TIDMFEVR

RNS Number : 9519T

Fevertree Drinks PLC

26 March 2019

26(th) March 2019

Fevertree Drinks plc

("Fever-Tree" or the "Group")

Preliminary Results

Fever-Tree, the world's leading supplier of premium carbonated

mixers, today announces its Preliminary Results for the year ended

for 31 December 2018.

Financial highlights:

-- Revenue up 40% to GBP237.4m (2017: GBP170.2m)

-- Gross profit margin of 51.8% (2017: 53.5%)

-- Adjusted EBITDA* of GBP78.6m (2017: GBP58.7m)

-- Profit after tax of GBP61.8m (2017: GBP45.5m)

-- Diluted EPS of 53.19 pence (2017: 39.15 pence)

-- Net cash at year end of GBP83.6m (2017: GBP50.9m)

-- Final dividend of 10.28 pence per share recommended to

shareholders, bringing the total dividend for the year to 14.50

pence per share (2017: 10.65 pence per share)

* Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation, share based payment charges and finance

costs.

Operational highlights:

-- Consolidated position as number one mixer brand by value(1)

in the UK Off-Trade channel while continuing to gain share across

the On-Trade

-- Transition to wholly-owned operations in the US with

Fever-Tree USA now directly managing marketing, sales and

distribution

-- Made gains across Continental Europe in both the On and

Off-Trade, as well as driving category growth in many of the key

markets in the region

-- Continued focus on innovation & product development with

the extension of the Refreshingly Light low-calorie range as well

as successful new product launches of Cucumber Tonic and Citrus

Tonic

-- Further strengthening of the Board with the appointment of

three non-executive Directors with a breadth of relevant beverage

and international experience

-- Named the no.1 best-selling and no.1 trending tonic water in

Drinks International's survey of world's top 250 bars for the fifth

year running

1. (IRI - Total UK Retail Mixer Market value share - 13 weeks to 31/12/18).

Tim Warrillow, Co-founder and CEO of Fever-Tree said:

"2018 was a significant year for Fever-Tree. In the UK, we

strengthened our position as the leading mixer brand in the Off

Trade. In the US, we successfully established our own operations

and the business made real progress in deepening and widening its

presence in multiple European regions. As the world's leading

premium mixer brand with a strengthening global distribution

network we are well set to drive the international opportunity as

the move towards the premium long mixed drink continues to gather

momentum around the world.

At this early stage in the year, the Group is trading in line

with Board expectations and we remain excited about the size of the

opportunity that lies ahead."

For further information:

Fevertree Drinks plc +44 (0)20 7349 4922

Tim Warrillow, Co-founder and CEO

Andy Branchflower, Finance Director

Oliver Winters, Communications & IR Director

Numis Securities - Nominated Adviser and Joint Broker +44 (0)20 7260 1000

Garry Levin

Matt Lewis

Hugo Rubinstein

Investec Bank plc - Joint Broker +44 (0)20 7597 5970

David Flin

Alex Wright

David Anderson

Brunswick Group +44 (0) 20 7404 5959

Jonathan Glass

Fiona Micallef-Eynaud

Cerith Evans

Notes to Editors:

Fever-Tree is the world's leading supplier of premium carbonated

mixers for alcoholic spirits by retail sales value, with

distribution to over 70 countries worldwide. Based in the UK, the

brand was launched in 2005 to provide high quality mixers which

could cater to the growing demand for premium spirits, in

particular gin, but also increasingly for vodka, rum and whisky.

The Company now sells a range of carbonated mixers to hotels,

restaurants, bars and cafes ("On-Trade") as well as selected retail

outlets ("Off-Trade").

CHAIRMAN'S STATEMENT

2018 has been a year of further operational and financial

progress for Fever-Tree. The Group reinforced its market leading

position in the global premium mixer category, expanded its

international footprint, including the establishment of Fever-Tree

USA, and continued to build a talented team across the globe - all

the while remaining true to the entrepreneurial and pioneering

culture of its co-founders.

Results

Group revenue was GBP237.4m, reflecting a 40% increase compared

to 2017, with adjusted EBITDA increasing to GBP78.6m (2017:

GBP58.7m). While the UK, our longest established market, once again

led the way in terms of revenue growth, the Group's other regions

all saw positive momentum in 2018.

