GE Swings to Quarterly Profit as It Shrinks

30 Abril 2019 - 6:34AM

Noticias Dow Jones

By Thomas Gryta

General Electric Co. swung to a first-quarter profit as the

conglomerate reported stronger cash production than expected while

leaving its full-year expectations unchanged.

GE reported adjusted cash flow from industrial operations of

negative $1.2 billion; the company warned earlier this year that

cash flow would drop as much as negative $2 billion this year from

its core industrial operations.

It has called 2019 a "reset year" but has warned the first

quarter would be the low point of the results. New CEO Larry Culp

is restructuring the company, prioritizing the struggling Power

division as well as reducing the conglomerates massive debt

load.

In the first quarter, GE reported a profit of $3.55 billion,

compared with a year-ago loss of $1.18 billion. Revenue fell 2% to

$27.29 billion, as a sharp decline in the Power division, which

makes turbines for power plants, offset gains in Aviation and other

units.

"Our quarterly results were better than our expectations,

largely driven by timing of certain items, which should balance out

over the course of the year," Mr. Culp said in a statement. "This

is one quarter in what will be a multiyear transformation."

In the quarter, GE completed the sale of its century-old

locomotive business, struck a more than $20 billion deal to sell

its biotechnology business and paid $1.5 billion to settle a

long-running Justice Department probe into a legacy mortgage

lending business.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

April 30, 2019 07:19 ET (11:19 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

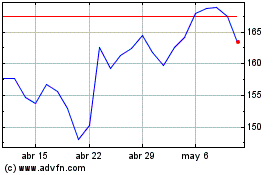

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

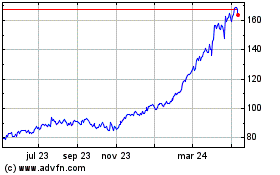

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024