Vicki Hollub goes all-in to best Chevron for Anadarko -- and

dominate a huge oil field

By Christopher M. Matthews, Bradley Olson and Cara Lombardo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 8, 2019).

Driven by a risk-taking chief executive, Occidental Petroleum

Corp. is trying to swallow a competitor close to its own size,

outmaneuvering one of the world's oil giants in the process.

If it succeeds, CEO Vicki Hollub will win accolades and

Occidental will ward off growing threats from the giants in one of

the world's biggest oil fields. If not, Occidental could itself be

vulnerable to a takeover.

Occidental's battle with mammoth Chevron Corp. to buy Anadarko

Petroleum Corp. has riveted the oil industry since it erupted in

mid-April. Occidental currently has the highest offer on the table,

one that Anadarko said Monday it now favors over Chevron's. A new

offer from Chevron could come any time.

Ms. Hollub lined up $10 billion of backing from Warren Buffett

and cut a deal with a French oil company, all in the space of two

days, to press her audacious project.

She is pushing it against the wishes of some of Occidental's

major investors, spooked by the cost and risk of mounting debt.

Mutual-fund giant T. Rowe Price Group intends to vote against

Occidental's board slate at the oil company's annual meeting

Friday, said a Price portfolio manager, John Linehan.

T. Rowe Price believes financing arranged from Mr. Buffett's

Berkshire Hathaway is "extraordinarily expensive," Mr. Linehan

said, adding: "We are concerned that as the bidding war intensifies

there will be a winner's curse for whoever buys Anadarko."

David Katz, president and chief investment officer of Occidental

shareholder Matrix Asset Advisors,, which expressed concerns to

Occidental's board, said, "Vicki Hollub seems committed to getting

this done at any cost." He said her " obligation should be to

maximize value, not to maximize the empire. We urge the company to

consider selling rather than buying."

Though it's fraught with danger, Ms. Hollub believes a deal for

Anadarko would be a rare chance to transform the company's size and

sway in the Permian Basin of Texas and New Mexico, the epicenter of

U.S. shale production, said people familiar with her strategy.

Though the fifth-largest U.S. oil company, according to this

thinking, Occidental is just too small to match Chevron and Exxon

Mobil Corp. as they squeeze other producers there with methodically

orchestrated expansions.

Top spot

Adding Anadarko's assets would vault Occidental to the top spot

in the huge field, according to consulting firm Rystad Energy.

Without major change, Occidental, now second, would be only the

fifth-largest there by 2025, according to Rystad's forecasts.

"If we're going to get in this thing, we're going to win it,"

said Glenn Vangolen, one of Ms. Hollub's top lieutenants and a

senior vice president. "We're not going to dip our toes in the

water and mess up the stock."

Occidental's offer for Anadarko is $38 billion. That tops a $33

billion deal Chevron struck to buy Anadarko last month. This week,

Occidental sweetened its bid further by upping the amount of cash

it includes.

That step indirectly added to the concerns of the objecting

Occidental investors. By reducing the number of new shares

Occidental would have to issue, the move eliminated the need to get

shareholder approval for a deal.

Ms. Hollub has argued Occidental's investors benefit from the

move because it makes the company's bid more likely to succeed.

Occidental declined to make Ms. Hollub available for this

article.

Those who know Ms. Hollub say beneath her plain-spoken persona

lies an intense competitor. An Alabama native and former French

horn player in the University of Alabama's "Million Dollar Band,"

Ms. Hollub, 59 years old, is a passionate fan of Crimson Tide

football. Her prized possessions include a portrait of the school's

legendary former coach, Paul "Bear" Bryant.

Since she became CEO three years ago -- the first female chief

executive at a large oil company -- current and former senior

executives saw her zeal for a big deal as a departure from her

predecessor, Stephen Chazen, who favored small "bolt-on"

transactions and tended to avoid big risks.

Given the size of Anadarko -- which has an enterprise value of

about $55.5 billion, only 7% smaller than Occidental -- Ms. Hollub

knew an acquisition of it would stretch Occidental to its limits.

She expected shareholders to trust her judgment that an acquisition

was necessary to ensure the company had the wherewithal to continue

competing against oil giants, said people who know her.

Ms. Hollub courted Anadarko, also a substantial player in the

Permian Basin, for nearly two years. Early last month she thought

she was close to a deal. But after Occidental revised a

still-confidential offer of about $76 a share temporarily down to

about $72 in early April, she said Anadarko CEO Al Walker stopped

responding to her calls and text messages.

Occidental sent a revised $76-a-share offer on April 11,

according to people familiar with the issue. By that time, Anadarko

had decided to move ahead with Chevron's offer due to concerns that

re-engaging in discussions with Occidental would prompt Chevron to

walk away, according to people familiar with Anadarko's

thinking.

On April 12, Anadarko announced it would be sold to Chevron for

roughly $65 a share. Ms. Hollub was frustrated. Instead of giving

up, she went public with a new $76-a-share offer -- and over a

whirlwind weekend lined up nearly $19 billion in financial

ammunition.

Occidental needed a big war chest to compete with Chevron. Ms.

Hollub and her advisers discussed approaching a Middle Eastern

sovereign-wealth fund, said people familiar with her thinking. They

determined that would take too long, one of the people said.

Another option seemed to lie in Omaha, Neb. Bank of America

Chief Executive Brian Moynihan had visited Occidental's Houston

office before the Chevron deal to discuss financing options. After

the Chevron-Anadarko deal was announced -- and Occidental needed

cash fast -- Mr. Moynihan offered to reach out Mr. Buffett, who was

looking for ways to invest Berkshire Hathaway's large pile of cash,

another person familiar with the maneuverings said.