Strategy

Fever-Tree pioneered the concept of the premium mixer to partner

the ongoing premiumisation of the spirits category and the

increasing focus on simple long mixed drinks. The Group's strategy

remains unchanged to this day and the year under review has seen

the Group continue to build an excellent platform for capturing the

global opportunity ahead. To this end, the establishment of

Fever-Tree USA was a significant milestone and I have greatly

enjoyed meeting the team in the US over the course of the year and

am impressed by their professionalism and appetite for the

opportunity ahead in that market. The Group also continues to make

great progress across multiple markets in Europe and we have

strengthened our European management team to reflect our growing

ambitions for that region. 2018 also saw the further development of

our Corporate Social Responsibility agenda, including increasing

the Group's support for the hugely important work being done by

Malaria No More.

Dividend

The Board is pleased to recommend a final dividend of 10.28

pence per share, bringing the total dividend for 2018 to 14.50

pence per share (2017: 10.65 pence per share). If approved by the

shareholders at the AGM on 24 May 2019, it will be paid on 31 May

2019 to shareholders on the register on 26 April 2019.

People

As Fever-Tree continues to grow, its people and culture remains

integral to our future success. I have been particularly encouraged

by the focus on and commitment to the development of our employees

throughout 2018. The passion and creativity that I have seen across

the business remains a source of inspiration and on behalf of the

Board I would like to thank all our employees for their hard work

and dedication.

During the year, it was my pleasure to welcome Kevin Havelock,

Jeff Popkin and Domenic De Lorenzo as non-executive Directors of

the Group. They each have highly impressive track records across

the beverages sector and a breadth of relevant international

experience that has already brought valuable insight and additional

perspective to the Group.

Outlook

Fever-Tree has the strategy, products, people and proposition to

deliver long term sustainable growth. I look forward to working

with my Board colleagues and the wider Fever-Tree team in the year

ahead.

Bill Ronald

Chairman

STRATEGIC REPORT

CHIEF EXECUTIVE'S REPORT

2018 has been one of the most significant years since Charles

and I founded Fever-Tree over 15 years ago. It has been a year

where, perhaps more than any other, we have seen how the advent of

the premium mixer, alongside the rise of premium spirits, is

reinvigorating and re-establishing the prominence of simple long

mixed drinks in the minds of the trade, retailers and most

importantly the consumer. Fever-Tree continues to drive this trend

through our product development, consumer engagement and the

strength of our relationships with customers as well as spirits

partners, not just in the UK but across many of our key markets in

mainland Europe and the USA with the move to premiumisation across

spirits categories and the evolution of drinking habits

underpinning the global opportunity.

2018 saw the Group deliver revenue of GBP237.4m, representing

growth of 40% on 2017. This revenue growth was underpinned by

strong margins, with a gross profit margin of 51.8% and adjusted

EBITDA margin of 33.1%, which translated to profit after tax for

the year of GBP61.8m, representing growth of 36% on 2017. We ended

the year with net cash of GBP83.6m, an increase of 64% on last

year.

Regional Review

We consider our global sales across four regions, being the UK,

USA, Continental Europe, and Rest of the World ("RoW").

UK

In the UK the Group delivered growth of 53% with revenue of

GBP134.2m (2017: GBP87.8m) and in doing so consolidated our

position as no. 1 mixer brand in UK retail with 42% market share

(IRI) in what remains one of the fastest growing categories in

carbonated soft drinks.

The Group's performance over the summer was exceptional, aided

by the prolonged period of hot weather as well as a number of

significant national events including the Football World Cup and

Royal Wedding all of which contributed to the continued growth and

popularity of the gin category with more gin being sold during the

three months of the summer in 2018 than the summers of 2014 and

2015 combined with the category now worth GBP1.9bn in the UK. The

Group finished the year with a good performance over Christmas

which saw further gains in market share from our competitors in

December, illustrating once again Fever-Tree's ability to drive

growth in the mixer category.

We delivered another strong performance in the Off-Trade in

2018. While we remain well established across the main estate of

our major retailers, the Group continued to benefit from increased

presence on the shelf, with gains across our flavours and formats.

Our extended range of Refreshingly Light mixers were introduced in

the first half and gained significant incremental distribution

alongside our regular range in many of our retailers. We have been

pleased with how the range has performed and our decision to offer

choice between our regular and light ranges without comprising on

quality or taste, has clearly resonated with consumers and

retailers alike. The Group's underlying rate of sales growth

remained strong across our existing SKUs (stock keeping units) with

our flavoured tonics such as Mediterranean, Elderflower and

Aromatic all continuing to perform well, stimulating engagement and

interest whilst continuing to attract consumers into the category

for the first time.

