TIDMPRIM

RNS Number : 2996Z

Primorus Investments PLC

16 May 2019

Primorus Investments plc

("Primorus" or the "Company")

Final results for year ended 31 December 2018

CHAIRMAN'S STATEMENT

I am pleased to present the Chairman's Statement and Strategic

report for the year ended 31 December 2018.

Overview

Primorus Investments plc ("Primorus") has a strong balance sheet

with total assets (including cash of GBP408,000) as at 31 December

2018 amounting to GBP5.276 million (2017: GBP5.047 million), and

net assets of GBP5.158 million (2017: GBP4.950 million)

It has been a successful year for the Company with the addition

of several new investments as detailed below. 2018 was dominated by

portfolio acquisition, consolidation and rationalisation through

the participation in further funding rounds; acquisition of an

initial stake in Greatland Gold PLC ("Greatland"); funding of loan

notes in Zuuse Pty Ltd ("Zuuse"); the sale of our 10% stake in

Horse Hill Developments Limited ("HHDL") and the strong growth seen

at Engage Technology Partners Limited ("Engage") and Fresho.

Highlights for the period were as follows:

-- Disposal of our 10% stake HHDL stake for net gain of approximately GBP1.1m

-- Investment in Greatland of approximately GBP630,000 to date

-- A further investment during 2018 in Engage of GBP1,000,000

-- Funding of loan notes in Zuuse during 2018 of approximately GBP275,000

Significant progress has also been made elsewhere in our

portfolio and we look forward to providing updates as key news

develops at TruSpine, Sport80, Fresho, Zuuse, WeShop, Nomad Energy,

SOA, and StreamTV.

We regularly meet the CEOs and management of companies which are

seeking funds to further their businesses. It is notable the

comments we receive on the perceived difficulty in securing funding

outside the VC/VCT and private equity universe. Several companies

pointed out to us that there is simply a dearth of investors able

to participate directly in pre-IPO and private funding rounds and

that VC/VCT funding terms are onerous to the point of being

unattractive.

It is important for shareholders to understand that whilst we do

everything possible to support our existing investments because it

is in our interest to do so, we do not have a direct effect on the

exact timing of any given IPO and or trade sale. We do however

maintain regular dialogue with the companies in question and use

the Board's extensive experience in public markets to make a value

judgement on when and if a transaction may occur.

Summary

As the Chairman of Primorus I would like to begin by thanking

shareholders for their continued support. We have achieved a lot in

the year including the first of our significant exits, the

construction of a better-balanced and growing portfolio of listed

and private investments. We have also gone through the year without

any need to raise further capital and therefore have issued no new

shares. All of this in the face of several difficult macro-economic

events and unprecedented political uncertainty in the UK. That

being said, and despite significant efforts, I believe none of this

has not been reflected in the price of our shares at the time of

writing.

The Board and I are well aware of the challenges that face

investment companies in terms of gaining recognition for the value

of their portfolios. Discounts to net asset values are the norm for

UK listed investment companies, however it is my firm belief that

the discount to value equation for Primorus is unduly wide. I can

reassure shareholders that through a combination of improving

market awareness and concluding successful exits we will endeavour

to make significant progress towards our goal of growing the

balance sheet to GBP25m in the short to medium term.

What we have achieved in the past year however should not be

understated as it puts us in a much stronger position going

forward.

As reflected in the accounts accompanying this report, we

managed to achieve a net gain of approximately GBP1.1m on disposal

of our 10% interest in HHDL. This involved several structured deals

involving cash and shares in other listed entities that we in turn

sold to realise the return. Not only was this complex and

multi-stage but the share sales were with hindsight well timed and

priced.

As well as being an excellent return on overall investment, the

HHDL exit should help demonstrate the ability of the company to

realise tangible cash returns on its private investment portfolio.

So whilst many of our investments are geared towards an

IPO/Post-IPO exit mechanism, as demonstrated by HHDL, there are

other ways to realise value from our portfolio.

It is my firm belief that if we can demonstrate a few more

successful exits in the coming year then, gains aside, there is a

strong case for the overall discount to net asset value of the

company to improve and thus by definition the shareprice. This is

what we are working towards.

Where we are materially different compared to previous years is

that we now have a significant weighting in publicly listed stock

and some interest-bearing corporate debt.

We own 37 million shares in Greatland Gold PLC ("Greatland")

which has recently announced it is soon to kick off exploration

across their projects and this includes the much-anticipated

Havieron which now forms part of a Farm-in Agreement with Newcrest

Mining (NCZ.AX) ('Newcrest"). We believe Greatland to be an

opportunity of the highest order and the flow-through effect of

success and newsflow has the potential to be a catalyst for our

share price.

