IBM's Revenue Falls Again

16 Abril 2019 - 3:44PM

Noticias Dow Jones

By Asa Fitch

International Business Machines Corp. reported a third

consecutive quarter of declining revenue Tuesday, further clouding

Chief Executive Ginni Rometty's yearslong quest to revitalize the

computing giant.

Under Ms. Rometty, who has been at the helm since 2012, IBM has

poured resources into its cloud-computing business and new

technologies such as artificial intelligence, aiming to reorient

Big Blue in a world where traditional growth engines like equipment

sales and services haven't been growing as fast. IBM said its cloud

businesses grew 10% in the past 12 months.

For a brief spell last year, it appeared as though IBM had

turned a corner, reporting successive quarters of overall revenue

growth -- however small.

That changed in the middle of 2018, as Wall Street analysts and

investors watched revenue tip back under. It fell again in the

first quarter, dropping 4.7% to $18.18 billion. Analysts had

expected $18.46 billion, according to Refinitiv.

IBM's software and technology services, which include computing

infrastructure and IT support services, drove the decline. IBM had

faced a tough comparison to last year's first quarter, when a new

generation of industrial-strength mainframe computers helped drive

sales.

Net income fell 5.2% to $1.59 billion. Adjusted profit, which

excludes some items such as acquisition costs, came to $2.25 a

share. Analysts had expected $2.22.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

April 16, 2019 16:29 ET (20:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

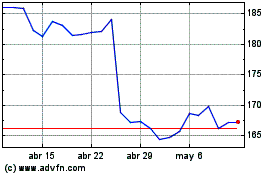

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

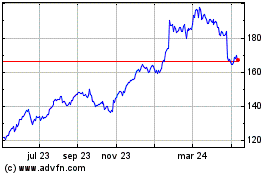

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024