The On-Trade remains a key focus for the Group and 2018 saw a

continuation of the positive performance from 2017. Our broad range

of high-quality mixers, brand strength, first mover advantage and

long-standing relationships we have with many of our On-Trade

partners means we are well positioned to continue to gain market

share in 2019 and beyond.

The move to simple long mixed drinks is gaining momentum in the

UK with spirits continuing to gain market share at the expense of

beer and wine reflecting the evolving drinking habits of

consumers.

Looking ahead to 2019, we are now clear market leader in the

Off-Trade and would naturally expect a moderation in growth rates

compared to those of 2018 but remain excited about the opportunity

ahead in the UK.

USA

In December 2017 we announced our intention to take direct

control of our operations in the USA. Following a six month

transition period, Fever-Tree USA took ownership of our sales,

marketing and distribution in the territory on 1(st) June 2018. We

now have a team of 35 people spanning sales, marketing, finance and

supply chain working across the USA, with a regional headquarters

in New York.

Notwithstanding the significant operational changes undertaken

in 2018, we are encouraged by the performance in the region with

sales growth of 21% (24% on a constant currency basis) to GBP35.8m.

Sales remained robust across both channels and the team did an

excellent job in managing the transition albeit, as would be

expected in any transition, there were some related distribution

losses. We stated at the time of our interim results that there was

"much transition-related work to do in the second half of 2018" and

therefore it was pleasing, despite these challenges, to see our

sales growth accelerate slightly in the second half.

As announced at our interim results, the Group signed an

exclusive on-trade national distribution agreement with Southern

Glazer's Wine and Spirits ("SGWS"), the largest wine and spirits

distribution company in North America. Commencing in August 2018

the agreement covers the 29 states in which SGWS and Fever-Tree can

operate side by side, with the remaining states covered by a

network of regional distributors. As well as providing a strong

national route to market, Fever-Tree is now the preferred mixer

partner for SGWS, sitting alongside their broad spirits portfolio,

which is a further endorsement of our brand's position and

potential in the US market. While the partnership is in its early

stages, with work ongoing in 2019 to continue to embed the

relationship, the progress to date has been encouraging.

While a lot of the focus in the second half of the year has been

on engaging directly with key national and local accounts for the

first time the period also saw the successful roll out of a number

of co-promotional campaigns with spirit partners. This has included

the launch of our Citrus Tonic Water in association with Patrón

Tequila, the largest premium tequila brand in the USA. We also

launched our Aromatic Tonic Water in the On and Off-Trade with an

exclusive listing with Target for an initial period.

Our ginger range remains a central focus and continues to lead

the sales mix in the US. Our commitment to the highest quality

ingredients, sourcing three different types of ginger from Africa

and Asia, gives us, we believe, a marked point of difference and an

excellent opportunity to promote our range further.

Following the operational progress made in 2018 we will continue

to build our distribution footprint and key relationships as 2019

progresses. The premium mixer category remains relatively immature

in the US but the trend towards spirits premiumisation and the

increasing focus on simple long drink mixability gives us

confidence in the medium to longer term opportunity for Fever-Tree

in the region.

Continental Europe

Sales growth of 24% was achieved across Continental Europe in

2018 (23% on a constant currency basis), delivering revenue for the

full year of GBP55.5m. It remains our second largest region.

2018 saw the Group continue to make gains across the region in

both the On and Off-Trade as well as drive the category growth in

many of the key markets in the region.

Alongside our distributors, we have started to work increasingly

closely with our retail partners, gaining additional shelf space

alongside new national retail listings in markets such as Germany,

Denmark, Italy, Ireland and the Nordics. While our whole range has

performed well, reflecting the consumer's growing awareness of the

brand and the brand's impact on the wider category, our tonic range

has been at the forefront of this growth, reflecting the excitement

and momentum in the premium gin category. This momentum is being

seen across the region, as the move to simple long mixed drinks

being enjoyed across different occasions gathers pace and

importantly continues to be a focus for the spirits companies. As

we have seen in other major markets, this trend is attracting a

broader range of consumers into the category for the first time and

is gaining market share from beer.

Our investment into Continental Europe continued during the year

with a more than doubling of headcount in the region, with our

senior regional management team being complemented by additional

hires to work in-country. Not only has this enabled us to gain a

more in depth understanding and insight into the different markets

but working alongside our European marketing team, it provided us

with the opportunity to plan and execute tailored marketing

activations.

