TIDMBHP

RNS Number : 4161W

BHP Group PLC

16 April 2019

Release Time IMMEDIATE

17 April

Date 2019

Release Number 09/19

BHP OPERATIONAL REVIEW

FOR THE NINE MONTHSED 31 MARCH 2019

-- Production guidance for the 2019 financial year remains unchanged for petroleum, copper, metallurgical coal

and energy coal. Iron ore production guidance decreased to between 265 and 270 Mt (100% basis), reflecting

impacts of Tropical Cyclone Veronica.

-- Group copper equivalent production(1) was broadly unchanged over the nine months ended March 2019, with

volumes for the full year also expected to be in line with last year.

-- Full year unit costs for Petroleum, Escondida and Queensland Coal are expected to be in line with

guidance(2). Unit costs for Western Australia Iron Ore are now expected to be below US$15 per tonne(2),

reflecting impacts of Tropical Cyclone Veronica. Unit costs for New South Wales Energy Coal are now expected to

be approximately US$51 per tonne(2) following changes to the mine plan.

-- All major projects under development are tracking to plan.

-- In Petroleum, the Atlantis Phase 3 project in the US Gulf of Mexico was approved and the Bélé-1

exploration well in Trinidad and Tobago encountered hydrocarbons (drilling still in progress) during the quarter.

Mar YTD19 Mar Q19

(vs Mar (vs Dec

Production YTD18) Q18) Mar Q19 commentary

Petroleum 92 29 Lower seasonal gas sales at Bass Strait

(MMboe) (1) partially offset by higher Trinidad

and Tobago volumes following maintenance

in the previous quarter.

(0%) (-5%)

Copper (kt) 1,245 420 Increased production from Olympic Dam

as surface operations returned to full

capacity following acid plant outage

in August 2018, offset by impact of

expected lower copper grades at Escondida.

(-3%) (+1%)

Iron ore 175 56 Volumes at Western Australia Iron Ore

(Mt) (WAIO) reflected the impact of Tropical

Cyclone Veronica.

(0%) (-3%)

Metallurgical 31 10 A solid underlying operating performance

coal (Mt) at Queensland Coal was offset by the

impacts of wet weather.

(0%) (-4%)

Energy coal 20 7 Increased production at New South Wales

(Mt) Energy Coal (NSWEC) was offset by the

impact of adverse weather at Cerrejón.

(0%) (+1%)

BHP Chief Executive Officer, Andrew Mackenzie, said: "During the

March 2019 quarter, we had a strong operational performance despite

weather impacts across Australia and Chile. We approved Atlantis

Phase 3 and now have five major projects under development. Those

projects, our work on transformation, technology and culture, and

our successful petroleum and copper exploration and appraisal

programs will grow value and returns for years to come."

1

Summary

Operational performance

Production and guidance are summarised below.

Mar Mar

Mar YTD19 Q19 Q19

vs vs vs Previous Current

Mar Mar Mar Mar Dec FY19 FY19

Production YTD19 Q19 YTD18 Q18 Q18 guidance guidance

113 - 113 - Upper end

Petroleum (MMboe) 92 29 0% 3% (5%) 118 118 of range

1,645 1,645

Copper (kt) 1,245 420 (3%) (8%) 1% - 1,740 - 1,740 Unchanged

1,120 1,120 Lower end

Escondida 848 268 (6%) (15%) (6%) - 1,180 - 1,180 of range

Olympic

525 - 525 - Dam: Lower

Other copper(i) 397 152 1% 7% 15% 560 560 end of range

Lowered

due to Tropical

241 - 235 - Cyclone

Iron ore(ii) (Mt) 175 56 0% (3%) (3%) 250 239 Veronica

273 - 265 -

WAIO (100% basis) 198 64 (2%) (5%) (3%) 283 270 As above

Metallurgical

coal (Mt) 31 10 0% (5%) (4%) 43 - 46 43 - 46 Unchanged

Queensland Coal

(100% basis) 54 17 (1%) (5%) (3%) 75 - 81 75 - 81 Unchanged

Energy coal (Mt) 20 7 0% 11% 1% 28 - 29 28 - 29 Unchanged

NSWEC 13 5 5% 24% 6% 18 - 19 18 - 19 Unchanged

Cerrejón 7 2 (8%) (10%) (7%) 10 10 Unchanged

(i) Other copper comprises Pampa Norte, Olympic Dam and Antamina.

(ii) Increase in BHP's share of volumes reflects the expiry of

the Wheelarra Joint Venture sublease in March 2018, with control of

the sublease area reverted to the Jimblebar Joint Venture, which is

accounted for on a consolidated basis with minority interest

adjustments.

Major development projects

During the March 2019 quarter, the BHP Board approved US$696

million (BHP share) in capital expenditure for the Atlantis Phase 3

project in the US Gulf of Mexico.

At the end of March 2019, BHP had five major projects under

development in petroleum, copper, iron ore and potash, with a

combined budget of US$11.1 billion over the life of the

projects.

Petroleum

Production

Mar YTD19 Mar Q19 Mar Q19

Mar Mar vs vs vs

YTD19 Q19 Mar YTD18 Mar Q18 Dec Q18

Crude oil, condensate and

natural gas liquids (MMboe) 42 13 (5%) (5%) (9%)

Natural gas (bcf) 299 93 4% 12% (1%)

Total petroleum production

(MMboe) 92 29 0% 3% (5%)

Petroleum - Total petroleum production was flat at 92 MMboe.

Guidance for the 2019 financial year remains unchanged at between

113 and 118 MMboe, with volumes expected to be towards the upper

end of the guidance range.

Crude oil, condensate and natural gas liquids production

decreased by five per cent to 42 MMboe due to natural field decline

across the portfolio and a 70 day planned dry dock maintenance

program at Pyrenees completed during the September 2018 quarter.

