from financing activities

Purchase of own shares for cancellation (225) - -

Dividends paid to equity shareholders - - (56)

---------- ---------- --------------

Net cash used in financing activities (225) - (56)

---------- ---------- --------------

Net (decrease)/increase in cash

and

cash equivalents (2,163) (2,724) 100

Cash and cash equivalents at

beginning of period 5,034 4,934 4,934

---------- ---------- --------------

Cash and cash equivalents at end

of period 2,871 2,210 5,034

---------- ---------- --------------

Notes to the financial statements

1. Corporate Information

The financial information for the half year ended 31 December

2018 set out in this interim report does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. The

group's statutory financial statements for the year ended 30 June

2018 have been filed with the Registrar of Companies. The auditor's

report on those financial statements was unqualified and did not

contain statements under Sections 498(2) and 498(3) of the

Companies Act 2006. The interim results are unaudited. Northamber

Plc is a public limited company incorporated and domiciled in

England and Wales. The company's shares are publicly traded on the

London Stock Exchange's AIM market.

2. Basis of preparation

These interim consolidated financial statements are for the six

months ended 31 December 2018. They have been prepared in

accordance with IAS34 Interim Financial Reporting. They do not

include all the information required for full annual financial

statements, and should be read in conjunction with the consolidated

financial statements of the group for the year ended 30 June

2018.

These interim consolidated financial statements have been

prepared under the historical cost convention.

These interim consolidated financial statements (the interim

financial statements) have been prepared in accordance with

accounting policies adopted in the last annual financial statements

for the year to 30 June 2018 except for the adoption of IAS1

Presentation of Financial Statements (Revised 2007).

The adoption of IAS1 (Revised 2007) does not affect the

financial position or profits of the group, but gives rise to

additional disclosures. The measurement and recognition of the

group's assets, liabilities, income and expenses is unchanged. A

separate 'Statement of changes in equity' is now presented.

The accounting policies have been applied consistently

throughout the group for the purposes of preparation of these

interim consolidated financial statements.

3. Basis of Consolidation

For the periods covered in these interim consolidated financial

statements all trading has been carried out by the parent company

alone. The group includes some non-trading dormant subsidiaries.

All the assets and liabilities of all subsidiaries have been

included in the statements of financial position.

4. Segmental Reporting

Although the sales of the group are predominantly to the UK

there are sales to other countries and the following schedule sets

out the split of the sales for the period. Revenue is attributable

to individual countries based on the location of the customer.

There are no non current assets outside the UK.

UK Other Total

GBP'000 GBP'000 GBP'000

6 months to December 2018

Total Segment revenue 23,967 267 24,234

Year to 30 June 2018

Total Segment revenue 57,661 475 58,136

One customer accounted for more than 10% of the group's revenue

for the period, being GBP3.6m.

5. Taxation

No tax charge has been provided in the interim consolidated

financial statements due to the losses accumulated both in prior

years and in the current period.

6. Earnings per Share

The calculation of earnings per share is based on the loss after

tax for the six months to 31 December 2018 of GBP353,000 (2017:

loss GBP201,000) and a weighted average of 27,639,779 (2017:

28,158,735) ordinary shares in issue.

7. Property, Plant and Equipment

There were no significant additions to or disposals of property,

plant or equipment in the period to 31 December 2018. The reduction

in the total value of property, plant and equipment was primarily

due to the depreciation charge for the year.

8. Risks and Uncertainties

The principal risks and uncertainties affecting the business

activities of the group are detailed in the strategic report which

can be found on pages 7 to 11 of the Annual Report and Accounts for

the year ended 30 June 2018 (the Annual Report). A copy of the

Annual Report is available on the company's web site at

www.northamber.com.

The risks affecting the business remain the same as in the

Annual Report. In summary these include:-

Market risk particularly those relating to the suppliers of

products to the group

Financial risks including exchange rate risk, liquidity risk,

interest rate risk and credit risk

In the opinion of the directors, these will remain the principal

risks for the remainder of the year, however, the directors have

reviewed the company's risk analysis and are of the opinion that

steps have been taken to minimise the potential impact of such

risks.

9. Related Party Transactions

Mr D M Phillips is the ultimate controlling party of the

Company.

During the six months period, the company paid GBP235,500 (2017:

GBP300,500) rent to Anitass Limited, a wholly owned subsidiary. At

31 December 2018 Northamber plc owed Anitass Ltd GBP3,793,000

(2017:GBP3,259,000).

10. Directors' Confirmation

The Directors confirm that to the best of their knowledge these

condensed consolidated half year financial statements have been

prepared in accordance with IAS 34 and that the interim management

report herein includes a fair review of the information required by

DTR 4.2.7R, an indication of important events during the first 6

months and descriptions of principal risks and uncertainties for

the remaining six months of the year, and DTR 4.2.8R the disclosure

of related party transactions and changes therein.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR JRMRTMBJMBJL

(END) Dow Jones Newswires

March 08, 2019 02:00 ET (07:00 GMT)

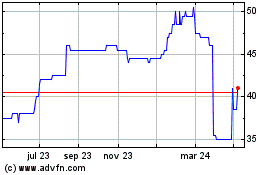

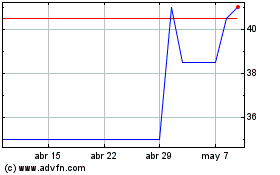

Northamber (LSE:NAR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Northamber (LSE:NAR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024