Big Banks Fined by EU for Foreign-Exchange Market Misconduct

16 Mayo 2019 - 7:07AM

Noticias Dow Jones

By Patricia Kowsmann in Frankfurt and Margot Patrick in London

European Union authorities on Thursday fined five global banks a

total of EUR1.07 billion ($1.2 billion) for manipulating the

foreign-currency market by exchanging sensitive information and

trading plans through online chat rooms to gain financially.

Citigroup Inc., JPMorgan Chase & Co., Barclays PLC, Royal

Bank of Scotland Group PLC and Japan's MUFG Bank Ltd. are paying

between EUR69.7 million ($78.1 million) and EUR310.7 million under

settlements with the European Commission. UBS Group AG, which in

2013 revealed the existence of two cartels formed by the banks, has

received full immunity and avoided EUR285 million in fines, the

commission said.

Citigroup, which is paying the top fine of EUR310.7 million, and

Barclays declined to comment. An RBS spokesman said the fine is a

reminder of how badly the bank "lost its way" in the past.

A JP Morgan spokesman said one former employee was involved in

the case, adding "we have since made significant control

improvements." A spokeswoman for MUFG said it had taken "a number

of measures to prevent this occurring again."

The manipulation involved 11 currencies, including the euro,

U.S. dollar and British pound, and took place between 2007 and

2013. It involved foreign exchange spot order transactions, which

are executed on the same day at the prevailing exchange rate. The

commission said individual traders at the five banks exchanged

information in a way that allowed them to coordinate whether and

when to sell and buy the currencies for their advantage.

Most of the traders knew each other outside work, the commission

said, including by commuting by train into London. The chat rooms,

with colorful names such as "Three Way Banana Split" and "Semi

Grumpy Old Men, " were kept open on the traders' screens all day,

and they would post regular updates on their trading activities,

the commission said.

The European Commission is one of the last global authorities to

impose a large fine over behavior in foreign exchange trading

markets that first came to light in 2013 and takes the total tab

paid by banks over $11 billion. The commission opened an

investigation that year but its findings come years after banks

settled similar allegations in the U.S. and U.K. The commission

said it hasn't completed its work, though.

"The commission will continue pursuing other ongoing procedures

concerning past conduct in the Forex spot trading market," it said.

HSBC Holdings PLC earlier this year said it also had been asked by

the European Commission for information around potential

coordination in foreign-exchange options trading.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com and

Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

May 16, 2019 07:52 ET (11:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

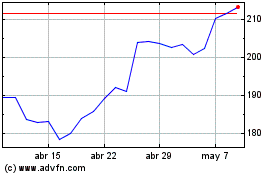

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

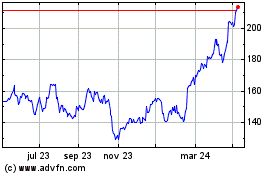

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024