This decline was partially offset by higher uptimes at our Gulf of

Mexico assets and stronger field performance in Atlantis.

2

Natural gas production increased by four per cent to 299 bcf,

reflecting increased tax barrels at Trinidad and Tobago in

accordance with the terms of our Production Sharing Contract and

higher uptime at North West Shelf. This was partially offset by

planned maintenance at Trinidad and Tobago in the December 2018

quarter, the impact of Tropical Cyclone Veronica and natural field

decline across the portfolio.

Projects

Initial

Capital production

Project and expenditure target

ownership US$M date Capacity Progress

Mad Dog Phase 2,154 CY22 New floating production On schedule and budget.

2 facility with the The overall project

(US Gulf of capacity to produce is 46% complete.

Mexico) up to 140,000 gross

23.9% (non-operator) barrels of crude

oil per day.

Atlantis Phase 696 CY20 New subsea production Project approved

3 system that will on 13 February 2019.

(US Gulf of tie back to the existing

Mexico) Atlantis facility,

44% (non-operator) with capacity to

produce up to 38,000

gross barrels of

oil equivalent per

day.

On 13 February 2019, the BHP Board approved the development of

the Atlantis Phase 3 project in the US Gulf of Mexico. The project

includes a subsea tie back of eight new production wells and is

expected to increase production by an estimated 38 Mboe/d (100 per

cent basis) at its peak. This decision follows sanction by BP (the

operator).

The Bass Strait West Barracouta project is tracking to plan and

study work continues on the Ruby project in Trinidad and Tobago

with an investment decision expected during the 2019 calendar

year.

Petroleum exploration

Exploration and appraisal wells drilled during the March 2019

quarter are summarised below.

Total

Formation BHP Water well

Well Location Target age equity Spud date depth depth Status

Hydrocarbons

Mexico 60% encountered;

Block (BHP 15 November 2,379 4,659 Plugged and

Trion-2DEL AE-0093 Oil Eocene Operator) 2018 m m abandoned

Hydrocarbons

Mexico 60% encountered;

Trion-2DEL Block (BHP 4 January 2,379 5,002 Plugged and

ST01 AE-0093 Oil Eocene Operator) 2019 m m abandoned

Hydrocarbons

Trinidad 70% encountered;

& Tobago (BHP 2 March 2,102 3,693 Drilling

Bélé-1 Block 23(a) Gas Pliocene Operator) 2019 m m ahead

In Mexico, we spud the Trion-2DEL appraisal well in November

2018 and encountered oil in line with expectations. This was

followed by a downdip sidetrack which encountered oil and water, as

predicted, further appraising the field and delineating the

resource. Following the recent encouraging results in the Trion

block, an additional appraisal well (3DEL), to further delineate

the scale and characterisation of the resource, has been approved

and is expected to be drilled in the second half of the 2019

calendar year.

The Deepwater Invictus rig mobilised to Trinidad and Tobago for

Phase 3 of our deepwater drilling campaign. This includes three

wells testing three prospects in our Northern licences around the

Bongos discovery. Bélé-1, the first of these wells, was spud on 2

March 2019 and encountered hydrocarbons. Drilling is still in

progress and our assessment is ongoing.

In the US Gulf of Mexico, following the Samurai-2 discovery in

2018, Murphy, the Operator, has commenced pre-FEED activities. In

the Western US Gulf of Mexico, our Ocean Bottom Node(3) seismic

acquisition survey and node recovery has been completed. This will

be incorporated into our ongoing analysis which we will continue to

progress over the next 24 months.

Petroleum exploration expenditure for the nine months ended

March 2019 was US$438 million, of which US$215 million was

expensed. A US$750 million exploration and appraisal program is

being executed for the 2019 financial year.

3

Copper

Production

Mar YTD19 Mar Q19 Mar Q19

Mar Mar vs vs vs

YTD19 Q19 Mar YTD18 Mar Q18 Dec Q18

Copper (kt) 1,245 420 (3%) (8%) 1%

Zinc (t) 75,643 20,848 (10%) (18%) (14%)

Uranium (t) 2,590 1,106 16% (1%) 19%

Copper - Total copper production decreased by three per cent to

1,245 kt. Guidance for the 2019 financial year remains unchanged at

between 1,645 and 1,740 kt.

Escondida copper production decreased by six per cent to 848 kt

as expected lower copper grades were partly offset by record

concentrator throughput. Production guidance remains unchanged at

between 1,120 and 1,180 kt for the 2019 financial year, with

volumes expected to be towards the lower end of the range.

Pampa Norte copper production decreased by 11 per cent to 172 kt

and reflects planned maintenance and a production outage at Spence

following a fire at the electro-winning plant in September 2018,

and the impact of heavy rainfall in northern Chile in February 2019

at both Spence and Cerro Colorado. This was partially offset by

record ore milled at both operations after implementing maintenance

improvement initiatives. Production guidance at Spence and Cerro

Colorado remains unchanged for the 2019 financial year, at between

160 and 175 kt and 60 and 70 kt respectively.

Olympic Dam copper production increased by 22 per cent to 115 kt

as a result of the major smelter maintenance campaign in the prior

period, which was partially offset by an unplanned acid plant

outage in August 2018. Following completion of the acid plant

remediation works, surface operations ramped up between October

2018 and February 2019. Production guidance remains unchanged at

between 170 and 180 kt for the 2019 financial year, with volumes

expected to be towards the lower end of the guidance range.

Antamina copper production increased by five per cent to 110 kt

due to higher head grades. Production guidance for the 2019

financial year remains unchanged at approximately 135 kt for copper

and approximately 85 kt for zinc.