The Group is establishing an increasingly strong platform in

Europe. We have a committed network of distributors, with whom we

are working ever more closely. Our ability to activate

co-promotional campaigns with key spirits partners across the

region is unrivalled amongst our premium competitors and remains a

key focus in the year ahead. We are continuing to drive the value

and growth in the category for both On and Off-Trade partners and

our key European markets are continuing to show good momentum, all

of which provides us with confidence as we move into 2019.

ROW

The RoW region grew by 48% with revenue of GBP12.0m and

continues to represent plenty of interesting opportunities for the

Group. The brand's visibility and awareness amongst consumers

continues to increase with the key territories of Australia and

Canada as well as South Africa all performing strongly with a

growing presence in both the On and Off-Trade and across our

flavours.

Our distribution network continues to evolve as we ensure we

have the right partners in place in each region to reflect the

opportunities ahead with the same trends being seen in our more

established markets beginning to emerge in many of these

territories.

Operational review

The Group operates a largely outsourced business model which

allows for scalability and flexibility alongside the ability to

benefit from specific, focused expertise and experience in key

areas of the supply chain. This model enables the Group to grow and

maintain the highest standards of quality control without the

requirement for significant capital investment and allows

management to maintain its focus on realising the Group's strategic

growth opportunities.

Manufacturing and distribution are completely outsourced, with

the Group responsible for arranging for the delivery of key

ingredients, flavours, water, glass, cans and packaging to a

manufacturer who then bottles or cans the final product from these

component parts.

We currently have six bottling and canning partners across UK

and Europe and have made good progress in identifying a bottling

partner in the USA in line with our stated strategy to bottle

closer to our key regions and territories as appropriate over

time.

The Group is closely monitoring the potential impact and risks

of the UK's exit from the European Union, including leaving the EU

without a deal. The Group has a designated Committee who meet

regularly to assess preparedness against the different potential

scenarios. The Group's outsourced business model and increased

European bottling footprint provides a degree of operational

flexibility which leaves the Group well placed to respond to and

mitigate the potential impacts of the different scenarios

identified under which the UK's exit from the EU could occur.

The Fever-Tree Team

We had already assembled what I believe to be the very best team

of people across the mixed drinks industry, but this strengthened

and broadened enormously over 2018.

We are now double the size of this time last year and have a

growing band of Fever-Tree employees not just in the UK but also

across Europe and further afield, and of course now our very own

Team USA.

Innovation

Innovation continues to be at the heart of the Group's strategy.

We are proud of our position as pioneers of the premium mixer and

our commitment to providing consumers and customers alike with the

highest quality products remains undimmed.

Refreshingly Light

The first half of the year saw the successful launch of the

Group's extended Refreshingly Light range of low-calorie mixers. We

have always believed in the appeal of a premium, superior tasting

low calorie tonic which doesn't compromise on quality and which

doesn't include artificial sweeteners. When we first launched our

light tonic with these very credentials over 10 years ago it was

the first of its kind, and that pioneering approach has proved to

be very successful, with it firmly established as our bestselling

SKU at retail in the UK. We are pleased that retailers are

recognising this performance and opening their shelf space to this

kind of product, hence our ability to offer consumers both our

Regular and Refreshingly Light range across our key retailers.

Co-Promotions

Our co-promotional activity with spirits partners, both large

and small, continued to deepen and develop across different spirits

categories as simple long mixed drinks become central to the serve

strategies of spirit companies around the world. In September we

took our collaboration one step further by developing a product

alongside a spirit partner, Patrón Tequila, the leading US premium

tequila brand with Fever-Tree Citrus Tonic Water launched in the

USA, Spain, Australia, Mexico and the UK. This partnership was born

out of our shared values around taste, provenance and versatility.

We worked very closely with the team at Patrón to develop the tonic

- I myself joined their Master Distiller, Francisco Alcaraz, in

Mexico to source the key ingredients of Mexican limes, tangerine

and bitter orange, selected to complement the sweet citrus and

peppery notes of Patrón.

Limited Editions

We continue to develop limited edition variants; our Cucumber

Tonic launched to great success in the summer, whilst the run up to

Christmas saw the relaunch of our seasonal favourite Clementine

Tonic Water in the UK. Our limited editions continue to drive

interest and engagement in the category and our Cucumber variant

proved so popular that it has now been added to our permanent range

and will be introduced into the on-trade in 2019.

