By Bradley Olson and Rebecca Elliott

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 27, 2019).

The world's largest oil companies are reporting underwhelming

first-quarter profits during a time of geopolitical challenges and

weaker global commodity prices.

Sanctions in Venezuela, production cuts in Canada and lower

natural-gas prices in Asia took a toll on Exxon Mobil Corp.,

Chevron Corp. and other companies. The business of refining crude,

one of the most reliable profit centers in the industry during the

last five years, was especially hard-hit.

The anemic results added to concerns about the direction of

crude prices, where lackluster demand, excess gasoline and a

buildup of oil in storage led analysts to question whether a market

rally of more than 40% this year may soon come to a close.

U.S. oil prices reported their largest one-day decline in dollar

terms since Christmas Eve, falling 2.9%, or $1.91, to close at

$63.30. The decline followed remarks by President Trump, who told

reporters that he "called up OPEC" and asked the group to help

lower fuel costs. President Trump, on Twitter, has repeatedly asked

the Organization of the Petroleum Exporting Countries to increase

production and lower gasoline prices.

According to people familiar with the matter, however, Mohammed

Barkindo, OPEC secretary-general, hasn't spoken with Mr. Trump, nor

has Khalid al-Falih, the energy minister of OPEC kingpin Saudi

Arabia. Mr. Trump also hasn't discussed lowering oil prices with

Saudi Crown Prince Mohammed bin Salman, Saudi officials said.

The White House didn't respond to a request for comment.

Exxon said earnings fell in every business segment inside and

outside the U.S., and the company's refining operations -- a profit

machine for decades in times of high prices and low -- showed a

loss of $256 million in the quarter. Overall, net income dropped to

$2.35 billion, the lowest in three years.

"It was a tough market environment for us this quarter," said

Exxon Senior Vice President Jack Williams, who oversees the

company's refining and chemicals businesses on its management

committee. "The margins were at historically low levels."

French oil giant Total SA missed earnings expectations, and

Chevron said profits fell by almost a third to $2.6 billion. BP PLC

and Royal Dutch Shell PLC are set to report next week.

For the refining crude business, in the past five years it has

contributed about 34% of the combined net income of Exxon and

Chevron, and in some years it made up more than 50% of profits, a

bulwark against the volatility of oil.

"They're still making money, but the fat margins have

disappeared," said Sandy Fielden, director of oil research for

Morningstar Inc.

Exxon, Chevron and independent U.S. refiners were hit by

production declines in Venezuela and Canada that led to scarcity

and higher prices for heavy oil, which can be highly profitable to

refine because it has generally been cheaper than lighter grades.

Yet when the difference in those prices narrows, it typically hurts

refining profits.

Exxon reported earnings per share of 55 cents, almost 50% below

the first quarter last year and missing analyst expectations. Sales

fell about 7% to $63.63 billion. Production rose to 3.9 million

barrels of oil and gas a day, a 2% increase from the same period

last year.

Chevron posted earnings of $1.39 a share, down from $1.90 a

share in the first quarter of 2018, and short of analyst

expectations. Production rose, but Chevron's share prices was

roughly flat before markets opened as investors waited for more

signals on whether the company will raise its $33 billion offer for

Anadarko Petroleum Corp.

Occidental Petroleum Corp. recently launched a potential bidding

war for Anadarko, making public a $38 billion offer.

Chevron Chief Executive Mike Wirth declined to say Friday

whether the company would raise its price and reiterated the

company's case for why it is a better buyer, including its larger

size and balance sheet that "mitigates risk."

"Our companies simply have the best strategic fit," he said.

"There are a whole host of reasons why we have a very compelling

transaction."

Last year, many refiners benefited from steeply discounted crude

in West Texas and Canada, where pipeline bottlenecks left oil

landlocked and depressed regional prices. But markdowns for

heavier, more sulfurous oil have eroded in the wake of production

curtailments in Canada and U.S. sanctions on Venezuela.

That has weighed on the margins refiners earn on each barrel of

oil they process into fuels such as gasoline and diesel.

Valero Energy Corp. generated $141 million in net income during

the first quarter, about 70% less than during the same period last

year, the company said Thursday. Its refining margin fell to $7.97

a barrel during the quarter, from $8.65 a year ago.

"The first quarter presented us with tough market conditions,"

Chief Executive Joe Gorder told investors, citing narrower

oil-price differentials paired with high gasoline inventories and

low margins for making the fuel.

Mexico's Maya crude, a heavier oil, traded for an average of

less than $4 a barrel below Louisiana Light Sweet, a Gulf Coast

benchmark, during the first quarter, according to S&P Global

Platts. That compares with an average discount of about $8 a barrel

during the same period last year.

Heavy Canadian oil, meanwhile, sold for an average of roughly

$10 less than West Texas Intermediate during the first quarter,

compared with an average discount of about $26 during the

year-earlier period, S&P Global Platts data show.

--Benoit Faucon, Summer Said and Micah Maidenberg contributed to

this article.

Write to Bradley Olson at Bradley.Olson@wsj.com and Rebecca

Elliott at rebecca.elliott@wsj.com

(END) Dow Jones Newswires

April 27, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

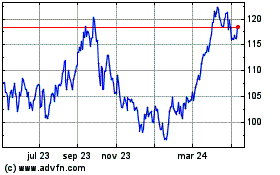

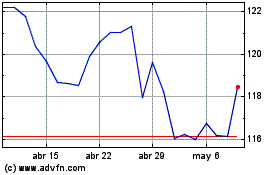

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024