Projects

Initial

Capital production

Project and expenditure target

ownership US$M date Capacity Progress

Spence Growth 2,460 FY21 New 95 ktpd concentrator On schedule and

Option is expected to increase budget. The overall

Spence's payable project is 47% complete.

copper in concentrate

production by approximately

185 ktpa in the first

10 years of operation

and extend the mining

operations by more

than 50 years.

(Chile)

100%

Iron Ore

Production

Mar YTD19 Mar Q19 Mar Q19

Mar Mar vs vs vs

YTD19 Q19 Mar YTD18 Mar Q18 Dec Q18

Iron ore (kt) 175,343 56,117 0% (3%) (3%)

Iron ore - Total iron ore production was broadly unchanged at

175 Mt (198 Mt on a 100 per cent basis). Production guidance for

the 2019 financial year has been reduced to between 235 and 239 Mt,

or 265 and 270 Mt on a 100 per cent basis, reflecting a 6 to 8 Mt

impact from Tropical Cyclone Veronica. As a result, full year unit

costs are now expected to be below US$15 per tonne, an increase

from previous guidance of less than US$14 per tonne, due to the

lower volumes, direct costs of remediation, increased demurrage,

rehandle to manage stockyards and opportune maintenance at the

mines during port downtime. In addition, private royalties are also

expected to be higher as a function of higher iron ore prices.

4

At WAIO, volumes reflected record production at Jimblebar and

the impact from the Mt Whaleback fire in the prior period. This was

offset by the impacts of planned maintenance in the September 2018

quarter, a train derailment on 5 November 2018 and Tropical Cyclone

Veronica in March 2019. While our facilities did not sustain major

damage as a result of the cyclone, the port ramp up was slowed by

localised flooding, processing wet material and equipment

assessments.

Mining and processing operations at Samarco remain suspended

following the failure of the Fundão tailings dam and Santarém water

dam on 5 November 2015.

Projects

Initial

Capital production

Project and expenditure target

ownership US$M date Capacity Progress

South Flank 3,061 CY21 Sustaining iron ore On schedule and budget.

mine to replace production The overall project

from the 80 Mtpa is 29% complete.

(100 per cent basis)

Yandi mine.

(Australia)

85%

Coal

Production

Mar YTD19 Mar Q19 Mar Q19

Mar Mar vs vs vs

YTD19 Q19 Mar YTD18 Mar Q18 Dec Q18

Metallurgical coal (kt) 30,507 9,877 0% (5%) (4%)

Energy coal (kt) 20,058 6,751 0% 11% 1%

Metallurgical coal - Metallurgical coal production was broadly

flat at 31 Mt (54 Mt on a 100 per cent basis). Guidance for the

2019 financial year remains unchanged at between 43 and 46 Mt (75

and 81 Mt on a 100 per cent basis).

At Queensland Coal, increased yields at South Walker Creek and

higher wash-plant throughput at Poitrel following the purchase of

the Red Mountain processing facility supported record production at

BMC. Despite record stripping, BMA's production decreased slightly

due to the scheduled longwall move at Broadmeadow in the December

2018 quarter and unfavourable weather impacts in the March 2019

quarter.

On 27 March 2019, BMA completed the sale of the Gregory Crinum

Mine to Sojitz Corporation.

Energy coal - Energy coal production was broadly flat at 20 Mt.

Guidance for the 2019 financial year remains unchanged at

approximately 28 to 29 Mt.

New South Wales Energy Coal production increased five per cent

supported by record stripping performance. Production guidance

remains unchanged at between 18 and 19 Mt for the 2019 financial

year. However, following optimisation of the mine plan through the

construction of Multiple Elevated Roadways (MERs) which will reduce

future cycle times, the focus on higher quality products and

challenges with labour hire attraction and retention, unit costs

for New South Wales Energy Coal are now expected to be

approximately US$51 per tonne, an increase from previous guidance

of between US$43 and US$48 per tonne. Ongoing labour hire

challenges are being addressed, including through the initial

deployment of BHP Operations Services in the June 2019 quarter.

Cerrejón production decreased by eight per cent due to adverse

weather and its impacts on mine sequencing. Production guidance

remains unchanged at approximately 10 Mt for the 2019 financial

year.

5

Other

Nickel production

Mar YTD19 Mar Q19 Mar Q19

Mar Mar vs vs vs

YTD19 Q19 Mar YTD18 Mar Q18 Dec Q18

Nickel (kt) 58.7 19.2 (13%) (9%) 6%

Nickel - Nickel West production decreased by 13 per cent to 59

kt as operations were suspended following a fire at the Kalgoorlie

smelter in September 2018. The smelter returned to operation on 1

October 2018, with final repairs and ramp up completed in the March

2019 quarter. Production guidance for the 2019 financial year

remains unchanged and is expected to be broadly in line with the

2018 financial year.

Potash project

Project and Investment

ownership US$M Scope Progress

Jansen Potash 2,700 Investment to finish the The project is 83% complete

excavation and lining and within the approved

of the production and budget. The main activity

service shafts, and to for the quarter remained

continue the installation centred on removing the

of essential surface infrastructure boring equipment from

and utilities. both shafts.

(Canada)

100%

Minerals exploration

Minerals exploration expenditure for the nine months ended March

2019 was US$122 million, of which US$84 million was expensed.

Greenfield minerals exploration is predominantly focused on

advancing copper targets within Chile, Ecuador, Peru, Canada, South

Australia and the South-West United States.

During March 2019, BHP signed a non-binding letter of intent

with Luminex for an earn-in and joint venture agreement on

Luminex's Tarqui 1 and 2 mining concessions in Ecuador.

Negotiations to complete a binding agreement will be undertaken

over the next two months.

On 15 April 2019, BHP secured a five per cent interest in

Midland Exploration Inc., which has copper exploration tenements in

Canada.

