Anadarko to Resume Talks With Occidental on Buyout Bid -- Update

29 Abril 2019 - 9:33AM

Noticias Dow Jones

By Bradley Olson and Kimberly Chin

Anadarko Petroleum Corp. said it was considering Occidental

Petroleum Corp.'s $38 billion offer, weeks after agreeing to be

taken over by Chevron Corp. for about $33 billion, raising the

likelihood of a bidding war for assets in the heart of the U.S.

fracking boom.

The declaration puts the onus on Chevron to raise its price or

walk away from its deal for Anadarko, whose acreage in the Permian

Basin of West Texas and New Mexico is coveted by both Chevron and

Occidental as a path to further expansion.

Chevron's deal with Anadarko includes a $1 billion breakup fee,

a factor that may not make it necessary for Chevron to completely

match the Occidental offer. While Chevron can afford to raise its

price significantly, some analysts have urged the company to

proceed with caution given the existence of other potential

targets.

The Anadarko board met Sunday and unanimously voted to reopen

discussions with Occidental. Occidental Chief Executive Vicki

Hollub said in an interview last week that the company had been in

discussions with Anadarko for almost two years and made several

offers in the weeks before the Chevron transaction announcement on

April 12 that were ignored by Anadarko executives.

Shareholders in recent days had pressured Anadarko to openly

consider both suitors and criticized the board's decision to

increase executive payouts on April 11 by millions of dollars.

The vote was "an inexcusable breach of corporate governance,"

said Matthew Halbower, chief executive of hedge fund Pentwater

Capital Management, in a letter Thursday. Pentwater owns about 7

million Anadarko shares.

Anadarko said its merger agreement with Chevron remains intact

and the board currently "reaffirms its existing recommendation of

the transaction." However, the agreement allows the board to resume

negotiations with Occidental to seek a superior proposal.

A Chevron spokesman said in a statement that the company

believes its agreement with Anadarko provides the best value and

most certainty to Anadarko shareholders.

An Occidental spokeswoman said the company hopes Anadarko will

move quickly to secure its "superior" transaction.

Shares of Occidental fell 1.5% in morning trading while shares

of Anadarko declined 0.1%. Chevron's shares were unchanged.

Last week, Occidental offered Anadarko a cash-and-stock deal of

$76 a share -- or about $11 a share more than the value of the

Chevron transaction on the day it was announced, April 12.

Occidental's offer would mean $38 in cash and 0.6094 of a share of

Occidental stock per each of Anadarko's stock.

Anadarko had entered an agreement with Chevron to be acquired in

a cash-and-stock deal where shareholders would receive $16.25 in

cash and 0.3869 of a share of Chevron stock per each of Anadarko

common shares.

Write to Bradley Olson at Bradley.Olson@wsj.com and Kimberly

Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

April 29, 2019 10:18 ET (14:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

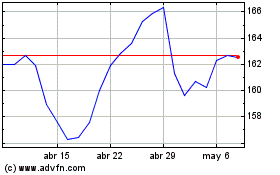

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

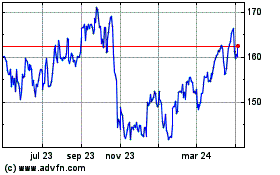

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024