TIDMBHP

RNS Number : 9356Y

BHP Group PLC

14 May 2019

Issued by: BHP Group Plc

Date: 14 May 2019

To: London Stock Exchange

JSE Limited

For Release: Immediately

Contact: Helen Ratsey +44 (0) 20 7802 7540

------------------- --------------------------------------------------

BHP - 2019 Global Metals, Mining and Steel Conference Presentation

-----------------------------------------------------------------------

UK Listing Authority Submissions

The following document has today been submitted to the National

Storage Mechanism and will shortly be available for inspection at

www.hemscott.com/nsm.do:

-- 2019 Global Metals, Mining and Steel Conference Presentation.

The document may also be accessed via BHP's website -

bhp.com

NEWS RELEASE

Release Time IMMEDIATE

Date 14 May 2019

Release Number 11/19

BHP CEO speaks at Bank of America Merrill Lynch Global Metals,

Mining and Steel Conference

BHP Chief Executive Officer, Andrew Mackenzie, today said BHP's

focus remains clear: to maximise cash flow, maintain capital

discipline and increase value and returns.

Speaking at the Bank of America Merrill Lynch Global Metals,

Mining and Steel Conference in Barcelona, Mr Mackenzie, said BHP's

strategy provides the framework to make the most of our portfolio

while developing options to secure future success.

Since the beginning of 2016, BHP has strengthened its balance

sheet through a US$16 billion reduction in net debt, reinvested

US$20 billion in the business and returned more than US$25 billion

to shareholders.

"We have increased volumes, reduced costs, and kept our people

safer at work. These actions lifted return on capital by around 50

per cent," Mr Mackenzie said. "These are strong outcomes. There is

still substantial opportunity to maximise the value of existing

assets to release latent capacity and improve performance.

"We have shaped our portfolio around commodities with attractive

fundamentals and we hold exploration licences and development

options in the world's premier copper, oil and potash basins.

"Developments such as climate change and dramatic shifts in

technology present both challenges and opportunities. To make sure

that we secure the future prosperity of our Company, we constantly

test our current assets and future options against many divergent

scenarios for how the world will look well into the future.

Decarbonisation, the electrification of transport, the future of

work and food security are examples of strategic themes that we

monitor.

"For example, Nickel West, which we will now retain in the

portfolio, offers high-return potential as a future growth option,

linked to the expected growth in battery markets and the relative

scarcity of quality nickel sulphide supply.

"While nobody can predict what will happen with absolute

precision, I am confident BHP's portfolio can thrive under almost

all plausible outcomes in this changing world."

Mr Mackenzie said BHP was well placed in the short, medium and

longer term with strict financial discipline and a transparent and

consistent approach to capital allocation.

"Our institutionalised capital allocation framework

transparently directs cash to its best use, be that development

opportunities, the balance sheet, or returns to shareholders. We

have a resilient portfolio, a transformation agenda and a suite of

options and ideas to create future value at the right time. We have

demonstrated this is the right formula for our shareholders.

"Regardless of how the world evolves, BHP is set up for a strong

future."

An audio-webcast of the presentation will be made available at:

https://edge.media-server.com/m6/p/d2ky883h

A summary of guidance and project details contained in the

presentation is included below.

Guidance

Asset FY19e Medium term

Production Unit costs(1) Production Unit costs(1)

====================== ============= =============== ================== =============

Western Australia 265-270 Mt <US$15/t 290 Mt <US$13/t

Iron Ore (100% basis) (100% basis)

---------------------- ------------- --------------- ------------------ -------------

Conventional Petroleum 113-118 MMboe <US$11/boe 110 MMboe average <US$13/boe

---------------------- ------------- --------------- ------------------ -------------

Queensland Coal 43-46 Mt US$68-72/t 49-54 Mt US$57-64/t

---------------------- ------------- --------------- ------------------ -------------

Escondida 1.12-1.18 Mt <US$1.15/lb 1.20 Mt average <US$1.15/lb

---------------------- ------------- --------------- ------------------ -------------