Following identification in November 2018 of a potential iron

oxide, copper and gold (IOCG) mineralised system at Oak Dam, 65

kilometres to the south east of Olympic Dam, BHP has commenced a

further drilling program to define the extent of

mineralisation.

Variance analysis relates to the relative performance of BHP

and/or its operations during the nine months ended March 2019

compared with the nine months ended March 2018, unless otherwise

noted. Production volumes, sales volumes and capital and

exploration expenditure from subsidiaries are reported on a 100 per

cent basis; production and sales volumes from equity accounted

investments and other operations are reported on a proportionate

consolidation basis. Numbers presented may not add up precisely to

the totals provided due to rounding. Copper equivalent production

based on 2018 financial year average realised prices.

The following footnotes apply to this Operational Review:

(1) Excludes production from Onshore US.

(2) 2019 financial year unit cost guidance: Petroleum

<US$11/boe, Escondida <US$1.15/lb, WAIO <US$15/t,

Queensland Coal US$68-72/t and NSWEC US$51/t; based on exchange

rates of AUD/USD 0.75 and USD/CLP 663.

(3) WGOM OBN 2018 Seismic Permit is OCS Permit T18-010.

The following abbreviations may have been used throughout this

report: barrels (bbl); billion cubic feet (bcf); cost and freight

(CFR); cost, insurance and freight (CIF); dry metric tonne unit

(dmtu); free on board (FOB); grams per tonne (g/t); kilograms per

tonne (kg/t); kilometre (km); metre (m); million barrels of oil

equivalent (MMboe); million cubic feet per day (MMcf/d); million

tonnes (Mt); million tonnes per annum (Mtpa); ounces (oz); pounds

(lb); thousand barrels of oil equivalent (Mboe); thousand barrels

of oil equivalent per day (Mboe/d); thousand ounces (koz); thousand

standard cubic feet (Mscf); thousand tonnes (kt); thousand tonnes

per annum (ktpa); thousand tonnes per day (ktpd); tonnes (t); and

wet metric tonnes (wmt).

In this release, the terms 'BHP', 'Group', 'BHP Group', 'we',

'us', 'our' and ourselves' are used to refer to BHP Group Limited,

BHP Group plc and, except where the context otherwise requires,

their respective subsidiaries as defined in note 27 'Subsidiaries'

in section 5.1 of BHP's 30 June 2018 Annual Report and Form 20-F,

unless stated otherwise. Notwithstanding that this release may

include production, financial and other information from

non-operated assets, non-operated assets are not included in the

BHP Group and, as a result, statements regarding our operations,

assets and values apply only to our operated assets unless stated

otherwise.

6

Further information on BHP can be found at: bhp.com

Media Relations Investor Relations

Email: media.relations@bhp.com Email: investor.relations@bhp.com

Australia and Asia Australia and Asia

Gabrielle Notley Tara Dines

Tel: +61 3 9609 3830 Mobile: Tel: +61 3 9609 2222 Mobile:

+61 411 071 715 +61 499 249 005

United Kingdom and South

United Kingdom and South Africa Africa

Neil Burrows Elisa Morniroli

Tel: +44 20 7802 7484 Mobile: Tel: +44 20 7802 7611 Mobile:

+44 7786 661 683 +44 7825 926 646

North America Americas

Judy Dane James Wear

Tel: +1 713 961 8283 Mobile: Tel: +1 713 993 3737 Mobile:

+1 713 299 5342 +1 347 882 3011

BHP Group Limited ABN 49 004 BHP Group plc Registration number

028 077 3196209

LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768

Registered in Australia Registered in England and Wales

Registered Office: Level 18, Registered Office: Nova South,

171 Collins Street 160 Victoria Street

Melbourne Victoria 3000 Australia London SW1E 5LB United Kingdom

Tel +61 1300 55 4757 Fax +61 Tel +44 20 7802 4000 Fax +44

3 9609 3015 20 7802 4111

Members of the BHP Group which is

headquartered in Australia

Follow us on social media

7

Production summary

Quarter ended Year to date

BHP Mar Jun Sep Dec Mar Mar Mar

interest 2018 2018 2018 2018 2019 2019 2018

Petroleum (1)

Petroleum

Conventional

Crude oil, condensate and

NGL (Mboe) 13,960 13,486 14,087 14,497 13,236 41,820 43,919

Natural gas (bcf) 82.9 90.7 112.3 93.9 92.9 299.1 286.3

Total (Mboe) 27,777 28,603 32,804 30,147 28,719 91,670 91,636

Copper (2)

Copper

Payable metal in concentrate

(kt)

Escondida (3) 57.5% 244.9 246.1 240.0 212.6 205.4 658.0 679.7

Antamina 33.8% 35.2 34.6 37.0 38.3 34.5 109.8 104.9

Total 280.1 280.7 277.0 250.9 239.9 767.8 784.6

Cathode (kt)

Escondida (3) 57.5% 69.4 70.1 55.4 71.9 62.4 189.7 217.4

Pampa Norte (4) 100% 66.8 70.6 43.4 61.8 67.2 172.4 193.2

Olympic Dam 100% 40.5 42.0 33.3 31.6 50.2 115.1 94.7

Total 176.7 182.7 132.1 165.3 179.8 477.2 505.3

Total copper (kt) 456.8 463.4 409.1 416.2 419.7 1,245.0 1,289.9

Lead

Payable metal in concentrate

(t)

Antamina 33.8% 464 546 563 600 456 1,619 2,888

Total 464 546 563 600 456 1,619 2,888

Zinc

Payable metal in concentrate

(t)

Antamina 33.8% 25,562 35,983 30,558 24,237 20,848 75,643 83,817

Total 25,562 35,983 30,558 24,237 20,848 75,643 83,817

Gold

Payable metal in concentrate

(troy oz)

