UniCredit 1Q Net Profit Beat Expectations -- Earnings Review

09 Mayo 2019 - 3:29AM

Noticias Dow Jones

By Pietro Lombardi

UniCredit SpA (UCG.MI) reported first-quarter results on

Thursday. Here's what you need to know:

NET PROFIT: Net profit for the period rose 25% to 1.39 billion

euros ($1.56 billion). This compares with analysts' expectations of

EUR1.29 billion, according to a consensus forecast provided by the

bank.

REVENUE: Revenue decreased 3% to EUR4.95 billion. Analysts had

expected revenue of EUR4.88 billion.

WHAT WE WATCHED:

-REVENUE STREAM: Net interest income rose 0.7% on year. Fees and

commissions declined 5.3% and trading income was down 6.4%.

-CAPITAL: The bank's core tier 1 ratio, a key measure of capital

strength, rose to 12.25% at the end of March from 12.07% in

December.

"Market should be relieved by the progress on capital (a concern

in following Fineco Bank news), and better level of CET1 trough in

2Q (above 12% now vs 11.7% in 4Q), improving asset quality and

commitment to noncore run down (accelerating 2019 disposals)," Citi

said.

-ONE-OFFS: Exceptional items boosted the results. UniCredit

released provisions in the quarter after it reached in April a $1.3

billion settlement with U.S. authorities related to U.S.

government-sanctions programs. The positive net impact of this

release was EUR320 million. It also posted a gain of EUR258 million

from real-estate sale.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

May 09, 2019 04:14 ET (08:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

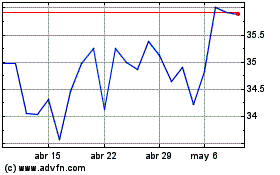

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024