Fox Corp. Names Paul Ryan To Board -- WSJ

20 Marzo 2019 - 1:02AM

Noticias Dow Jones

By Allison Prang and Benjamin Mullin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 20, 2019).

Fox Corp., which began trading as a stand-alone company Tuesday

following a spinoff from 21st Century Fox, named Paul Ryan, the

former speaker of the U.S. House of Representatives, to its

board.

The new Fox, which holds TV assets including Fox News, the Fox

broadcast network and television stations, and Fox Sports, also

appointed Anne Dias, Roland Hernandez and Chase Carey to its

board.

Mr. Hernandez, chief executive of Hernandez Media Ventures,

served as chief executive of Telemundo Group Inc. from 1995 to

2000. Ms. Dias founded media-focused investment fund Aragon Global

Holdings. Mr. Carey, the chairman and CEO of Formula 1, held

various top posts at 21st Century Fox, including vice chairman

until this year.

The board also includes Jacques Nasser, who previously served as

chairman of mining company BHP Billiton Limited, Rupert Murdoch,

the company's co-chairman, and his son Lachlan Murdoch, the

company's chairman and chief executive.

Mr. Ryan, the Republican Party nominee for vice president in

2012, left his role as House speaker this year.

Walt Disney Co. is acquiring the remaining 21st Century Fox

entertainment assets for $71.3 billion, a deal expected to close

Wednesday. Disney is purchasing production businesses such as the

Twentieth Century Fox studio, U.S. cable networks including FX and

National Geographic and international properties including Star

India. It also will acquire Fox's stake in streaming-video service

Hulu.

The acquisition of 21st Century Fox's assets and content

libraries will help Disney compete with streaming giants like

Netflix Inc. and emerging competitors such as Warner Media and

Apple Inc. Disney is launching a streaming service, Disney+, this

year, part of the company's broader strategy to offer films,

scripted television shows and live sports directly to

consumers.

With its major entertainment and international assets sold, Fox

Corp. is planning to focus on sports and news specifically for the

U.S. market. Rupert Murdoch and his family are significant

shareholders in Fox Corp. and Wall Street Journal parent News

Corp.

James Murdoch, Lachlan's younger brother, is not expected to

have a role at the company and is starting an investment fund

targeting digital and international media businesses, people

familiar with the matter have said.

The assets that now make up Fox Corp. generated $10.2 billion in

revenue in the fiscal year ended June 30, 2018, up 2% from the

previous year, according to a securities filing by the company. Net

income for the Fox Corp. business in fiscal 2018 was up 59% to $2.2

billion, powered by a tax benefit. Without that gain, income fell

3%.

Affiliate fees, such as carriage payments from cable TV

providers, have been a major revenue driver, and they grew 15% in

fiscal 2018. In a separate filing, Fox said it expects the pace of

affiliate fee growth to "meaningfully decelerate" in the last half

of the fiscal year that ends June 30.

Some executives from 21st Century Fox are joining Disney,

including 21st Century Fox President Peter Rice and top television

executives Dana Walden and John Landgraf. On the film side, Emma

Watts, the vice chairman of the Twentieth Century Fox studio, has

been named vice chairman of the Twentieth Century Fox film label.

Nancy Utley and Stephen Gilula, the heads of Fox Searchlight

Pictures, will continue in those roles.

Write to Allison Prang at allison.prang@wsj.com and Benjamin

Mullin at Benjamin.Mullin@wsj.com

(END) Dow Jones Newswires

March 20, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

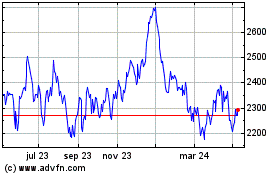

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

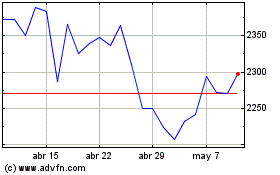

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024