Escondida (3) 57.5% 59,953 68,345 63,578 73,726 73,998 211,302 160,757

Olympic Dam (refined gold) 100% 28,989 33,497 23,471 17,856 28,609 69,936 58,059

Total 88,942 101,842 87,049 91,582 102,607 281,238 218,816

8

Quarter ended Year to date

BHP Mar Jun Sep Dec Mar Mar Mar

interest 2018 2018 2018 2018 2019 2019 2018

Silver

Payable metal in concentrate

(troy koz)

Escondida (3) 57.5% 2,339 2,527 1,997 2,570 2,189 6,756 6,269

Antamina 33.8% 1,189 1,321 1,309 1,178 1,062 3,549 4,116

Olympic Dam (refined silver) 100% 248 278 213 212 230 655 514

Total 3,776 4,126 3,519 3,960 3,481 10,960 10,899

Uranium

Payable metal in concentrate

(t)

Olympic Dam 100% 1,118 1,123 555 929 1,106 2,590 2,241

Total 1,118 1,123 555 929 1,106 2,590 2,241

Molybdenum

Payable metal in concentrate

(t)

Antamina 33.8% 420 261 464 417 82 963 1,401

Total 420 261 464 417 82 963 1,401

9

Production summary

Quarter ended Year to date

BHP Mar Jun Sep Dec Mar Mar Mar

interest 2018 2018 2018 2018 2019 2019 2018

Iron Ore

Iron Ore

Production (kt) (5)

Newman 85% 16,412 18,500 16,378 17,578 15,608 49,564 48,571

Area C Joint Venture 85% 12,802 12,041 11,696 10,280 11,627 33,603 39,476

Yandi Joint Venture 85% 15,802 17,339 16,870 15,627 15,214 47,711 46,709

Jimblebar (6) 85% 4,669 15,092 16,333 14,320 13,658 44,311 15,535

Wheelarra 85% 8,006 614 114 30 10 154 24,544

Samarco 50% - - - - - - -

Total 57,691 63,586 61,391 57,835 56,117 175,343 174,835

Coal

Metallurgical coal

Production (kt) (7)

BMA 50% 7,983 9,220 7,744 7,694 7,608 23,046 23,673

BHP Mitsui Coal (8) 80% 2,396 2,789 2,614 2,578 2,269 7,461 6,958

Total 10,379 12,009 10,358 10,272 9,877 30,507 30,631

Energy coal

Production (kt)

Australia 100% 3,662 6,261 3,982 4,311 4,552 12,845 12,280

Colombia 33.3% 2,444 2,762 2,658 2,356 2,199 7,213 7,855

Total 6,106 9,023 6,640 6,667 6,751 20,058 20,135

Other

Nickel

Saleable production

(kt)

Nickel West (9) 100% 21.1 25.6 21.4 18.1 19.2 58.7 67.4

Total 21.1 25.6 21.4 18.1 19.2 58.7 67.4

Cobalt

Saleable production

(t)

Nickel West 100% 240 277 249 154 194 597 783

Total 240 277 249 154 194 597 783

(1) LPG and ethane are reported as natural gas liquids (NGL).

Product-specific conversions are made and NGL is reported in

barrels of oil equivalent (boe). Total boe conversions are based on

6 bcf of natural gas equals 1 MMboe.

(2) Metal production is reported on the basis of payable metal.

(3) Shown on a 100% basis. BHP interest in saleable production is 57.5%.

(4) Includes Cerro Colorado and Spence.

(5) Iron ore production is reported on a wet tonnes basis.

(6) Shown on a 100% basis. BHP interest in saleable production is 85%.

(7) Metallurgical coal production is reported on the basis of

saleable product. Production figures include some thermal coal.

(8) Shown on a 100% basis. BHP interest in saleable production is 80%.

(9) Production restated to include other nickel by-products.

Throughout this report figures in italics indicate that this

figure has been adjusted since it was previously reported.

10

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2018 2018 2018 2018 2019 2019 2018

Petroleum - Conventional

(1)

Bass Strait

Crude oil and condensate (Mboe) 1,126 1,361 1,653 1,401 893 3,947 4,454

NGL (Mboe) 1,170 1,428 1,840 1,447 849 4,136 4,704

Natural gas (bcf) 20.5 29.9 35.1 25.2 21.0 81.3 96.0

Total petroleum products (MMboe) 5.7 7.8 9.3 7.0 5.2 21.6 25.2

North West Shelf

Crude oil and condensate (Mboe) 1,377 1,267 1,514 1,520 1,431 4,465 4,293

NGL (Mboe) 210 186 242 206 193 641 637

Natural gas (bcf) 35.8 34.2 36.6 37.5 36.6 110.7 108.2

Total petroleum products (MMboe) 7.6 7.2 7.9 8.0 7.7 23.6 23.0

Pyrenees

Crude oil and condensate (Mboe) 1,250 1,168 282 1,101 940 2,323 3,970

Total petroleum products (MMboe) 1.3 1.2 0.3 1.1 0.9 2.3 4.0

Other Australia (2)

Crude oil and condensate (Mboe) 8 7 7 8 6 21 25

Natural gas (bcf) 13.4 13.9 13.8 13.9 13.0 40.7 42.8

Total petroleum products (MMboe) 2.2 2.3 2.3 2.3 2.2 6.8 7.2

Atlantis (3)

Crude oil and condensate (Mboe) 3,459 3,471 3,190 3,802 3,888 10,880 9,858

NGL (Mboe) 248 217 215 268 275 758 661

Natural gas (bcf) 1.8 1.5 1.5 1.9 2.0 5.4 5.2

Total petroleum products (MMboe) 4.0 3.9 3.7 4.4 4.5 12.5 11.4

Mad Dog (3)

