Berkshire To Make $10 Billion Investment In Occidental To Finance Anadarko Bid

30 Abril 2019 - 8:53AM

Noticias Dow Jones

By Micah Maidenberg

Berkshire Hathaway Inc. has agreed to make a $10 billion equity

investment in Occidental Petroleum Corp., a bid to help the oil

company complete its proposed acquisition of Anadarko Petroleum

Corp.

In return for the investment, Berkshire will receive 100,000

shares of preferred stock, according to a statement from

Occidental. The preferred stock will generated dividends at 8% a

year.

In addition, Bekrshire will receive a warrant to buy up to 80

million shares of Occidental common stock at a price of $62.50 a

share.

Shares of Occidental closed Monday at $60.13.

A spokesman for Berkshire couldn't immediately be reached for

comment. Berkshire will only follow through on the investment if

Occidental is able to enter into and complete its proposed

acquisition of Anadarko.

Last week, Houston-based Occidental offered to purchase Anadarko

for $38 billion. The bid topped the $33 billion that Chevron Corp.

agreed to pay to buy the company.

On Monday, Anadarko said it was considering Occidental's offer,

but added its merger agreement with Chevron remained in place.

Chevron's deal entitles it to receive a $1 billion breakup fee if

Anadarko walks away.

"We are thrilled to have Berkshire Hathaway's financial support

of this exciting opportunity," Occidental Chief Executive Officer

Vicki Hollub said in prepared remarks.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 30, 2019 09:38 ET (13:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

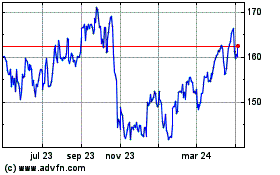

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

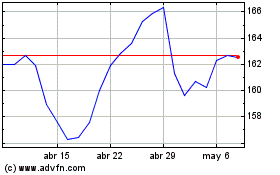

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024