By Bradley Olson and Rebecca Elliott

Occidental Petroleum Corp. offered to buy Anadarko Petroleum

Corp. for $38 billion, launching a potential bidding war for a

company that agreed earlier this month to be purchased by Chevron

Corp. for about $33 billion.

The competition for Anadarko, which has prized assets from the

heart of the West Texas oil boom to East Africa, is set to

intensify as Chevron weighs whether it will make a counteroffer, a

step some analysts and shareholders now expect.

Anadarko said in a written statement Wednesday that its board

hasn't determined whether it views Occidental's offer as better

than Chevron's, adding that it would respond to Occidental after

reviewing the bid. In the meantime, the board continues to

recommend a deal with Chevron, the company said.

Anadarko's handling of the offers is also sure to raise

questions among investors about whether it was too quick to strike

a deal with Chevron, given Occidental's interest. A day before

announcing a deal with Chevron, Anadarko's board boosted the

potential payout Chief Executive Al Walker and other top leaders

would receive in the event of a sale by millions of dollars, The

Wall Street Journal reported Tuesday.

Occidental Chief Executive Vicki Hollub said Anadarko ignored

two offers it made in the week before the April 12 deal

announcement with Chevron, including a written offer April 11 that

would have represented a 20% premium to that transaction.

In an interview, Ms. Hollub said that she had first engaged in

discussions with Mr. Walker about a possible deal in July 2017, and

that Occidental had made serious overtures since late March. But

that communication, she said, ended abruptly earlier this month

when Mr. Walker stopped responding to calls, emails and text

messages.

"We have a superior proposal," she said, adding that the

Houston-based company enhanced its offer with more cash to entice

Anadarko shareholders.

Chevron didn't respond to a request for comment Wednesday. A

Chevron spokesman earlier said the company wasn't aware of any

Occidental discussions with Anadarko during its negotiations with

the company, after reports of Occidental's interest.

Before Occidental went public with its offer Wednesday, Chevron

Chief Executive Mike Wirth said in an interview with the Journal

that he didn't anticipate improving the company's offer.

Several large shareholders in both companies had previously said

they preferred the Chevron combination because of its larger size

and the degree to which it could more easily absorb Anadarko and

avoid any financial strain. But the investor response to

Occidental's offer Wednesday was generally positive, given that it

is both higher and includes more cash.

Occidental is offering a cash-and-stock deal of $76 a share --

or about $11 a share more than the value of the Chevron transaction

on the day it was announced, April 12. The offer, $38 in cash and

0.6094 share of Occidental stock, represents a 20% premium to the

Chevron agreement as of Tuesday's close. Occidental's offer was

valued at $57 billion including debt.

Earlier this month, Chevron said it would buy Anadarko in a

cash-and-stock deal valued at $33 billion. In that agreement,

shareholders would receive 0.3869 share of Chevron and $16.25 in

cash per share.

Shares of Anadarko were up 12% Wednesday amid the news, while

Occidental's stock was down 2.3%. Chevron shares were off 2.5%.

If Anadarko were to accept Occidental's offer, the company plans

to finance the cash portion of the transaction with a bridge loan.

Its debt levels would increase for about a year, but would

ultimately fall as Occidental plans for billions in asset sales,

according to a person familiar with the offer. The company expects

that its credit-rating would remain at investment-grade levels.

Occidental's primary case for the deal is that it will be

positioned to reduce costs significantly and expand its footprint

in the booming Permian Basin, an area where it is already one of

the largest operators. The deal would allow Occidental to achieve

economies of scale in the region, a step giant companies such as

Chevron and Exxon Mobil Corp. have been taking.

Acquiring Anadarko also likely would help Occidental fulfill a

longtime priority of increasing its dividend while reducing the

burden of making those payments, though it would make the company

more highly leveraged, analysts for Bank of America Merrill Lynch

wrote prior to the deal.

"Financially, the deal would be a big stretch for Occidental,"

said Zoe Sutherland, an analyst at Wood Mackenzie. "A potential

transaction would materially increase the company's leverage

ratios, and stretch its balance sheet."

Ms. Hollub said in the Wednesday interview that while she had

been making direct overtures to Mr. Walker since late March, he

stopped responding entirely in the days before Anadarko agreed to a

deal with Chevron.

In a letter to Anadarko's board, Occidental expressed

frustration with Anadarko, which agreed to pay a $1 billion breakup

fee with Chevron if that deal doesn't go through.

"It is unfortunate that Anadarko agreed to pay a break up fee of

$1 billion, representing approximately $2 per share, without even

picking up the phone to speak to us after we made two proposals

during the week of April 8 that were at a significantly higher

value to the transaction you were apparently negotiating with

Chevron," Ms. Hollub said in her letter.

Tom McNulty, a managing director for consulting firm Great

American Group Advisory & Valuation Services LLC, said an

Anadarko acquisition would be strategically beneficial for both

Occidental and Chevron, but added that Chevron's larger platform

gave it greater flexibility.

"If it turns into a bidding war, then you're going to start to

see it reach the upper limits of where valuation will make sense,"

Mr. McNulty said.

Micah Maidenberg contributed to this article.

Write to Bradley Olson at Bradley.Olson@wsj.com and Rebecca

Elliott at rebecca.elliott@wsj.com

(END) Dow Jones Newswires

April 24, 2019 14:21 ET (18:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

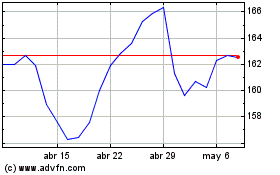

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

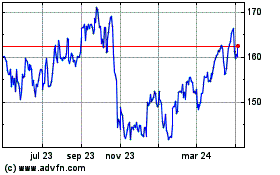

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024