Crude oil and condensate (Mboe) 1,140 581 1,270 1,158 1,258 3,686 3,391

NGL (Mboe) 55 27 61 54 58 173 171

Natural gas (bcf) 0.2 0.1 0.2 0.2 0.2 0.6 0.5

Total petroleum products (MMboe) 1.2 0.6 1.4 1.2 1.3 4.0 3.6

Shenzi (3)

Crude oil and condensate (Mboe) 2,323 2,110 2,016 2,024 1,881 5,921 7,127

NGL (Mboe) 140 151 122 121 112 355 465

Natural gas (bcf) 0.4 0.4 0.4 0.4 0.4 1.2 1.3

Total petroleum products (MMboe) 2.5 2.3 2.2 2.2 2.1 6.5 7.8

11

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2018 2018 2018 2018 2019 2019 2018

Petroleum - Conventional

(1)

(continued)

Trinidad/Tobago

Crude oil and condensate (Mboe) 232 233 447 200 284 931 485

Natural gas (bcf) 10.0 9.8 24.0 14.0 19.5 57.5 30.2

Total petroleum products (MMboe) 1.9 1.9 4.4 2.5 3.5 10.5 5.5

Other Americas (3)

(4)

Crude oil and condensate (Mboe) 189 313 207 218 284 709 625

NGL (Mboe) 3 22 3 4 18 25 11

Natural gas (bcf) - 0.3 - 0.1 0.2 0.3 0.2

Total petroleum products (MMboe) 0.2 0.4 0.2 0.2 0.3 0.8 0.7

UK (5)

Crude oil and condensate (Mboe) 43 38 36 36 - 72 105

NGL (Mboe) 18 18 21 21 - 42 70

Natural gas (bcf) 0.8 0.6 0.7 0.7 - 1.4 1.9

Total petroleum products (MMboe) 0.2 0.2 0.2 0.2 - 0.3 0.5

Algeria

Crude oil and condensate (Mboe) 969 888 961 908 866 2,735 2,867

Total petroleum products (MMboe) 1.0 0.9 1.0 0.9 0.9 2.7 2.9

Petroleum - Total

(1)

Conventional

Crude oil and condensate (Mboe) 12,116 11,437 11,583 12,376 11,731 35,690 37,200

NGL (Mboe) 1,844 2,049 2,504 2,121 1,505 6,130 6,719

Natural gas (bcf) 82.9 90.7 112.3 93.9 92.9 299.1 286.3

Total (Mboe) 27,777 28,603 32,804 30,147 28,719 91,670 91,636

(1) Total boe conversions are based on 6 bcf of natural gas

equals 1 MMboe. Negative production figures represent finalisation

adjustments.

(2) Other Australia includes Minerva and Macedon.

(3) Gulf of Mexico volumes are net of royalties.

(4) Other Americas includes Neptune, Genesis and Overriding Royalty Interest.

(5) BHP completed the sale of its interest in the Bruce and

Keith oil and gas fields on 30 November 2018. The sale has an

effective date of 1 January 2018.

12

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2018 2018 2018 2018 2019 2019 2018

Copper

Metals production is payable metal unless otherwise stated.

Escondida, Chile

(1)

Material mined (kt) 103,385 106,788 107,260 105,580 103,936 316,776 309,623

Sulphide ore milled (kt) 32,203 31,732 30,513 30,507 32,027 93,047 86,543

Average concentrator

head grade (%) 0.96% 0.96% 0.94% 0.87% 0.82% 0.88% 0.99%

Production ex mill (kt) 252.6 253.6 241.9 219.9 216.9 678.7 702.5

Production

Payable copper (kt) 244.9 246.1 240.0 212.6 205.4 658.0 679.7

Copper cathode (EW) (kt) 69.4 70.1 55.4 71.9 62.4 189.7 217.4

* Oxide leach (kt) 24.5 27.1 19.5 23.4 20.9 63.8 74.3

* Sulphide leach (kt) 44.9 43.0 35.8 48.5 41.5 125.8 143.1

Total copper (kt) 314.3 316.2 295.4 284.5 267.8 847.7 897.1

(troy

Payable gold concentrate oz) 59,953 68,345 63,578 73,726 73,998 211,302 160,757

(troy

Payable silver concentrate koz) 2,339 2,527 1,997 2,570 2,189 6,756 6,269

Sales

Payable copper (kt) 228.3 260.3 216.5 229.2 212.0 657.7 660.1

Copper cathode (EW) (kt) 61.7 80.9 53.2 72.3 56.6 182.1 207.4

(troy

Payable gold concentrate oz) 59,953 68,345 63,578 73,726 73,999 211,303 160,757

(troy

Payable silver concentrate koz) 2,339 2,527 1,997 2,570 2,189 6,756 6,269

(1) Shown on a 100% basis. BHP interest in saleable production

is 57.5%.

Pampa Norte, Chile

Cerro Colorado

Material mined (kt) 17,766 17,918 18,488 19,875 15,561 53,924 59,338

Ore milled (kt) 4,905 4,833 4,802 5,069 4,277 14,148 13,467

Average copper grade (%) 0.58% 0.58% 0.53% 0.62% 0.63% 0.59% 0.60%

Production

Copper cathode (EW) (kt) 13.6 19.0 14.2 19.4 18.2 51.8 44.3

Sales

Copper cathode (EW) (kt) 13.7 20.9 13.8 19.0 15.5 48.3 43.7

Spence

Material mined (kt) 21,463 23,103 23,007 21,661 18,632 63,300 66,873

Ore milled (kt) 5,144 4,009 5,642 5,428 4,376 15,446 15,438

Average copper grade (%) 1.03% 1.11% 1.21% 1.10% 1.03% 1.12% 1.14%

Production

Copper cathode (EW) (kt) 53.2 51.6 29.2 42.4 49.0 120.6 148.9

Sales

Copper cathode (EW) (kt) 49.8 57.1 29.7 39.1 46.1 114.9 145.0

13

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2018 2018 2018 2018 2019 2019 2018

Copper (continued)

Metals production is payable metal unless otherwise stated.