Future options

Options Potential execution timing Capex Tollgate IRR(2) Risk(3) Description

(US$m) (%) (1-5)

================== ========================== ========== =================== ====== ========= ==================

Ruby <1 year >250 Feasibility >15 ---- Tie back into

Petroleum existing

processing

facilities in

Trinidad & Tobago

------------------ -------------------------- ---------- ------------------- ------ --------- ------------------

Mad Dog northwest <5 years >250 Pre-feasibility * Non- Incremental

water injection operated production of

Petroleum existing A-Spar

production wells

in Mad Dog field

------------------ -------------------------- ---------- ------------------- ------ --------- ------------------

Scarborough <5 years <2,000 Pre-feasibility * Non- Tie back

Petroleum operated development to

existing LNG

facility

------------------ -------------------------- ---------- ------------------- ------ --------- ------------------

Olympic Dam BFX(4) <5 years Up to Pre-feasibility 12-25 ---- Development into

Copper 2,500 the Southern Mine

Area,

debottlenecking of

existing surface

infrastructure

to increase

production to

240--300 ktpa

------------------ -------------------------- ---------- ------------------- ------ --------- ------------------

Resolution >5 years <3,000 Concept 15 Non- Underground block

Copper operated cave with

attractive grade

profile and

competitive cost

curve position

------------------ -------------------------- ---------- ------------------- ------ --------- ------------------

Jansen Stage 1(5) <5 years 5,300 - Feasibility 14-15 ------ Tier 1 resource

Potash 5,700 with potential

initial capacity

of 4.3--4.5 Mtpa,

with valuable

expansion

optionality

------------------ -------------------------- ---------- ------------------- ------ --------- ------------------

Jansen Stage >15 years 4,000 Opportunity 20 ---- Sequenced

2-4(5) per stage assessment brownfield

Potash expansions of up

to 12 Mtpa (4 Mtpa

per stage)

================== ========================== ========== =================== ====== ========= ==================

Aggregate 17 Aggregate unrisked

value(2) of US$14

billion spanning

commodities and

time periods

================== ========================== ========== =================== ====== ========= ==================

Note: * Mad Dog northwest water injection and Scarborough IRRs

under review with joint venture partners.

Exploration

Options Location Ownership Maturity Earliest first Description

production

===================== ======================= ========= =========== ====================== ======================

Trion Mexico - Gulf of Mexico 60% Appraisal Mid 2020s Large oil discovery in

Petroleum Operator the Mexican deepwater

Gulf of Mexico

--------------------- ----------------------- --------- ----------- ---------------------- ----------------------

Wildling US - Gulf of Mexico 80+% Appraisal Mid 2020s Large oil resource

Petroleum Operator across multiple

horizons near operated

infrastructure in US

Gulf of Mexico

--------------------- ----------------------- --------- ----------- ---------------------- ----------------------

Samurai US - Gulf of Mexico 50% Appraisal Early 2020s Oil discovery in the

Petroleum Wildling mini basin

--------------------- ----------------------- --------- ----------- ---------------------- ----------------------

Northern Gas Trinidad and Tobago 70% Exploration Mid 2020s Potential material gas

Petroleum Operator play in Deepwater

Trinidad, well

positioned to the

Atlantic LNG plant

onshore T&T

--------------------- ----------------------- --------- ----------- ---------------------- ----------------------

Magellan Southern Gas Trinidad and Tobago 65% Exploration Mid 2020s Potential material gas

Petroleum Operator play in Deepwater

Trinidad, well

positioned to the

Atlantic LNG plant

onshore T&T

--------------------- ----------------------- --------- ----------- ---------------------- ----------------------

Western GOM US - Gulf of Mexico 100% Frontier Early 2030s Acquired a significant

Petroleum Operator acreage position in

Western Gulf of Mexico

--------------------- ----------------------- --------- ----------- ---------------------- ----------------------

