Insider Trades of Oil Stock Alleged -- WSJ

30 Abril 2019 - 2:02AM

Noticias Dow Jones

By Micah Maidenberg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 30, 2019).

Traders used insider information to turn a profit of about $2.5

million related to the sale of Anadarko Petroleum Corp., according

to the Securities and Exchange Commission on Monday.

The trader or group of traders who executed the transactions are

currently unknown to the SEC. However, the agency said it had

obtained a court order to freeze assets related to the alleged

trading based on nonpublic information tied to Chevron's proposed

$33 billion merger with Anadarko and Occidental Petroleum Corp.'s

$38 billion offer for the company.

Between February 8 and April 1, the traders purchased 1,650 call

options, which gave the trader or group of traders the right to buy

Anadarko shares at a set price for a certain period, according to a

lawsuit the SEC filed in federal court in New York.

Chevron delivered its offer to Anadarko on February 6, the SEC

said in the lawsuit. Anadarko was also in discussions, starting in

March, with Occidental, which offered last week to acquire Anadarko

for about $38 billion.

Media representatives for Anadarko and Occidental didn't respond

to requests for comment. A Chevron spokesman declined to comment.

The oil companies aren't named as defendants in the SEC's suit.

The judge overseeing the case signed off on an order freezing

assets related to the trades, according to court records.

In two brokerage accounts, the unknown traders purchased equity

call options in Anadarko shares.

For example, in one account, a trader bought 650 call options in

Anadarko shares on April 1 for about $70,000. Those options allowed

the owner to acquire the oil company's shares for $50 a share,

according to the SEC. That same day, leaders at Occidental and

Anadarko were scheduled to meet.

On April 12, the news that Chevron would acquire Anadarko became

public. Shares of Anadarko closed at $61.78 that day, up roughly

32% from the previous day.

Three days later, the owner of the call options bought on April

1 exercised them, giving the trader the right to buy 65,000

Anadarko shares at the lower price, according to the SEC, allowing

the holder of the options to earn a profit of $727,350, less

commissions.

On Monday, shares of Anadarko closed at $72.93 after the company

said it would resume talks with Occidental.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 30, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

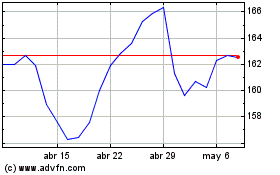

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

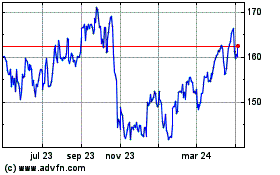

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024