An investment from him would have the bonus of looking like an

endorsement of an Occidental deal from the famed investor, this

person said.

Mr. Moynihan called Mr. Buffett to broker a meeting. Ms. Hollub

planned a visit to Omaha for that weekend.

First, however, she made a quick trip to Paris on April 26 and

struck a conditional deal to sell Anadarko's extensive African

assets to oil company Total SA for $8.8 billion, reducing

Occidental's leverage after an Anadarko takeover.

Her next trip was to Omaha. With her was a top lieutenant and

former Bank of America banker, Oscar Brown, Mr. Buffett said at

Berkshire's annual meeting on Saturday.

Within an hour, they struck a deal for Berkshire to spend $10

billion for 100,000 Occidental preferred shares yielding 8% if the

Anadarko deal went through.

It gave Ms. Hollub more room to raise her offer. "They

absolutely know we have $10 billion and we're not going to tell

them how to structure their transaction and do anything else," Mr.

Buffett said on Saturday.

Decades ago, Occidental was one of a handful of oil explorers

led by charismatic wildcatters -- companies like J. Paul Getty's

Getty Oil Co. and Leon Hess's Hess Corp. -- that took risks in

places others avoided. Occidental boomed under Armand Hammer, who

took over what was a sleepy California oil company in 1957 and

turned it into a substantial player, mainly through an oil

concession in Libya he obtained in the late 1960s.

Competing with companies five or six times its size, Occidental

developed an expertise at pumping oil from places that others were

willing to discard. One such was the Permian Basin, which had once

been among the world's hottest oil fields but by the late 1990s and

early 2000s was left for dead by most of the majors.

Occidental developed ways to get more oil out of aging

conventional wells there by injecting carbon dioxide into them. It

is now a leader in the process, which analysts say could extend the

lives not only of conventional wells but of shale wells, which

produce prodigiously at first but rapidly decline.

That has also put Occidental at the forefront of the burgeoning

business of capturing carbon to forestall climate change. Last

year, Ms. Hollub helped lobby for legislation, since passed, to

extend and increase carbon-capture tax credits.

"She was the go-to phone call," said former Sen. Heidi Heitkamp

of North Dakota. "She's not like a lot of executives who might just

say, 'I need this.' She will put the credibility of her company

into something she believes in."

Ms. Hollub, who studied mineral engineering at Alabama, worked

on oil rigs right out of college and landed at Occidental in 1982

when it bought the company she worked for, Cities Service. She rose

through Occidental's ranks, running operations from Russia to

Venezuela to West Texas.

One of her first big jobs was overseeing Occidental oil fields

in a remote part of Ecuador, where she was essentially the mayor of

a small city as she managed drilling operations in the Amazon

jungle, said the company's Mr. Vangolen.

Workers there, mostly men, "were all very skeptical of her,

being a female in the middle of the jungle, where there basically

were no women, " said Mr. Vangolen. "Very quickly, she figured out

how to get everyone's input and get them onboard."

Glass ceiling

Edward Djerejian, a former chairman of Occidental and onetime

U.S. ambassador to Israel and Syria, recalled Ms. Hollub impressing

the board years ago with a presentation on Permian Basin

operations. Around 2014, he and then-CEO Mr. Chazen identified her

as Mr. Chazen's successor.

"The major consideration was her competence," he said. "We also

obviously realized if we made this move we'd be breaking the glass

ceiling in the oil-and-gas industry."

With Ms. Hollub as CEO, Occidental has performed in the middle

of the pack. After she took over in April 2016, the company stuck

to Ms. Hollub's pledge not to lay off employees resulting from the

industry downturn that began with a late-2014 plunge in oil

prices.

But Occidental has shed nearly $9 billion in market value during

her tenure while its share prices have fallen about 11%. Much of

that decline has come as a result of the offer. Through April 11,

the day before Chevron's announcement, when Occidental's interest

was also revealed, the company's performance in total return to

investors was better than its smaller peers but worse than that of

major oil companies including Chevron or ConocoPhillips.

In discussions with shareholders about the company's all-in bid

for Anadarko, Ms. Hollub and her team have invoked an acquisition

Occidental made in 2000. The takeover then of Altura Energy gave

Occidental the rights to depleted conventional wells in the Permian

Basin, wells Occidental has since reinvigorated with carbon

injection. The $3.6 billion price for Altura meant that Occidental

essentially would acquire for nothing the takeover target's shale

reserves, which frackers would later figure out how to tap.

Similar to that deal, Occidental believes that in an acquisition

of Anadarko, it would acquire not just that company's known oil

reserves in the Permian Basin but potentially much more. On a

Monday call with investors, Ms. Hollub described a deal for

Anadarko as "transformational."

Write to Christopher M. Matthews at

christopher.matthews@wsj.com, Bradley Olson at

Bradley.Olson@wsj.com and Cara Lombardo at

cara.lombardo@wsj.com

(END) Dow Jones Newswires

May 08, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

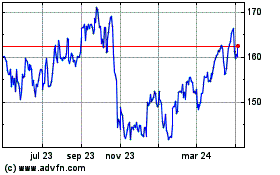

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

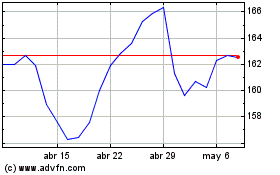

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024