We also now hold in Zuuse A$500,000 in loan notes due December

2019 at an attractive rolled up coupon of 12% as well as some

options. Zuuse is an international construction payments and

lifecycle software vendor with significant operations in the UK,

United States and Australia.

Elsewhere as reported recently in our Q1 2019 Report to

shareholders our oil and gas portfolio has begun to clear some key

hurdles and with respect to SOA Energy we expect there to be news

of a drilling campaign on the Ofek Licence in Israel soon.

In our core pre-IPO investment portfolio most of our investee

companies continue to make significant progress despite a difficult

funding environment for unlisted companies. Our largest overall

investment, Engage, has begun sales of its pure SaaS, fully-self

serve product range and whilst early days, the spike in sales and

billable transactions is very impressive. Fresho has grown its

platform substantially and is busy expanding into new markets. They

have attracted significant funding and are well financed to execute

their business plan over the next 12 months. We have been made an

offer to sell our stock but we declined for now.

Other companies such as WeShop, TruSpine and Sport:80 have made

excellent progress however there is no doubt the timing to exits

have been affected by weak UK equity markets for IPOs and scarce

funding for smaller private companies.

We are committed to building up distributable returns such that

when appropriate we can either buy our own shares back in the

market or pay dividends to shareholders.

So reflecting on the last year and looking forward I am

confident that the overall balance of our investments should

enhance the potential for profitable returns and with no debt and

no foreseeable need to raise capital, we are in a good position to

maximise any potential uplifts and exits in our portfolio for

existing shareholders.

Financial Results

The operating loss for the year was GBP4,000 (2017: GBP703,000

loss). The net loss after tax was GBP4,000 (2017: GBP947,000 loss).

The decrease in the net loss is mainly due to net gains on AFS

investments of GBP913,000 (2017: GBP41,000).

Total assets including cash at 31 December 2018 amounted to

GBP5.276 million (2017: GBP5.047 million).

Outlook

The Board remains confident that the private and pre-IPO markets

remain significantly under-served and as such significant

opportunities exist for the Company going forward. We look forward

to 2019 being one in which we can further demonstrate our business

model by exiting some more of our investment positions, thereby

realising tangible value for all shareholders.

We will continue to seek out further investments in line with

the Company's investing strategy.

The directors would like to take this opportunity to thank our

shareholders, staff and consultants for their continued

support.

Jeremy Taylor-Firth

Chairman

16 May 2019

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3621 4120

Turner Pope Investments

Andy Thacker

FINANCIAL STATEMENTS

STATEMENT OF COMPREHENSIVE INCOME

YEARED 31 DECEMBER 2018

2018 2017

Notes GBP000 GBP000

Revenue

Investment income 2 7 -

Realised gain on disposal of AFS investments 2 985 12

Unrealised gain on market value movement

of AFS investments 2 (79) 29

--------- ---------

Total gains on AFS investments 913 41

--------- ---------

Impairment provision on AFS investments 8 (100) -

Share based payments (212) (311)

Administrative costs (605) (433)

--------- ---------

Operating (loss) 3 (4) (703)

--------- ---------

Share of (loss) of associate 7 - (45)

Net (loss) on disposal of associate 7 - (199)

--------- ---------

(Loss) before tax (4) (947)

Taxation 5 - -

--------- ---------

(Loss) for the year attributable to equity

holders of the company (4) (947)

--------- ---------

(Loss) per Share

Basic and diluted (loss) per share (pence) 6 (0.0001) (0.0543)

--------- ---------

There are no other recognised gains or losses for the year.

The Accounting Policies and Notes form an integral part of these

Financial Statements.

STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2018

2018 2018 2017 2017

ASSETS Notes GBP000 GBP000 GBP000 GBP000

Non-Current Assets

Investment in Associate 7 - -

Available for Sale Investments 8 4,779 3,761

--------- ---------

4,779 3,761

Current Assets

Trade and other receivables 9 89 725

Cash and cash equivalents 10 408 561

--------- ---------

497 1,286

Total Assets 5,276 5,047

------- -------

LIABILITIES

Current Liabilities

Trade and other payables 11 (118) (97)

Total Liabilities (118) (97)

------- -------

Net Assets 5,158 4,950

======= =======

EQUITY

Equity Attributable to Equity

Holders

of the Company

Share capital 13 15,391 15,391

Share premium account 35,296 35,296

Share based payment reserve 683 471

Retained earnings (46,212) (46,208)

--------- ---------

Total Equity 5,158 4,950

======= =======

These Financial Statements were approved by the Board of

Directors and authorised for issue on 16 May 2019.

