U.S. Dollar Falls On Fed Rate Cut Hopes

13 Mayo 2019 - 2:28AM

RTTF2

The U.S. dollar depreciated against its major counterparts in

the European session on Monday, as hopes for a Fed rate cut

returned back following the U.S. decision to hike tariffs on

Chinese goods last week.

Market participants renewed bets for a quarter-point rate cut by

December, after U.S. President Donald Trump raised tariffs on US

imports from China.

The Fed's short-term rates are currently in a range of 2.25

percent to 2.5 percent.

Speaking in Mississippi, Atlanta Fed President Raphael Bostic

said Friday that he could not rule out whether the new tariffs

could trigger a rate cut.

"Depending on the severity of the response, it could," Bostic

told.

"It really depends. It depends on what businesses decide to do

and then it depends on how long the tariffs are in place."

Today's economic calendar is quiet, with investors awaiting

speeches from FOMC members Rosengren and Clarida in Boston.

Key economic data for the week include retail sales, import and

export prices, manufacturing production and building permits for

April.

The currency traded mixed against its major counterparts in the

Asian session. While it fell against the franc and the yen, it held

steady against the euro and the pound.

The greenback declined to 1.0079 against the Swiss franc, its

lowest since April 17. If the greenback extends fall, 0.99 is

likely seen as its next support level.

Having climbed to 1.1223 against the euro at 3:45 am ET, the

greenback reversed direction with the pair trading at 1.1242. The

greenback is seen finding support around the 1.14 region.

The greenback edged down to 109.59 against the yen, from a high

of 109.84 hit at 5:30 pm ET. The next possible support for the

greenback is seen around the 107.00 level.

Preliminary data from the Cabinet Office showed that Japan's

leading index reached its lowest level since mid-2016.

The leading index, which measures the future economic activity,

declined to 96.3 in March from 97.1 in February. The score matched

economists' expectations.

The greenback reversed from an early high of 1.2998 against the

pound, falling to 1.3028. The currency is poised to target support

around the 1.32 mark.

The greenback slightly eased to 0.6986 against the aussie and

0.6592 against the kiwi, from its early 4-day highs of 0.6968 and

0.6573,respectively. On the downside, 0.715 and 0.68 are likely

seen as the next support levels for the greenback against the

aussie and the kiwi, respectively.

The greenback pulled back to 1.3421 against the loonie, off its

early high of 1.3445. The greenback is likely to test support

around the 1.32 region.

In today's events, Federal Reserve Governor Richard Clarida will

deliver a speech at an event hosted by the Federal Reserve Bank of

Boston at 9:05 am ET.

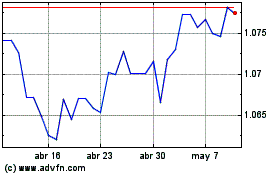

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024