Antamina, Peru

Material mined (100%) (kt) 58,085 59,002 62,470 62,850 57,900 183,220 176,426

Sulphide ore milled

(100%) (kt) 12,166 12,973 13,197 12,912 11,466 37,575 38,086

Average head grades

* Copper (%) 1.01% 0.91% 0.96% 1.02% 1.04% 1.01% 0.95%

* Zinc (%) 1.01% 1.19% 1.10% 0.85% 0.87% 0.94% 0.98%

Production

Payable copper (kt) 35.2 34.6 37.0 38.3 34.5 109.8 104.9

Payable zinc (t) 25,562 35,983 30,558 24,237 20,848 75,643 83,817

(troy

Payable silver koz) 1,189 1,321 1,309 1,178 1,062 3,549 4,116

Payable lead (t) 464 546 563 600 456 1,619 2,888

Payable molybdenum (t) 420 261 464 417 82 963 1,401

Sales

Payable copper (kt) 32.1 36.6 33.6 40.7 33.3 107.6 101.0

Payable zinc (t) 26,456 33,088 31,822 26,072 20,595 78,489 82,020

(troy

Payable silver koz) 1,052 1,311 1,193 1,236 1,027 3,456 3,997

Payable lead (t) 859 595 612 649 749 2,010 3,455

Payable molybdenum (t) 500 388 208 535 256 999 1,361

Olympic Dam, Australia

Material mined (1) (kt) 2,056 2,201 2,044 2,434 2,191 6,669 5,298

Ore milled (kt) 2,188 2,171 1,242 2,157 2,371 5,770 5,044

Average copper grade (%) 2.36% 2.12% 2.05% 2.10% 2.22% 2.14% 2.23%

Average uranium grade (kg/t) 0.71 0.69 0.62 0.62 0.65 0.63 0.62

Production

Copper cathode (ER

and EW) (kt) 40.5 42.0 33.3 31.6 50.2 115.1 94.7

Payable uranium (t) 1,118 1,123 555 929 1,106 2,590 2,241

(troy

Refined gold oz) 28,989 33,497 23,471 17,856 28,609 69,936 58,059

(troy

Refined silver koz) 248 278 213 212 230 655 514

Sales

Copper cathode (ER

and EW) (kt) 36.8 46.0 33.9 26.6 47.4 107.9 92.7

Payable uranium (t) 509 1,230 765 828 375 1,968 1,527

(troy

Refined gold oz) 20,715 35,714 21,145 17,812 27,574 66,531 61,149

(troy

Refined silver koz) 202 307 216 177 241 634 539

(1) Material mined refers to run of mine ore mined and

hoisted.

14

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2018 2018 2018 2018 2019 2019 2018

Iron Ore

Iron ore production and sales are reported on a wet tonnes basis.

Pilbara, Australia

Production

Newman (kt) 16,412 18,500 16,378 17,578 15,608 49,564 48,571

Area C Joint Venture (kt) 12,802 12,041 11,696 10,280 11,627 33,603 39,476

Yandi Joint Venture (kt) 15,802 17,339 16,870 15,627 15,214 47,711 46,709

Jimblebar (1) (kt) 4,669 15,092 16,333 14,320 13,658 44,311 15,535

Wheelarra (kt) 8,006 614 114 30 10 154 24,544

Total production (kt) 57,691 63,586 61,391 57,835 56,117 175,343 174,835

Total production

(100%) (kt) 67,048 72,145 69,342 65,515 63,609 198,466 202,946

Sales

Lump (kt) 13,993 15,173 15,014 14,020 13,603 42,637 43,034

Fines (kt) 44,332 47,730 46,527 44,059 41,981 132,567 130,834

Total (kt) 58,325 62,903 61,541 58,079 55,584 175,204 173,868

Total sales (100%) (kt) 67,799 71,385 69,421 65,758 62,853 198,032 201,854

(1) Shown on a 100% basis. BHP interest in saleable production

is 85%.

Samarco, Brazil (1)

Production (kt) - -- - - - -

Sales (kt) 25 --10 -10 39

(1) Mining and processing operations remain suspended following

the failure of the Fundão tailings dam and Santarém water dam on 5

November 2015.

15

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2018 2018 2018 2018 2019 2019 2018

Coal

Coal production is reported on the basis of saleable product.

Queensland Coal

Production (1)

BMA

Blackwater (kt) 1,384 1,849 1,704 1,680 1,484 4,868 4,839

Goonyella (kt) 2,314 2,639 1,989 1,813 2,141 5,943 5,322

Peak Downs (kt) 1,723 1,658 1,131 1,685 1,468 4,284 4,692

Saraji (kt) 1,240 1,201 1,111 1,288 1,250 3,649 3,852

Daunia (kt) 547 629 620 419 470 1,509 1,927

Caval Ridge (kt) 775 1,244 1,189 809 795 2,793 3,041

Total BMA (kt) 7,983 9,220 7,744 7,694 7,608 23,046 23,673

Total BMA (100%) (kt) 15,966 18,440 15,488 15,388 15,216 46,092 47,346

BHP Mitsui Coal (2)

South Walker Creek (kt) 1,490 1,615 1,505 1,636 1,429 4,570 4,414

Poitrel (kt) 906 1,174 1,109 942 840 2,891 2,544

Total BHP Mitsui

Coal (kt) 2,396 2,789 2,614 2,578 2,269 7,461 6,958

Total Queensland

Coal (kt) 10,379 12,009 10,358 10,272 9,877 30,507 30,631

Total Queensland

Coal (100%) (kt) 18,362 21,229 18,102 17,966 17,485 53,553 54,304

Sales

Coking coal (kt) 7,177 8,489 7,356 7,514 7,221 22,091 21,452

Weak coking coal (kt) 2,598 2,866 2,813 3,058 3,282 9,153 8,564

Thermal coal (kt) 168 85 141 157 379 677 443

Total (kt) 9,943 11,440 10,310 10,729 10,882 31,921 30,459

Total (100%) (kt) 17,658 20,162 18,102 18,818 19,176 56,096 53,921

(1) Production figures include some thermal coal.