Formats

The Group's core formats remain un-changed but we are conscious

of ensuring we have the correct flavours and formats for the

markets we operate in. To this end, 2018 saw the launch of 250ml

cans in Spain as well as the roll-out of 4x200ml variety packs

across a number of key markets

Gifting

We continued to develop our gifting range in 2018 with

Fever-Tree crackers and advent calendars launched in the run up to

Christmas. Sold through John Lewis and Waitrose respectively in the

UK, they both proved incredibly popular, demonstrating the strength

and appeal of the brand beyond the mixer aisle.

Due to the success of "The Art of Mixing" our cocktail book,

with over 125 recipes created and mixed by bartenders around the

world, which once again finished the year as the leading drinks

book in the UK, it has now been made available to purchase in eight

international markets as well as being published in three foreign

language editions: German, Spanish and Dutch, with a French edition

to follow in 2019.

Fever-Tree Championships

2018 saw the inaugural staging of the Fever-Tree Championships,

the prestigious grass tennis tournament held in June at The Queen's

Club, London. This was our first title sponsorship of a major

sporting event and was covered widely across BBC television, radio

and online and by Amazon Prime Video with a total television

audience of over 20 million across 142 markets, with a peak

audience of over two million on BBC watching the return of Andy

Murray.

It was a fantastic week and the tournament provided the ideal

platform to not only showcase the brand but also to engage with

consumers and we are already looking forward to the 2019

Championships. The feedback from the first year of the event from

players, spectators and officials alike has been extremely positive

with the tournament being voted ATP World Tour Tournament of the

Year in its category at the ATP's annual awards as well as recently

being shortlisted for event of the year at the forthcoming

prestigious BT Sport industry awards.

Market developments

There is clear evidence that drinking habits are evolving, not

just in the UK but across many of the markets we operate in, driven

by an acceleration in the macro trends that Charles and I

identified at the outset of Fever-Tree. Premium spirit consumption

is growing ahead of mainstream spirits while consumer interest in

quality and craft is prevalent across the beverage sector. Nowhere

is this more starkly illustrated than the explosion in craft

distilleries. In 2003 there were about 30 such distilleries in the

UK and there are now ten times that. The figures for the USA are

even more illuminating with the numbers increasing from fewer than

50 when Fever-Tree was established to nearly 2,000 today.

This interest in and desire for quality and provenance sits

alongside a growing interest in health and wellbeing which, when

applied to the beverage sector, means consumers are drinking less

but also drinking better. Not only this, they are also changing the

way in which they want to consume their spirits both in terms of

serve and occasion. Consumers are turning away from wanting to

drink them neat or over ice; it is no longer compatible with modern

lifestyles or the evolution of drinking occasions with late night

drinking being replaced by more casual occasions throughout the day

which are not suited to drinking neat spirits.

Previously, the much talked about cocktail/mixology culture was

seen as a way to satisfy the changing demands of consumers.

However, by its very nature it is complex to execute and cannot

scale. In the On-trade there are challenges in training,

consistency of serve and the ability to make great tasting drinks

quickly. In the Off-trade it is even more of a challenge. As

research shows, as the complexity of a drink increases the

likelihood of people habitually making the drink at home declines

rapidly which, simply means, bottles sit undrunk, gathering dust in

the cupboard never to be repurchased.

So the alternative, which suffers from none of these

limitations, is the simple long mixed drink - the G&T, the

Moscow Mule, the Whiskey and Ginger and the Highball, to name a

few. The advent of Fever-Tree and the premium mixer has

reinvigorated and re-established the quality and enjoyment of these

drinks as well as importantly introducing choice and margin back

into a category that had been long overlooked and ignored.

By simply combining a premium spirit and a premium mixer

together enables the On-Trade to deliver an easy to make yet great

tasting drink that can be enjoyed throughout the day, supporting a

premium price point and in addition a drink that consumers can

easily replicate at home thus driving volume in the Off-Trade

It is becoming evident that spirits companies, both big and

small, are increasingly focused on their long serve strategy for

their premium portfolios and Fever-Tree's broad range of high

quality mixers, global footprint and brand strength means we are

increasingly well positioned to work closely with our spirits

partners to drive premium spirits consumption and as a result

provide a genuine alternative to the beer and wine occasion.

Outlook

2018 was a significant year for Fever-Tree. In the UK, we

strengthened our position as the leading mixer brand in the

Off-Trade. In the US, we successfully established our own

operations and the business made real progress in deepening and

widening its presence in multiple European regions. As the world's

leading premium mixer brand with a strengthening global

distribution network we are well set to drive the international

opportunity as the move towards the premium long mixed drink

continues to gather momentum around the world.