The Accounting Policies and Notes form an integral part of these

Financial Statements.

STATEMENT OF CHANGES IN EQUITY

AT 31 DECEMBER 2018

Share Share Share Retained Total

capital premium based earnings attributable

payment to owners

reserve of the

Company

GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 31 December 2016 15,223 32,205 160 (45,261) 2,327

========= ========= ========= ========== ==============

Loss for the year - - - (947) (947)

Total comprehensive income

for the year - - - (947) (947)

Shares issued 168 3,219 - - 3,387

Share Issue costs - (128) - - (128)

Share options issued - - 311 - 311

Transactions with owners

of the company 168 3,091 311 - 3,570

Balance at 31 December 2017 15,391 35,296 471 (46,208) 4,950

--------- --------- --------- ---------- --------------

Loss for the year - - - (4) (4)

Total comprehensive income

for the year - - - (4) (4)

Share options issued - - 212 - 212

Transactions with owners

of the company - - 212 - 212

Balance at 31 December 2018 15,391 35,296 683 (46,212) 5,158

========= ========= ========= ========== ==============

STATEMENT OF CASH FLOWS

YEARED 31 DECEMBER 2018

2018 2018 2017 2017

GBP000 GBP000 GBP000 GBP000

Cash Flows from Operating Activities

Operating Loss (4) (703)

Adjustments for:

Share based payment charge 212 311

Impairment provision 100 -

Change in trade and other receivables (47) (26)

Change in trade and other payables 21 59

Change in AFS Investments (175) (2,530)

Taxation (paid) - -

107 (2,186)

------- --------

Net Cash used in Operating Activities 107 (2,889)

Cash Flows from Investing Activities

Loan advanced to associate - (5)

Loan advanced to related party (260) (25)

Net Cash used in Investing Activities (260) (30)

Cash Flows from Financing Activities

Proceeds from share issues - 3,387

Share issue costs - (128)

------- --------

Net Cash in generated from Financing

Activities - 3,259

------- --------

Net Change in Cash and Cash Equivalents (153) 340

Cash and Cash Equivalents at beginning

of period 561 221

------- --------

Cash and Cash Equivalents at end

of period 408 561

======= ========

NOTES TO THE FINANCIAL STATEMENTS

YEARED 31 DECEMBER 2018

1. Accounting Policies

Basis of Preparation

Primorus Investments Plc is a company incorporated in the United

Kingdom. The Company's shares are listed on the AIM market of the

London Stock Exchange, and on the NEX Exchange Growth Market as

operated by NEX Exchange Limited ("NEX").

The Financial Statements are for the year ended 31 December 2018

and have been prepared under the historical cost convention and in

accordance with International Financial Reporting Standards as

adopted by the EU ("adopted IFRS"). These Financial Statements (the

"Financial Statements") have been prepared and approved by the

Directors on 16 May 2019 and signed on their behalf by Donald

Strang and Alastair Clayton.

The accounting policies have been applied consistently

throughout the preparation of these Financial Statements, and the

financial report is presented in Pound Sterling (GBP) and all

values are rounded to the nearest thousand pounds (GBP'000) unless

otherwise stated.

Investing Policy

The Company's investing policy is to acquire a diverse portfolio

of direct and indirect interests in exploration and producing

projects and assets in the natural resources sector in addition to

acquisition(s) in the leisure, corporate services, consultancy and

brand licensing sectors. The Company will consider possible

opportunities anywhere in the world.

The Directors have considerable experience investing, both in

structuring and executing deals and in raising funds. The Directors

will use this experience to identify and investigate investment

opportunities, and to negotiate acquisitions. Wherever necessary

the Company will engage suitably qualified technical personnel to

carry out specialist due diligence prior to making an acquisition

or an investment.

The Company may invest by way of outright acquisition or by the

acquisition of assets, including the intellectual property, of a

relevant business, or by entering into partnerships or joint

venture arrangements. Such investments may result in the Company

acquiring the whole or part of a company or project (which in the

case of an investment in a company may be private or listed on a

stock exchange, and which may be pre-revenue), and such investments

may constitute a minority stake in the company or project in

question.

The Company may be both an active and a passive investor

depending on the nature of the individual investments in its

portfolio. Although the Company intends to be a long-term investor,

the Directors will place no minimum or maximum limit on the length

of time that any investment may be held.

