Additional Proxy Soliciting Materials (definitive) (defa14a)

13 Mayo 2019 - 10:37AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant

☒

Filed by a Party other than the Registrant

☐

Check the appropriate box:

|

|

|

|

|

☐

Preliminary Proxy Statement

|

|

☐

Confidential, for Use of the Commission Only(as permitted by Rule 14a-6(e)(2))

|

|

☐

Definitive Proxy Statement

|

|

|

|

|

☒

Definitive Additional Materials

|

|

|

|

|

|

|

☐

Soliciting Material Pursuant to §240.14a-12

|

|

|

E

XXON

M

OBIL

C

ORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

ExxonMobil on Climate Change

and Shareholder Engagement

|

|

|

|

|

|

|

|

P

E

R

S

P

E

C

T

I

V

E

S

B

L

O

G

|

|

|

By Neil Hansen

– May 13, 2019

As we approach ExxonMobil’s annual shareholders meeting later this month, I wanted to highlight two important issues to the company –

climate change and shareholder engagement.

We feel this is important because two funds representing retirees and other ExxonMobil investors,

the Church of England and New York State Common Retirement Fund, are currently misrepresenting our position on these important matters in an effort to influence voting at our annual shareholders meeting later this month.

Managing Climate Change Risks

ExxonMobil is committed to doing its part to address the dual challenge of meeting the world’s growing demand for energy while reducing the

risks of climate change.

1

In February, ExxonMobil released the latest edition of our

Energy

&

Carbon Summary

, which details how the company manages the risks of climate change.

The report analyzes potential impacts to the

company’s business through 2040, considering the average of potential 2°C scenarios which project global energy-related CO

2

emissions in line with the goals of the

Paris Agreement, which we support.

It highlights some of the business-wide emissions reduction measures we’re undertaking, including a

15 percent reduction in methane emissions and a 25 percent reduction in flaring by 2020, each when compared with 2016.

Since 2000,

ExxonMobil has spent more than $9 billion to develop and deploy lower-emission energy technology such as cogeneration, algae biofuels, and carbon capture and storage. The

Energy & Carbon Summary

highlights the solutions that

ExxonMobil is providing customers to help them reduce their emissions and improve energy efficiency.

2

The report also details elements of our climate-related public policy work. This includes our

leadership in calling for regulation of new and existing sources of methane emissions from oil and gas operations (in addition to being a signatory to the Methane Guiding Principles), participation in the Oil and Gas Climate Initiative, our Founding

Membership of the Climate Leadership Council, and financial support for Americans for Carbon Dividends, a carbon tax advocacy organization.

Shareholder Engagement

Not all

owners agree on how best to manage the myriad risks a company faces, including the risks of climate change. This is why ongoing and robust shareholder engagement is so critical to the effective governance of the company. It enables the Board and

senior management to hear multiple perspectives, including conflicting points of view, and to incorporate those views as appropriate.

In 2018,

we held more than 80 engagements on Environmental, Social, and Governance issues with investors, pension funds, and other organizations, including multiple engagements with the Church of England and New York State Common Retirement Fund.

We believe our extensive engagement is evidence of our commitment to good corporate governance and the importance we place on receiving insights

from all segments of our diverse and varied shareholder base.

3

While shareholders do not need to file shareholder proposals to engage directly with the company,

when they do, ExxonMobil considers all resolutions thoroughly and in accordance with the rules established by the Securities and Exchange Commission (SEC).

During this year’s proxy season, we received 14 shareholder proposals, including the proposal jointly submitted by the New York State Common

Retirement Fund and the Church of England. While some proposals asserted that ExxonMobil needed to do more to respond to the risks of climate change, others opposed additional action on the issue.

We engaged directly with all proponents or their representatives to best understand their concerns, which were carefully considered by

ExxonMobil’s Board and management.

In several instances, we opposed including a proposal in our proxy statement because what was being

asked of the company had been already substantially implemented or because the proposal sought to micromanage the company, two reasons the SEC considers under its rules.

4

After considering positions by the company and proposal advocates, the SEC supported the

company’s views that five of the submitted proposals – including one by the New York State Common Retirement Fund and the Church of England – met the SEC’s standards for omission from our proxy statement. I should note that some

of the excluded proposals also included those that opposed additional action on climate change.

Unfortunately, the Church of England and New

York State Common Retirement Fund are now arguing that ExxonMobil, by successfully requesting SEC confirmation that their resolution could be omitted, is failing to engage with shareholders and is not taking climate change seriously.

We disagree.

Over the past year, we

engaged in detailed discussions with the Church of England and New York State Common Retirement Fund on three separate occasions, including an

in-person

meeting just a few months ago. While their perspectives

were carefully and respectfully considered, the Board viewed matters differently, and followed the SEC’s established process.

We respect

their right to disagree but believe their campaign urging other shareholders to vote against the Board and to change the company’s governance structure by separating the roles of chairman and CEO is unwarranted.

5

ExxonMobil’s annual shareholders meeting, on May 29, gives shareholders the opportunity

to have their voices heard on many topics that are important to our company. We encourage our shareholders to carefully consider the issues using the information in our proxy statement,

Energy

& Carbon Summary

, and our

website, and vote in accordance with the Board’s recommendations.

6

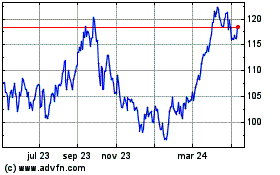

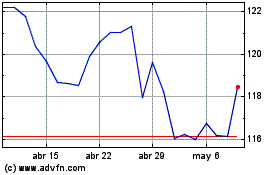

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024