Anadarko to Resume Talks With Occidental Petroleum on Buyout Bid

29 Abril 2019 - 7:33AM

Noticias Dow Jones

By Kimberly Chin

Anadarko Petroleum Corp. said it would consider Occidental

Petroleum Corp.'s $38 billion bid, weeks after the company entered

an agreement to be taken over by Chevron Corp. for about $33

billion.

The company said Monday it would resume talks with Occidental

after its board had unanimously determined that Occidental's offer

could result in a superior proposal to the one offered by

Chevron.

.

Anadarko said its merger agreement with Chevron remains intact

and the board currently "reaffirms its existing recommendation of

the transaction." However, the agreement allows the board to resume

negotiations with Occidental to seek a superior proposal.

A Chevron spokesman said in a statement that the company

believes its agreement with Anadarko provides the best value and

most certainty to Anadarko shareholders.

Anadarko's deal with Chevron includes $1 billion breakup

fee.

Shares of Occidental fell 2.5% in premarket trading while shares

of Anadarko were flat. Chevron's shares were also unchanged.

Last week, Occidental offered Anadarko a cash-and-stock deal of

$76 a share -- or about $11 a share more than the value of the

Chevron transaction on the day it was announced, April 12.

Occidental's offer would mean $38 in cash and 0.6094 of a share of

Occidental stock per each of Anadarko's stock.

Anadarko had entered an agreement with Chevron to be acquired in

a cash-and-stock deal where shareholders would receive $16.25 in

cash and 0.3869 of a share of Chevron stock in each of Anadarko

common shares.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

April 29, 2019 08:18 ET (12:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

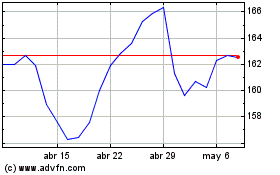

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

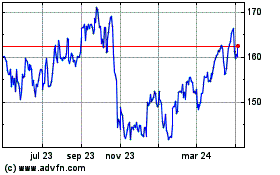

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024