The Directors may offer new Ordinary Shares by way of

consideration as well as cash, thereby helping to preserve the

Company's cash for working capital and as a reserve against

unforeseen contingencies including by way of example, and without

limitation, delays in collecting accounts receivable, unexpected

changes in the economic environment and unforeseen operational

problems. The Company may in appropriate circumstances issue debt

securities or otherwise borrow money to complete an investment. The

Directors do not intend to acquire any cross-holdings in other

corporate entities that have an interest in the Ordinary

Shares.

There are no restrictions in the type of investment that the

Company might make nor on the type of opportunity that may be

considered other than set out in this Investing policy.

In addition, the Directors may consider from time to time other

means of facilitating returns to Shareholders including dividends,

share repurchases, demergers, and schemes of arrangements or

liquidation.

Going Concern

The Directors noted the losses that the Company has made for the

Year Ended 31 December 2018. The Directors have prepared cash flow

forecasts for the period ending 31 May 2020 which take account of

the current cost and operational structure of the Company.

The cost structure of the Company comprises a high proportion of

discretionary spend and therefore in the event that cash flows

become constrained, costs can be quickly reduced to enable the

Company to operate within its available funding.

These forecasts demonstrate that the Company has sufficient cash

funds available to allow it to continue in business for a period of

at least twelve months from the date of approval of these financial

statements. Accordingly, the financial statements have been

prepared on a going concern basis.

It is the prime responsibility of the Board to ensure the

Company remains a going concern. At 31 December 2018 the Company

had cash and cash equivalents of GBP408,000 and no borrowings. The

Company has minimal contractual expenditure commitments and the

Board considers the present funds sufficient to maintain the

working capital of the Company for a period of at least 12 months

from the date of signing the Annual Report and Financial

Statements. For these reasons the Directors adopt the going concern

basis in the preparation of the Financial Statements.

New standards, amendments and interpretations adopted by the

Company

No new and/or revised Standards and Interpretations have been

required to be adopted, and/or are applicable in the current year

by/to the Company, as standards, amendments and interpretations

which are effective for the financial year beginning on 1 January

2018 are not material to the Company.

New standards, amendments and interpretations not yet

adopted

At the date of authorisation of these financial statements, the

following Standards and Interpretations which have not been applied

in these financial statements, were in issue but not yet effective

for the year presented:

- IFRS 16 in respect of Leases which will be effective for

accounting periods beginning on or after 1 January 2019.

- IFRS 17 Insurance Contracts (effective date 1 January

2021).

There are no other IFRSs or IFRIC interpretations that are not

yet effective that would be expected to have a material impact on

the Company.

Sources of Estimation and Key Judgements

The preparation of the Financial Statements requires the Company

to make estimates, judgements and assumptions that affect the

reported amounts of assets, liabilities, revenues and expenses and

related disclosure of contingent assets and liabilities. The

Directors base their estimates on historic experience and various

other assumptions that they believe are reasonable under the

circumstances, the results of which form the basis of making

judgements about the carrying value of assets and liabilities that

are not readily apparent from other sources. Actual results may

differ from these estimates under different assumptions or

conditions.

Revenue

Revenue is measured by reference to the fair value of

consideration received or receivable by the Company for services

provided, excluding VAT and trade discounts. Revenue is credited to

the Income Statement in the period it is deemed to be earned.

Interest income from financial assets at FVPL is included in the

net fair value gains/(losses) on these assets. Interest income on

financial assets at amortised cost and financial assets at,

available-for-sale securities, held-to-maturity investments and

loans and receivables is calculated using the effective interest

method is recognised in the statement of profit or loss as part of

investment or other income.

Finance Income and Costs

Finance income and costs are reported on an accruals basis.

Taxation

Current tax is the tax currently payable based on taxable profit

for the year.

Deferred income taxes are calculated using the liability method

on temporary differences. Deferred tax is generally provided on the

difference between the carrying amounts of assets and liabilities

and their tax bases. However, deferred tax is not provided on the

initial recognition of goodwill, nor on the initial recognition of

an asset or liability unless the related transaction is a business

combination or affects tax or accounting profit. Deferred tax on

temporary differences associated with shares in subsidiaries and

joint ventures is not provided if reversal of these temporary

differences can be controlled by the Company and it is probable

that reversal will not occur in the foreseeable future. In

addition, tax losses available to be carried forward as well as

other income tax credits to the Company are assessed for

recognition as deferred tax assets.

Deferred tax liabilities are provided in full, with no

discounting. Deferred tax assets are recognised to the extent that

it is probable that the underlying deductible temporary differences

will be able to be offset against future taxable income. Current

and deferred tax assets and liabilities are calculated at tax rates

that are expected to apply to their respective period of

realisation, provided they are enacted or substantively enacted at

the balance sheet date.

