Pound Climbs On Trade Optimism

01 Mayo 2019 - 12:47AM

RTTF2

The pound was higher against its most major counterparts in the

European session on Wednesday, as U.K. markets advanced on optimism

about U.S-China trade talks and strong earnings from Apple

overnight.

Apple's earnings and revenue estimates for the second quarter

topped forecasts, sending its stock surging in after-market trading

in the U.S. Trade talks between China and U.S. began in Beijing,

with the U.S. aide describing as it as "productive," as both seek

to end the spat.

US Treasury Secretary Steven Mnuchin wrote on twitter that US

trade negotiators concluded productive meetings with China's Vice

Premier Liu He and that decisive talks will be held in the U.S.

next week.

The Federal Reserve is widely expected to leave interest rates

unchanged when it ends a two-day policy meeting later in the

day.

Traders are likely to keep a close eye on the accompanying

statement and Fed Chairman Jerome Powell's subsequent press

conference for clues on the outlook for interest rates.

Survey data from the Nationwide housing society showed that UK

house prices rose at the fastest annual pace in five months in

April, but inflation remained subdued.

The house price index rose 0.9 percent year-on-year following a

0.7 percent increase in March. Economists had expected the

inflation rate to remain unchanged.

Survey data from IHS Markit showed that UK manufacturing

expansion slowed to a two-month low in April amid a decline in

export business and an easing in the robust pace of

stock-building.

The IHS Markit/CIPS Purchasing Managers' Index, or PMI, fell to

53.1 in April from March's 13-month high of 55.1. The score was in

line with economists' expectations.

The currency has been trading higher against its major

counterparts in the Asian session, barring the euro.

The pound strengthened to more than a 2-week high of 1.3074

against the greenback, from a low of 1.3024 hit at 5:00 pm ET. The

pound is seen finding resistance around the 1.32 level.

The pound appreciated to 145.70 against the yen, its highest

since April 18. Next key resistance for the pound is seen around

the 147.00 level.

The pound climbed to 0.8587 against the euro, a level unseen

since April 5. On the upside, 0.84 is possibly seen as the next

resistance level for the pound.

On the flip side, the pound pared some of its early gains

against the franc with the pair trading at 1.3285.This follows a

high of 1.3304 touched at 3:00 am ET. The pound is poised to test

support around the 1.30 level.

Looking ahead, at 8:15 am ET, ADP private payrolls data for

April is scheduled for release.

In the New York session, U.S. construction spending for March

and ISM manufacturing for April will be released.

The Fed announces its interest rate decision at 2:00 pm ET.

Economists widely expect the fed funds rate to remain in a range

between 2.25 percent and 2.50 percent.

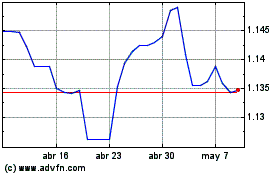

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024