(2) Shown on a 100% basis. BHP interest in saleable production

is 80%.

16

NSW Energy Coal,

Australia

Production (kt) 3,662 6,261 3,982 4,311 4,552 12,845 12,280

Sales

Export thermal coal (kt) 3,181 5,795 3,549 4,809 3,529 11,887 10,851

Inland thermal coal (kt) 400 160 332 393 302 1,027 1,216

Total (kt) 3,581 5,955 3,881 5,202 3,831 12,914 12,067

Cerrejón, Colombia

Production (kt) 2,444 2,762 2,658 2,356 2,199 7,213 7,855

Sales thermal coal

- export (kt) 2,480 2,763 2,589 2,297 2,200 7,086 7,617

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2018 2018 2018 2018 2019 2019 2018

Other

Nickel production is reported on the basis of saleable product

Nickel West, Australia

Mt Keith

Nickel concentrate (kt) 44.9 55.6 50.2 44.9 52.5 147.6 149.1

Average nickel grade (%) 21.3 18.8 18.9 19.8 19.2 57.9 62.1

Leinster

Nickel concentrate (kt) 54.7 78.4 78.8 65.3 51.8 195.9 221.0

Average nickel grade (%) 9.3 9.8 8.4 8.4 9.3 26.1 27.4

Saleable production

Refined nickel (1)

(2) (kt) 19.2 18.5 19.8 16.3 17.6 53.7 52.9

Intermediates and

nickel by-products

(1) (3) (kt) 1.9 7.1 1.6 1.8 1.6 5.0 14.5

Total nickel (1) (kt) 21.1 25.6 21.4 18.1 19.2 58.7 67.4

Cobalt by-products (t) 240 277 249 154 194 597 783

Sales - -

Refined nickel (1)

(2) (kt) 19.5 17.5 19.3 17.3 17.9 54.5 53.5

Intermediates and

nickel by-products

(1) (3) (kt) 2.5 6.3 2.2 2.1 0.1 4.4 14.3

Total nickel (1) (kt) 21.9 23.8 21.5 19.4 18.0 58.9 67.8

Cobalt by-products (t) 240 277 249 154 194 597 783

(1) Production and sales restated to include other nickel by-products.

(2) High quality refined nickel metal, including briquettes and powder.

(3) Nickel contained in matte and by-product streams.

17

Production and sales report

Quarter ended Year to date

Mar Jun Sep Dec Mar Mar Mar

2018 2018 2018 2018 2019 2019 2018

Onshore US - Discontinued operations (1)(2)

Eagle Ford (3)

Crude oil and condensate (Mboe) 2,838 3,826 3,256 1,035 - 4,291 10,015

NGL (Mboe) 1,555 1,767 1,919 614 - 2,533 5,511

Natural gas (bcf) 12.6 13.9 13.8 4.3 - 18.1 40.8

Total petroleum products (MMboe) 6.5 7.9 7.5 2.4 - 9.8 22.3

Permian (3)

Crude oil and condensate (Mboe) 1,398 1,903 1,478 631 - 2,109 3,719

NGL (Mboe) 465 770 687 284 - 971 1,512

Natural gas (bcf) 4.1 6.4 4.8 1.9 - 6.7 12.2

Total petroleum products (MMboe) 2.5 3.7 3.0 1.2 - 4.2 7.3

Haynesville (3)

Crude oil and condensate (Mboe) - - 11 - - 11 1

NGL (Mboe) - - - - - - -

Natural gas (bcf) 28.7 33.1 39.0 13.9 - 52.9 72.2

Total petroleum products (MMboe) 4.8 5.5 6.5 2.3 - 8.8 12.0

Fayetteville (4)

Natural gas (bcf) 18.7 19.1 18.6 - - 18.6 60.8

Total petroleum products (MMboe) 3.1 3.2 3.1 - - 3.1 10.1

Onshore US

Crude oil and condensate (Mboe) 4,236 5,729 4,745 1,666 - 6,411 13,735

NGL (Mboe) 2,020 2,537 2,606 898 - 3,504 7,023

Natural gas (bcf) 64.1 72.5 76.2 20.1 - 96.3 186.0

Total (Mboe) 16,939 20,349 20,051 5,914 - 25,965 51,758

(1) Total boe conversions are based on 6 bcf of natural gas

equals 1 MMboe. Negative production figures represent finalisation

adjustments.

(2) Volumes are net of mineral holder royalties.

(3) BHP completed the sale of its interests in the Eagle Ford,

Haynesville and Permian assets on 31 October 2018.

(4) BHP completed the sale of its Fayetteville assets on 28 September 2018.

18

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDSFDEEMFUSEFL

(END) Dow Jones Newswires

April 17, 2019 02:00 ET (06:00 GMT)

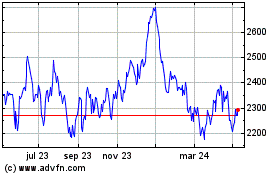

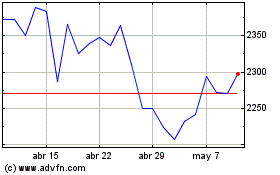

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024