Changes in deferred tax assets or liabilities are recognised as

a component of tax expense in the income statement, except where

they relate to items that are charged or credited directly to

equity in which case the related deferred tax is also charged or

credited directly to equity.

Foreign Currencies

Transactions in foreign currencies are translated at the

exchange rate ruling at the date of the transaction. Monetary

assets and liabilities in foreign currencies are translated at the

rates of exchange ruling at the balance sheet date. Non-monetary

items that are measured at historical cost in a foreign currency

are translated at the exchange rate at the date of the transaction.

Non-monetary items that are measured at fair value in a foreign

currency are translated using the exchange rates at the date when

the fair value was determined. Any exchange differences arising on

the settlement of monetary items or on translating monetary items

at rates different from those at which they were initially recorded

are recognised in the profit or loss in the period in which they

arise. Exchange differences on non-monetary items are recognised in

other comprehensive income to the extent that they relate to a gain

or loss on that non-monetary item taken to other comprehensive

income, otherwise such gains and losses are recognised in the

income statement.

The Company's functional currency and presentational currency is

Sterling.

Equity

Equity comprises the following:

-- "Share capital" representing the nominal value of equity shares.

-- "Share premium" representing the excess over nominal value of

the fair value of consideration received for equity shares, net of

expenses of the share issue.

-- "Share based payment reserve" represents the value of equity

benefits provided to employees and directors as part of their

remuneration and provided to consultants and advisors hired by the

Company from time to time as part of the consideration paid.

-- "Retained earnings" representing retained profits.

Financial Assets

Financial assets are divided into the following categories:

loans and receivables and available-for-sale financial assets.

Financial assets are assigned to the different categories by

management on initial recognition, depending on the purpose for

which they were acquired, and are recognised when the Company

becomes party to contractual arrangements. Both loans and

receivables and available for sale financial assets are initially

recorded at fair value.

Loans and receivables are non-derivative financial assets with

fixed or determinable payments that are not quoted in an active

market. Trade, most other receivables and cash and cash equivalents

fall into this category of financial assets. Loans and receivables

are measured subsequent to initial recognition at amortised cost

using the effective interest method, less provision for impairment.

Any change in their value through impairment or reversal of

impairment is recognised in the income statement.

Provision against trade receivables is made when there is

objective evidence that the Company will not be able to collect all

amounts due to it in accordance with the original terms of those

receivables. The amount of the write-down is determined as the

difference between the asset's carrying amount and the present

value of estimated future cash flows.

A financial asset is derecognised only where the contractual

rights to the cash flows from the asset expire or the financial

asset is transferred and that transfer qualifies for derecognition.

A financial asset is transferred if the contractual rights to

receive the cash flows of the asset have been transferred or the

Company retains the contractual rights to receive the cash flows of

the asset but assumes a contractual obligation to pay the cash

flows to one or more recipients. A financial asset that is

transferred qualifies for derecognition if the Company transfers

substantially all the risks and rewards of ownership of the asset,

or if the Company neither retains nor transfers substantially all

the risks and rewards of ownership but does transfer control of

that asset.

Available-for-sale financial assets are non-derivative financial

assets that are either designated to this category or do not

qualify for inclusion in any of the other categories of financial

assets. The Company's available-for-sale financial assets include

listed and unlisted securities. These available-for-sale financial

assets are measured at fair value. Gains and losses are recognised

in the income statment and reported within revenue, except for

impairment losses and foreign exchange differences, which are

recognised separately within the income statement. When the asset

is disposed of or is determined to be impaired, the cumulative gain

or loss is recognised in the income statement.

Financial Liabilities

Financial liabilities are obligations to pay cash or other

financial assets and are recognised when the Company becomes a

party to the contractual provisions of the instrument.

All financial liabilities initially recognised at fair value

less transaction costs and thereafter carried at amortised cost

using the effective interest method, with interest-related charges

recognised as an expense in finance cost in the income statement. A

financial liability is derecognised only when the obligation is

extinguished, that is, when the obligation is discharged or

cancelled or expires.

Cash and Cash Equivalents

Cash and cash equivalents comprise cash on hand and demand

deposits, together with other short-term, highly liquid investments

that are readily convertible into known amounts of cash and which

are subject to an insignificant risk of changes in value.

Share-Based Payments

The Company operates a number of equity-settled, share-based

compensation plans, under which the entity receives services from

employees as consideration for equity instruments (options) of the

Company. The fair value of the employee services received in

exchange for the grant of the options is recognised as an expense.

The total amount to be expensed is determined by reference to the

fair value of the options granted:

-- including any market performance conditions;

-- excluding the impact of any service and non-market

performance vesting conditions (for example, profitability or sales

growth targets, or remaining an employee of the entity over a

specified time period; and

-- including the impact of any non-vesting conditions (for

example, the requirement for employees to save).