At this early stage in the year, the Group is trading in line

with Board expectations and we remain excited about the size of the

opportunity that lies ahead.

Tim Warrillow

Chief Executive

FINANCIAL REVIEW

REVENUE

Revenue grew by 40% from GBP170.2m in 2017 to GBP237.4m, with

the Group enjoying growth consistently across flavours, formats,

regions and channels, as outlined in the Chief Executive's

report.

GROSS MARGIN AND OPERATING EXPENSES

In 2018, gross margin remained robust but decreased to 51.8%

(2017: 53.5%). As expected, the decrease in percentage gross margin

was largely an effect of the implementation of the Soft Drinks

Industry Levy in the UK. From April 2018 the levy was charged to

the Group on our regular range of products sold in the UK (our

Refreshingly Light range is exempt) and in turn this cost was

passed directly through to our UK customers, hence the levy had no

impact on the amount of gross profit made by the Group. The

incremental revenue created by the recharge of the levy, generated

at nil margin, did, however, have the effect of diluting the

overall percentage gross margin made by the Group. Otherwise,

underlying cost increases, most notably glass, also had a

corresponding impact on gross margin. Meanwhile a marginally

stronger Euro was offset by a slightly weaker US Dollar, and so

foreign exchange movements combined to have minimal impact on gross

margin in the year.

Underlying operating expenses are defined as all operating

expenditure exclusive of depreciation, amortisation and share based

payment charges and the proportion of this expenditure relative to

revenue is seen as an effective indicator of changes in underlying

operating activity year on year. In 2018 underlying operating

expenses as a proportion of revenue reduced marginally to 18.7%

(2017: 19.1%). Within this, efficiencies gained in central

overheads were reinvested in staffing and marketing spend and

therefore, in absolute terms, the Group significantly increased

investment in staff and marketing expenditure in 2018, especially

in the US. A new Enterprise Resource Planning system was also

successfully implemented early in the year, providing the platform

to underpin our increasingly global operating base as well as

allowing real-time data analytics to help drive operational

efficiencies going forward.

Therefore, the reduction in percentage gross margin, which was

largely a factor of the recharge of the UK Soft Drinks Industry

Levy, was only marginally offset by efficiencies in underlying

operating expense and hence the adjusted EBITDA margin for the

group reduced to 33.1% (2017: 34.5%), with adjusted EBITDA growing

by 34% to GBP78.6m (2017: GBP58.7m). Operating profit increased by

34% to GBP75.4m (2017: GBP56.4m) following an increase in share

based payment charges to GBP1.8m (2017: GBP1.1m) and an increase in

depreciation.

TAX

The effective tax rate in 2018 was 18.26% (2017: 19.35%).

EARNINGS PER SHARE AND DIVIDS

The basic earnings per share for the year are 53.38 pence (2017:

39.48 pence) and the diluted earnings per share for the year are

53.19 pence (2017: 39.15 pence).

In order to compare earnings per share year on year, earnings

have been adjusted to exclude amortisation and the UK statutory tax

rates have been applied (disregarding other tax adjusting items).

On this basis, normalised earnings per share for 2018 were 53.40

pence per share and for 2017 were 40.04 pence per share, an

increase of 33.4%.

The Board is recommending a final dividend of 10.28 pence per

share in respect of 2018 (2017: 7.64 pence per share), which brings

the total dividend for 2018 to 14.50 pence per share (2017: 10.65

pence per share). If approved by shareholders at the AGM on 24 May

2019, it will be paid on 31 May 2019 to shareholders on the

register on 26 April 2019.

CASH POSITION

The Group had net cash of GBP83.6m at year end, with GBP89.7m of

cash and cash equivalents at the bank offset by GBP6.1m of bank

loans (2017: net cash of GBP50.9m). The Group had access to a

GBP10m 3-year revolving credit facility provided by Lloyds Bank

plc, which expired in January 2019 and was not renewed, resulting

in the repayment of the GBP6.1m bank loan post year end.

WORKING CAPITAL

Working capital increased by GBP18.8m during 2018 to GBP57.9m.

The increase in working capital resulted from an elevation in

inventory levels at year end (which allowed for increased

flexibility in the early part of 2019 ahead of the UK's potential

exit from the EU in 2019). This increase in inventory levels was

partially offset by a significant improvement in the collection of

trade debtors in the second half of the year and working capital

management will remain an area of focus in 2019. Operating cash

flow remains strong, and consistent with the prior year at 74% of

adjusted EBITDA.

