By Nina Trentmann

Suppliers to Boeing Co. are struggling to navigate uncertainty

arising from the continued grounding of the company's 737 MAX

aircraft.

Reliant on Boeing orders, executives of the 600-plus companies

that supply more than three million parts to make the beleaguered

jet are bracing for potential changes to production levels should

the aircraft remain grounded beyond the summer.

Boeing in April reduced its monthly production rate of the jet

to 42, down from 52 before the second fatal crash of a 737 MAX in

five months on March 10 in Ethiopia.

Boeing last week said it would go through its list of suppliers

and components one by one and make adjustments if necessary. That

might make suppliers -- who provide parts from fan blades to

fuselages -- reconsider their risk-management strategies and growth

plans, given that Boeing before the crashes had indicated it could

boost monthly production to 57 planes later this year.

A production rate increase with short notice could be just as

disruptive as a cut. "It is not an easy supply chain to switch on

and off," said Douglas Groves, chief financial officer and

treasurer at Ducommun Inc., a Boeing supplier that makes wing

flaps, also called spoilers; floor panels; and pylons for the 737

MAX. "Once you turn it off, it takes a while to turn it back

on."

The companies have had discussions, but Ducommun hasn't received

formal purchase order changes, Mr. Groves said. Ducommun still

makes its components at a rate of 52 planes a month. The company

generates around $100 million a year from part sales for the 737

MAX.

The company's management discusses the 737 MAX situation every

day, Mr. Groves said. "We are doing a lot of scenario planning," he

said. "But it all depends on how long this is going on for."

Investigations into the causes of the two fatal crashes are

ongoing. For many suppliers, the core question is whether the

grounding of the aircraft will continue beyond the summer, said

Kenneth Herbert, an analyst at Canaccord Genuity LLC.

The Federal Aviation Administration grounded all 737 MAX jets on

March 13, three days after the Ethiopian Air accident.

"The million-dollar question is at what point will suppliers

decide to slow investments," Mr. Herbert said. CFOs at some Boeing

suppliers haven't adjusted their spending, but that could change,

depending on the outcome of the accident investigations, said Mr.

Herbert.

Honeywell International Inc., which makes mechanical systems and

avionics for the 737 MAX, said it is optimistic the plane will

resume service in the second half of the year. "Given that most --

just about everybody -- expects a resolution, we do too," Chief

Executive Darius Adamczyk said on a recent earnings call.

Honeywell has absorbed the production rate cut to 42 planes a

month, he said, adding that the impact on the company's finances is

negligible.

Safran SA, a French company that makes passenger seats, wheels

and fans for the 737 MAX, on Friday said it would adjust its

production if necessary. It expects a EUR200 million ($222.9

million) cash-flow impact if Boeing doesn't deliver any new 737 MAX

planes to its customers in the second quarter, Chief Financial

Officer Bernard-Pierre Jacques Delpit said during an earnings call.

The company declined to comment further.

CFM International, a joint venture between Safran and General

Electric Co. that makes the engine for the 737 MAX, said it doesn't

plan to cut production at this point. It has been coordinating with

Boeing, a spokesman said.

For Ducommun, a short-term cut in output would be challenging,

Mr. Groves said. The company places its orders for titanium, one of

the metals used in its components, more than 12 months in advance.

Instead, Ducommun could hold excess inventory, but that would come

at a cost to Boeing, Mr. Groves said.

Some suppliers already have bespoke arrangements with Boeing to

reduce their financial exposure to the grounding.

Spirit AeroSystems Holdings Inc., a maker of fuselages for the

737 MAX, will keep producing at a 52-plane-per-month rate and

receive payments from Boeing, even though excess fuselages will be

stored by Spirit, it said in a recent regulatory filing.

Given the complexity of its supply chain, Boeing needs to

discourage component makers from reducing production, said Cai von

Rumohr, an analyst at Cowen Inc. "You don't want a supplier to

anticipate a rate cut," the analyst said. Spirit declined to

comment.

Boeing is aware of the potential risks to its supply chain,

which can outweigh the cost of overstocking parts for a few months,

analysts say.

"When we do come back up and ramp, we're going to do it in a

very steady fashion with stability in each step along the way,"

Boeing CFO Greg Smith said during the company's first-quarter

earnings call last week. Boeing didn't immediately respond to a

request for additional comment.

Meanwhile, suppliers face the daunting task of trying to manage

the customer risk. Ducommun makes products for Airbus SE and

Gulfstream Aerospace Corp. as well as Boeing, and could expand its

business with those plane makers to mitigate the risk. "For us,

[the effort] is continuing to diversify our product portfolio," Mr.

Groves said.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

April 29, 2019 16:33 ET (20:33 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

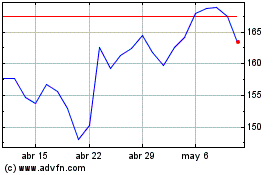

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

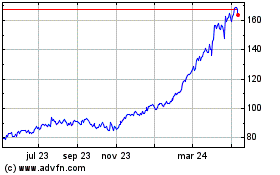

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024