Non-market vesting conditions are included in assumptions about

the number of options that are expected to vest. The total expense

is recognised over the vesting period, which is the period over

which all of the specified vesting conditions are to be

satisfied.

In addition, in some circumstances, employees may provide

services in advance of the grant date, and therefore the grant-date

fair value is estimated for the purposes of recognising the expense

during the period between service commencement period and grant

date.

At the end of each reporting period, the entity revises its

estimates of the number of options that are expected to vest based

on the non-market vesting conditions. It recognises the impact of

the revision to original estimates, if any, in profit or loss, with

a corresponding adjustment to equity.

When the options are exercised, the Company issues new shares.

The proceeds received, net of any directly attributable transaction

costs, are credited to share capital (nominal value) and share

premium.

2. Segment Reporting & Revenue

The Company is now operating as a single UK based segment with a

single primary activity to invest in businesses so as to generate a

return for the shareholders. The revenue from this segment,

generated from sale of investments, was GBP985,000 (2017 -

GBP12,000). The non-current assets of the segment is GBP4,779,000

(2017 - GBP3,761,000).

2018 2017

GBP000 GBP000

Revenue

Investment income - interest received on 7 -

loan notes

Realised gain on disposal of AFS investments 985 12

Unrealised gain on market value movement

of AFS investments (79) 29

913 41

------- -------

3. Operating Activities and Auditor's Remuneration

2018 2017

GBP000 GBP000

Included within results from operating activities

are the following:

Operating lease rentals - land and buildings 35 10

Auditor's remuneration:

Audit services:

- Company statutory audit 10 10

Non-audit services:

- Taxation compliance - -

------- -------

4. Information Regarding Directors and Employees

2018 2017

GBP000 GBP000

Employment costs, including Directors, during

the year:

Wages and salaries 336 190

Share based payments - 311

336 501

------- -------

Average number of persons, including Directors No. No.

employed

Administration 4 4

------- -------

4 4

------- -------

Directors' remuneration GBP000 GBP000

Emoluments 320 489

------- -------

The Company operates only the basic pension plan required under

UK legislation, contributions thereto during the year amounted

to GBPnil (2017: GBP15).

Emoluments of the Individual Directors

Fees and Share based

salaries payments Total

(non-cash)

2018 GBP000 GBP000 GBP000

A Clayton 200 106 306

J Taylor Firth 60 106 166

D Strang 60 - 60

320 212 532

--------------- --------- ------------ -------

2017 GBP000 GBP000 GBP000

A Clayton 112 156 268

J Taylor Firth 42 - 42

D Strang 24 155 179

178 311 489

--------------- --------- ------------ -------

Directors' interest in share options is set out in Note 14.

Key Management Personnel

The key management personnel are considered to be the Directors.

Their remuneration is included in Note 4 above.

5. Income Tax (Credit)/Expense

The relationship between the expected tax (credit)/expense based

on the effective tax rate of the Company at 19% (2017 - 19/20%) and

the tax (credit)/expense actually recognised in the income

statement can be reconciled as follows:

2018 2017

GBP000 GBP000

Loss for the year before tax (4) (947)

Tax rate 19% 19/20%

Expected tax credit (1) (182)

Expenses not deductible for tax purposes 41 68

Deferred tax asset not recognised - 114

Set off against tax losses (40) -

Actual tax expense - -

------- -------

Deferred Tax

The amount of approximate unused tax losses for which no

deferred tax asset is recognised in the statement of financial

position is GBP1,759,000 (2017 - GBP1,973,000).

6. Loss per Share

Weighted Basic per

average share amount

No. of shares

2018 GBP000 (pence)

Loss after tax (4)

Earnings attributable to ordinary

shareholders (4)

=======

Weighted average number of shares 2,796,619,344

Total basic and diluted loss

per share (0.0001)

==============

2017 GBP000 (pence)

Loss after tax (947)

Earnings attributable to ordinary

shareholders (947)

=======

Weighted average number of shares 1,743,253,998

Total basic and diluted loss

per share (0.0543)

==============

7. Investment in associate

2018 2017

GBP000 GBP000

Investment in associate - -

--------- --------

2018 2017

GBP'000 GBP'000

Carrying amount at 1 January - 155

Share of associate loss - (45)

Value at disposal of associate - (110)

--------- --------

Carrying amount at 31 December - -

--------- --------

On 1 December 2017, the Company completed the sale of its entire

49% interest in Gold Mines of Wales Limited to Alba Mineral

Resources PLC ("Alba") for a total consideration of 83,333,333

shares in Alba. Alba's closing share price on December 1 2017 was

0.38p, these shares had a market value of approximately GBP316,667

and representED 3.6% of the enlarged issued share capital of Alba

at that date. These shares are subject to a six month orderly

market agreement and were issued immediately upon completion of the

sale.