CAPITAL EXPITURE

Due to the Group's outsourced business model, capital

expenditure requirements remain low. The only area of notable

capital expenditure in 2018 continued to be investment in crates

used to transport reusable bottles within Germany of GBP0.8m (2017:

GBP0.5m), reflecting the on-going strong growth in that territory.

Additional spend of GBP0.6m was also made towards leasehold

improvements in 2018 as part of the head office relocation.

PERFORMANCE INDICATORS

The Group monitors its performance through a number of key

indicators. These are formulated at Board meetings and reviewed at

both an operational and Board level.

Revenue growth %

Group revenue growth was 40% in 2018 which was ahead of Board

expectations (2017: 66%).

Gross margin %

The Group achieved a gross margin of 51.8% in 2018 which was

ahead of Board expectations (2017: 53.5%).

Adjusted EBITDA margin %

The Group achieved an adjusted EBITDA margin of 33.1% which was

ahead of Board expectations (2017: 34.5%).

Andrew Branchflower

Finance Director

Fevertree Drinks plc

Consolidated statement of profit or loss and other comprehensive

income

For the year ended 31 December 2018

2018 2017

GBP'000 GBP'000

Revenue 237,449.3 170,171.7

Cost of sales (114,489.2) (79,073.0)

Gross profit 122,960.1 91,098.7

Administrative expenses (47,602.9) (34,694.9)

Adjusted EBITDA* 78,637.6 58,665.1

Depreciation (738.6) (405.5)

Amortisation (720.0) (720.0)

Share based payment charges (1,821.8) (1,135.8)

Operating profit 75,357.2 56,403.8

Finance costs

Finance income 327.2 94.9

Finance expense (107.0) (71.9)

Profit before tax 75,577.4 56,426.8

Tax expense (13,801.6) (10,917.8)

Profit for the year 61,775.8 45,509.0

Items that may be reclassified

to profit or loss

Foreign currency translation

difference of foreign operations (110.3) -

------------ -----------

Comprehensive income attributable

to equity holders of the parent

company 61,665.5 45,509.0

------------ -----------

Earnings per share for profit

attributable to the owners of

the parent during the year

Basic (pence) 53.38 39.48

Diluted (pence) 53.19 39.15

* Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation, share based payment charges and finance

costs.

Fevertree Drinks plc

Consolidated statement of financial position

At 31 December 2018

2018 2017

GBP'000 GBP'000

Non-current assets

Property, plant and equipment 2,734.3 1,995.6

Intangible assets 41,690.7 42,410.7

Deferred tax asset - 1,371.0

Total non-current assets 44,425.0 45,777.3

----------- -----------

Current assets

Inventories 28,322.2 13,235.8

Trade and other receivables 62,916.1 55,587.0

Derivative financial instruments - 229.8

Cash and cash equivalents 89,721.1 56,959.5

Total current assets 180,959.4 126,012.1

----------- -----------

Total assets 225,384.4 171,789.4

----------- -----------

Current liabilities

Trade and other payables (33,033.2) (29,948.9)

Loans and borrowings (6,075.0) -

Corporation tax liability (2,607.7) (5,695.1)

Derivative financial instruments (309.4) -

----------- -----------

Total current liabilities (42,025.3) (35,644.0)

----------- -----------

Non-current liabilities

Loans and borrowings - (6,061.3)

Deferred tax liability (193.6) -

Total non-current liabilities (193.6) (6,061.3)

----------- -----------

Total liabilities (42,218.9) (41,705.3)

----------- -----------

Net assets 183,165.5 130,084.1

----------- -----------

Equity attributable to equity

holders of the company

Share capital 290.3 288.4

Share premium 54,769.5 53,689.2

Capital redemption reserve 93.2 93.2

Translation reserve (110.3) -

Retained earnings 128,122.8 76,013.3

Total equity 183,165.5 130,084.1

----------- -----------

Fevertree Drinks plc

Consolidated statement of cash flows

For the year ended 31 December 2018

2018 2017

GBP'000 GBP'000

Operating activities

Profit before tax 75,577.4 56,426.8

Finance expense 107.0 71.9

Finance income (327.2) (94.9)

Depreciation of property, plant and equipment 738.6 405.4

Amortisation of intangible assets 720.0 720.0

Share based payments 1,821.8 1,135.9

78,637.6 58,665.1

(Increase) in trade and other receivables (7,301.0) (26,405.2)

(Increase) in inventories (16,414.0) (2,712.0)