Trinidad Oil Trinidad and Tobago 65-70% Frontier Late 2020s Potential oil play in

Petroleum Operator deepwater Trinidad

--------------------- ----------------------- --------- ----------- ---------------------- ----------------------

Orphan Basin Canada 100% Frontier Early 2030s Recent bid success for

Petroleum Operator blocks with large oil

resource potential in

the offshore Orphan

Basin

in Eastern Canada

===================== ======================= ========= =========== ====================== ======================

Multi-billion barrel equivalent risked potential; unrisked NPV of up to US$15 billion(6)

======================================================================================================================

1. Based on an exchange rate of AUD/USD 0.75 and USD/CLP 663.

Unit costs are in nominal terms.

2. Calculated at 2019 analyst consensus price forecasts (except

Potash which are at CRU and Integer price forecasts); ungeared,

post-tax, nominal rates.

3. Risk profile is based on a BHP assessment of each project

against defined quantified and non-quantified risk metrics rated

out of 5; 5 represents more risk.

4. IRR of 12% to 25% represents different development options of

varying levels of certainty. The upper end of range relates to

investment in a potential lower capital and production development

towards BFX.

5. Based on CRU and Integer (Argus Media) price assumptions

(2025-2035 average mid-case: CRU US$325/t and Integer (Argus Media)

US$342/t). Jansen Stage 1 IRR of 14-15% reflects capex range and

excludes remaining funded investment of

US$0.3 billion for completion of the shafts and installation of

essential service infrastructure and utilities. Jansen Stages 2-4

capex is presented in real terms (July 2019) - those options would

be brownfield and predominately require surface infrastructure,

with shorter construction schedules and less risk than Stage 1. The

execution of future stages would be subject to our review of supply

and demand fundamentals and successful competition for capital

under our Capital Allocation Framework. However, we expect that

each subsequent expansion would be approved for development after

the previous expansion had reached 3 to 4 years of full production.

The existing shafts are capable of supporting production for

Stages 2-4.

6. Petroleum exploration and appraisal NPV: Unrisked values at

BHP long-term price forecasts.

Further information on BHP can be found at: bhp.com

Media Relations Investor Relations

Email: media.relations@bhp.com Email: investor.relations@bhp.com

Australia and Asia Australia and Asia

Gabrielle Notley Tara Dines

Tel: +61 3 9609 3830 Mobile: Tel: +61 3 9609 2222 Mobile:

+61 411 071 715 +61 499 249 005

United Kingdom and South Africa United Kingdom and South Africa

Neil Burrows Elisa Morniroli

Tel: +44 20 7802 7484 Mobile: Tel: +44 20 7802 7611 Mobile:

+44 7786 661 683 +44 7825 926 646

North America Americas

Judy Dane James Wear

Tel: +1 713 961 8283 Mobile: Tel: +1 713 993 3737 Mobile:

+1 713 299 5342 +1 347 882 3011

BHP Group Limited ABN 49 004 BHP Group Plc Registration

028 077 number 3196209

LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768

Registered in Australia Registered in England and Wales

Registered Office: Level 18, Registered Office: Nova South,

171 Collins Street 160 Victoria Street

Melbourne Victoria 3000 Australia London SW1E 5LB United Kingdom

Tel +61 1300 55 4757 Fax +61 Tel +44 20 7802 4000 Fax +44

3 9609 3015 20 7802 4111

Members of the BHP Group which is

headquartered in Australia

Follow us on social media

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCAIMFTMBBBMBL

(END) Dow Jones Newswires

May 14, 2019 02:14 ET (06:14 GMT)

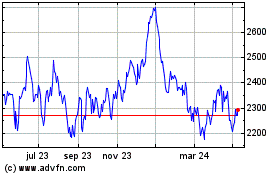

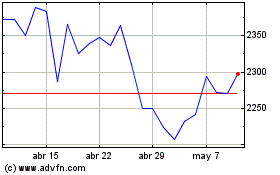

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024