Disposal of Associate GBP'000

Sale Proceeds 316

Value of loan to associate satisfied on

disposal (405)

Value of associate at disposal (110)

--------

(Loss) on disposal of associate (199)

--------

8. Available for Sale Investments

2018 2017

Investment in listed and unlisted securities GBP000 GBP000

Valuation at beginning of the period 3,761 915

Additions at cost 3,621 3,052

Disposal proceeds (4,332) (247)

Investee loan "sold" included within equity sale 943 -

Gains on disposals 985 12

(Loss) / gain on Market value revaluation (79) 29

Impairment in value of unlisted investment (100) -

Foreign exchange loss (20) -

------------ ---------

Valuation at the end of the period 4,779 3,761

============ =========

The available for sale investments splits are as below:

Non-current assets - listed 902 466

Non-current assets - unlisted 3,872 3,295

4,779 3,761

The Directors have reviewed the carrying value of the unlisted investments, and have considered

an impairment of GBP100,000 against the Company's investment in Farina Investments (UK) Limited

is appropriate on the basis of Farina Investments (UK) Limited's current difficult trading

position. For the year ended 31 December 2017, an impairment of GBPnil against the Company's

investment.

Available-for-sale investments comprise both listed and unlisted investments. The listed investments

are traded on stock markets throughout the world, and are held by the Company as a mix of

strategic and short term investments.

9. Trade and Other Receivables

Current trade and other receivables 2018 2017

GBP000 GBP000

Trade receivables - -

Other receivables 30 24

Due from related party (see Note 16) - 683

Prepayments and accrued income 59 18

89 725

------- -------

The directors consider that the carrying amount of trade and

other receivables approximates to their fair value.

10. Cash at Bank and Cash Equivalents

2018 2017

GBP000 GBP000

Cash at Bank 408 561

------- -------

11. Trade and Other Payables

2018 2017

Current trade other payables GBP000 GBP000

Trade payables 19 44

Taxation and social security 15 13

Accruals and deferred income 84 40

------- -------

118 97

------- -------

All amounts are short term and the carrying values are

considered to be a reasonable approximation of fair value.

12. Risk Management Objectives and Policies

Financial assets by category

The categories of financial asset included in the balance sheet

and the headings in which they are included are as follows:

Current assets 2018 2017

GBP000 GBP000

Loans and receivables 30 725

Cash 408 561

------- -------

438 1,268

------- -------

Financial Liabilities by Category

The categories of financial liability included in the balance

sheet and the headings in which they are included are as

follows:

Current liabilities

Financial liabilities measured at amortised

cost 118 97

---- ---

The Company is exposed to market risk through its use of

financial instruments and specifically to credit risk, and

liquidity risk which result from both its operating and investing

activities. The Company's risk management is coordinated at its

headquarters, in close co-operation with the board of Directors,

and focuses on actively securing the Company's short to medium term

cash flows by minimising the exposure to financial markets. Long

term financial investments are managed to generate lasting returns.

The Company does not actively engage in the trading of financial

assets for speculative purposes nor does it write options. The most

significant financial risks to which the Company is exposed to are

described below.

Interest rate sensitivity

The Company is not substantially exposed to interest rate

sensitivity, other than in relation to interest bearing bank

accounts.

Credit risk analysis

The Company's exposure to credit risk is limited to the carrying

amount of trade receivables. The Company continuously monitors

defaults of customers and other counterparties, identified either

individually or by Company, and incorporates this information into

its credit risk controls. Where available at reasonable cost,

external credit ratings and/or reports on customers and other

counterparties are obtained and used. Company's policy is to deal

only with creditworthy counterparties. Company management considers

that trade receivables that are not impaired for each of the

reporting dates under review are of good credit quality, including

those that are past due.

None of the Company's financial assets are secured by collateral

or other credit enhancements.

The credit risk for liquid funds and other short-term financial

assets is considered negligible, since the counterparties are

reputable banks with high quality external credit ratings.

Liquidity risk analysis

The Company's continued future operations depend on the ability

to raise sufficient working capital through the issue of equity

share capital. The Directors are confident that adequate funding

will be forthcoming with which to finance operations. Controls over

expenditure are carefully managed.

