Traders Brace for Big Moves After GE Earnings This Week

28 Abril 2019 - 7:29AM

Noticias Dow Jones

By Gunjan Banerji

Options traders are betting on an explosive move in General

Electric Co. shares after its earnings on Tuesday, a sign that

turbulence in the battered stock may not be over.

Prices of options indicate expectations for about a 9% swing in

the conglomerate's shares after first-quarter earnings are

released, according to data provider Trade Alert. That is bigger

than the average move of 4.7% that the stock posted after the past

eight earnings releases. The forecast measures the size of the

move, not the direction.

Potentially adding to GE investors' worries: Companies that have

fallen short of Wall Street expectations this earnings season have

seen their shares punished more than normal. While Boston-based

GE's stock has rallied so far in 2019, it is still down 31% over

the past year. The sharp decline has left the company's share price

at $9.57 as of Friday, making it more likely the stock could see

big percentage swings up and down.

Market participants have been buying GE put options ahead of its

earnings, according to Ling Zhou, director of equity-derivatives

strategy at Cowen Inc. Puts give the right to sell shares at a

given price, known as a strike, later in time. These types of

contracts can help investors protect against further losses in the

stock. Mr. Zhou said GE options have also been used by the

company's bondholders, who can take profits if the shares

weaken.

Calls confer the right to buy stock. Market participants often

tap options to make directional bets on stocks or hedge other parts

of their portfolios.

The options activity is a sign of how GE's stock has evolved in

recent years, from a steady dividend-paying company to one more

prone to wild gyrations.

"On a normal trading day, it's two to three times as volatile as

it used to be," Mr. Zhou said. Now, "the overall market view is

that earnings will be more volatile."

GE's market capitalization has dropped by almost $200 billion

since the end of 2016 -- to about $83 billion -- as investors have

grown worried about the company's cash flow and billions of dollars

of debt. Recently, company executives warned investors about

another year of lower profits and poor cash flow from the company's

core industrial operations. Last year, the company's stock was

dropped from the Dow Jones Industrial Average after having a place

on the blue-chip index for more than a century, while its bonds

were downgraded by ratings firms.

To be sure, some options traders appeared to be wagering on a

dramatic rebound in the shares. One of the biggest options

positions outstanding would profit if the stock reaches $20 by

January.

Meanwhile, a popular contract that traded on Thursday would pay

out if GE shares climb to $20 by 2021, according to Trade Alert.

Such a jump would mean a rally of at least 100% from the stock's

price on Friday and bring the shares back to a level they were at

in late 2017.

Analysts are closely watching for clues on what GE will do with

its health-care business. GE has said it would sell assets to raise

cash and recently agreed to sell its biotechnology business for $21

billion. The shares rallied 6.4% on news of the biotechnology sale,

though they've fallen since then.

"There's still a bull case where you can see this as a $20 stock

in 2020," said Deane Dray, an analyst at RBC Capital Markets. Mr.

Dray has an outperform rating and a price target of $13 on the

shares.

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

April 28, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

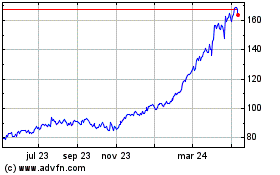

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

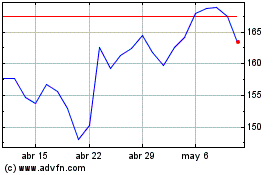

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024