Increase in trade and other payables 3,461.9 13,820.5

----------- -----------

(20,253.1) (15,296.7)

----------- -----------

Cash generated from operations 58,384.5 43,368.4

----------- -----------

Income taxes paid (12,744.1) (9,408.0)

----------- -----------

Net cash flows from operating activities 45,640.4 33,960.4

----------- -----------

Investing activities

Purchase of property, plant and equipment (1,477.3) (1,238.0)

Interest received 327.2 74.3

Net cash used in investing activities (1,150.1) (1,163.7)

----------- -----------

Financing activities

Interest paid (107.0) (71.9)

Issue of shares 1,082.2 168.1

Dividends paid (13,725.2) (8,896.6)

----------- -----------

Net cash used in financing activities (12,750.0) (8,800.4)

----------- -----------

Net increase in cash and cash equivalents 31,740.3 23,996.3

Cash and cash equivalents at beginning

of period 56,959.5 32,963.2

----------- -----------

Effect of movements in exchange rates 1,021.3 -

on cash held

Cash and cash equivalents at end of period 89,721.1 56,959.5

----------- -----------

NOTES TO THE CONSOLIDATED PRELIMINARY FINANCIAL STATEMENTS

1. Basis of preparation

The financial information presented in this preliminary

announcement has been prepared in accordance with the recognition

and measurement requirements of International Financial Reporting

Standards ("IFRS") as issued by the International Accounting

Standards Board ("IASB") and as adopted by the EU and those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS. The principal accounting policies adopted in the preparation

of the financial information in this preliminary announcement are

unchanged from those used in the company's financial statements for

the year ended 31 December 2017 except for those relating to IFRS

15 Revenue from Contracts with Customers and IFRS 9 Financial

Instruments and are consistent with those that the company has

applied in its financial statements for the year ended 31 December

2018.

The financial information set out above does not constitute the

company's statutory accounts for 2018 or 2017. Statutory accounts

for the years ended 31 December 2018 and 31 December 2017 have been

reported on by the Independent Auditor. The Independent Auditor's

Report on the Annual Report and Financial Statements for 2018 and

2017 was unqualified, did not draw attention to any matters by way

of emphasis, and did not contain a statement under 498(2) or 498(3)

of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2017 have been

filed with the Registrar of Companies. The statutory accounts for

the year ended 31 December 2018 will be delivered to the Registrar

in due course.

2. Revenue

An analysis of turnover by geographical

market is given below:

2018 2017

GBP'000 GBP'000

United Kingdom 134,172.9 87,778.2

United States of America 35,769.1 29,539.5

Europe 55,516.2 44,741.0

Rest of the World 11,991.1 8,113.0

237,449.3 170,171.7

========== ==========

3. Dividends

The final dividend of 10.28 pence per share, bringing the total

dividend to 14.50 pence per share, will be paid on 31 May 2018 to

the shareholders on the register on 26 April 2019 if approved by

the shareholders at the AGM on 24 May 2019.

4. Earnings per share

Basic earnings per ordinary share are calculated using the

weighted average number of ordinary shares in issue during the

financial year of 115,734,845 (2017: 115,256,374). Diluted earnings

per ordinary share are calculated with reference to 116,131,195

(2017: 116,236,486) ordinary shares. The effect of the exercise of

options on the weighted average number of ordinary shares in issue

is 396,350 (2017: 980,112).

2018 2017

GBP'000 GBP'000

Profit

Profit used in calculating basic and diluted

EPS 61,775.8 45,509.0

Number of shares

Weighted average number of shares for the

purpose of

basic earnings per share 115,734,845 115,256,374

Weighted average number of dilutive employee

share options outstanding 396,350 980,112

------------ ------------

Weighted average number of shares for the

purpose of

diluted earnings per share 116,131,195 116,236,486

------------ ------------

Basic earnings per share (pence) 53.38 39.48

------------ ------------

Diluted earnings per share (pence) 53.19 39.15

------------ ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR EAEDSAANNEAF

(END) Dow Jones Newswires

March 26, 2019 03:00 ET (07:00 GMT)

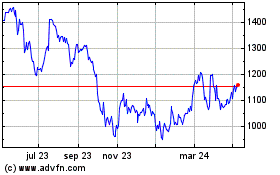

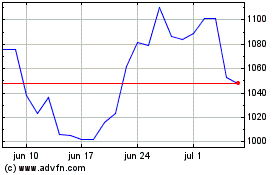

Fevertree Drinks (LSE:FEVR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Fevertree Drinks (LSE:FEVR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024