IBM's Revenue Falls Again -- Update

16 Abril 2019 - 3:57PM

Noticias Dow Jones

By Asa Fitch

International Business Machines Corp. reported a

third-consecutive quarter of declining revenue Tuesday, further

clouding Chief Executive Ginni Rometty's yearslong quest to

revitalize the computing giant.

Under Ms. Rometty, who has been at the helm since 2012, IBM has

poured resources into its cloud-computing business and new

technologies such as artificial intelligence, aiming to reorient

Big Blue in a world where traditional growth engines like equipment

sales and services haven't been growing as fast as they once did.

IBM said its cloud businesses grew 10% in the past 12 months.

For a brief spell last year, it appeared as though IBM had

turned a corner, reporting successive quarters of overall revenue

growth -- however small.

That changed in the middle of 2018, as Wall Street analysts and

investors watched revenue tip back under. It fell again in the

first quarter, dropping 4.7% to $18.18 billion. Analysts had

expected $18.46 billion, according to Refinitiv.

IBM's software and technology services, which include computing

infrastructure and IT support services, drove the decline. IBM had

faced a tough comparison to last year's first quarter, when a new

generation of industrial-strength mainframe computers helped drive

sales.

Net income fell 5.2% to $1.59 billion. Adjusted profit, which

excludes some items such as acquisition costs, came to $2.25 a

share. Analysts had expected $2.22.

Despite the drop in net profit and revenue, IBM touted the

growth in its cloud-computing revenue, which reached $19.5 billion

for the past 12 months. Chief Financial Officer James Kavanagh also

pointed to IBM's expanding margins as the company pursues

faster-growing businesses that cost less to run.

While growth was flat or declined in all of IBM's main reported

lines of business, the company bumped up its overall profit margin

by a percentage point to 44.2%.

Once an icon of American ingenuity, IBM has struggled to compete

in the modern computing era as the rise of cloud giants like

Amazon.com Inc. and Alphabet Inc.'s Google have challenged an old

model where big companies handled their critical computing needs

largely in-house. IBM sees promise in the so-called hybrid cloud --

the idea that companies will increasingly use a combination of

cloud services and their own equipment to accomplish those tasks --

and aims to grow that business.

IBM's cloud segment may not be growing as fast as some of Amazon

or Microsoft's cloud services, Mr. Kavanagh said, but the company

is keeping pace with its target for mid-teen growth in the hybrid

cloud, a rate he said can allow it to take share in that arena.

Ms. Rometty is aiming to bolster IBM's hybrid-cloud strategy

through IBM's acquisition of Red Hat Inc., an open-source software

and services company that helps businesses streamline their

computing strategies as they grow. That deal, valued at around $33

billion, is IBM's largest-ever acquisition and is expected to close

in the second half of the year.

IBM's revenue had fallen virtually every quarter since Ms.

Rometty took over, up until the last quarter of 2017, when it

suddenly rose again. The company saw further revenue rises in the

first half of last year, but that turnaround proved short-lived:

Revenue declined again in the last two quarters of 2018.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

April 16, 2019 16:42 ET (20:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

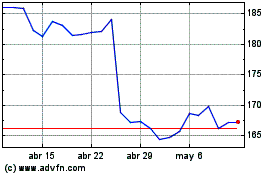

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

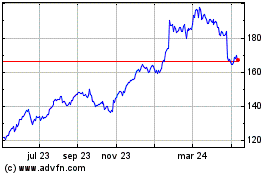

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024