HSBC Backs Dividend, Returns Targets Despite Gloomy Economic Outlook

12 Abril 2019 - 6:06AM

Noticias Dow Jones

By Adam Clark

HSBC Holdings PLC (HSBA.LN) on Friday committed to maintaining

its dividend payout at its current level and stuck to its returns

targets, despite its bosses warning of a slowdown in global

growth.

"Looking at the current environment, the global economy is much

less predictable now than it was a year ago. Global growth is

slowing, largely as a result of weakness in Europe although the

economic outlook is also softer in the U.S. and in Asia," Chairman

Mark Tucker said, speaking at HSBC's annual general meeting in

Birmingham, England.

Chief Executive John Flint also said the global economic outlook

had worsened since late 2018. He said HSBC is yet to take higher

credit losses, but warned that could change in a downturn.

Despite the pessimistic tone, Mr. Flint said HSBC is still

aiming for its previously announced targets of making a return on

tangible equity higher than 11% by 2020, up from 8.6% in 2018. The

Asia-focused lender also still expects "positive jaws"--where

revenue grows faster than costs--in 2019, after falling short last

year due to a weak fourth quarter.

Mr. Tucker said HSBC would keep its dividend at the 51 cents a

share it paid out in 2018 for the foreseeable future.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

April 12, 2019 06:51 ET (10:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

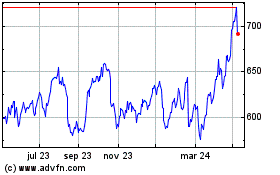

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

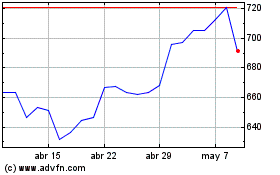

Hsbc (LSE:HSBA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024