Capital Management Policies

The Company's capital management objectives are:

-- to ensure the Company's ability to continue as a going concern; and

-- to provide a return to shareholders

The Company monitors capital on the basis of the carrying amount

of equity less cash and cash equivalents.

13. Share Capital

2018 2017

GBP000 GBP000

Allotted, issued and fully paid

2,796,619,344 ordinary shares of 0.01p each

(2017 - 2,796,619,344 of 0.01p each) 279 279

28,976,581 deferred shares of 45p each (2017

- 28,976,581) 13,040 13,040

28,976,581 A deferred shares of 4p each (2017-

28,976,581) 1,159 1,159

92,230,985 B deferred shares of 0.99p each

(2017- 92,230,985) 913 913

------- -------

15,391 15,391

------- -------

The deferred shares and the A and B deferred shares do not carry

voting rights.

Ordinary Nominal

Shares Value

Number GBP'000

Ordinary shares of 0.01p each

As at 31 December 2016 1,110,549,167 111

-------------- --------

2 March 2017 - Placing for cash at 0.15p

per share 158,000,000 16

7 July 2017 - Placing for cash at 0.15p

per share 333,333,334 33

2 August 2017 - Placing for cash at 0.15p

per share 694,736,843 69

23 November 2017 - Placing for cash at 0.20p

per share 500,000,000 50

As at 31 December 2017 2,796,619,344 279

-------------- --------

No issue of shares during the period - -

As at 31 December 2018 2,796,619,344 279

-------------- --------

Details of the share options and warrants the Company has in

issue are disclosed in Note 14.

14. Share-based payments

Details of share options and warrants granted to Directors,

employees & consultants, over the ordinary shares are as

follows:

Exercised

or

At Issued expired At Exercise Date from

1 January during during 31 December price which Expiry

2018 the year the year 2018 exercisable date

No. No. No. No. GBP

Share options

D. Strang 10,000,000 - - 10,000,000 0.004 14/11/2013 14/11/2023

D. Strang 12,000,000 - - 12,000,000 0.003 30/11/2015 31/12/2020

A Clayton 12,000,000 - - 12,000,000 0.003 30/11/2015 31/12/2020

J Taylor-Firth 12,000,000 - - 12,000,000 0.003 30/11/2015 31/12/2020

Consultants 10,000,000 - - 10,000,000 0.004 14/11/2013 14/11/2023

D Strang 75,000,000 - 75,000,000 0.003 03/08/2017 03/08/2022

A Clayton 75,000,000 - 75,000,000 0.003 03/08/2017 03/08/2022

A Clayton - 75,000,000 - 75,000,000 0.003 09/01/2018 09/01/2025

J Taylor-Firth - 75,000,000 - 75,000,000 0.003 09/01/2018 09/01/2025

------------ ------------ ---------- -------------

206,000,000 150,000,000 - 356,000,000

------------ ------------ ---------- -------------

Warrants

Various 4,075,000 - 4,075,000 - 0.004 29/10/2013 14/11/2018

------------ ------------ ---------- -------------

4,075,000 - 4,075,000 -

------------ ------------ ---------- -------------

The share price range during the year was GBP0.0020 to

GBP0.00095 (2017 - GBP0.00075 to GBP0.0036).

The weighted average values of options are 2018 2017

as follows:

Weighted average exercise price of options

granted 0.30p 0.30p

Weighted average exercise price of options

exercisable at the

end of the year 0.30p 0.31p

Weighted average option life remaining 4.53 years 4.43 years

For those options granted where IFRS 2 "Share-Based Payment" is

applicable, the fair values were calculated using the Black-Scholes

model. The inputs into the model were as follows:

Risk free Share price Expected Share

rate volatility life price

at date

of grant

9 January 2018 1.10% 102.63% 7.00 years GBP0.0018

Expected volatility was determined by calculating the historical

volatility of the Company's share price for 12 months prior to the

date of grant. The expected life used in the model has been

adjusted, based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations.

The Company recognised total expenses of GBP212,000 (2017:

GBP311,000) relating to equity-settled share-based payment

transactions during the year, and GBPnil was transferred via equity

to retained earnings on the exercise of nil options (2017: nil

options) during the year (2017: GBPnil).

During the year, 4.075m warrants expired (2017: nil).

15. Capital Commitments

The directors have confirmed that there were no contingent

liabilities or capital commitments which should be disclosed at 31

December 2018. No provision has been made in the financial

statements for any amounts in relation to any capital expenditure

requirements of the Company's associate or investments, and such

costs are expected to be fulfilled in the normal course of the

operations of the Company.

16. Related Party Transactions

The Company had the following amounts outstanding from its

investee companies (Note 9) at 31 December:

2018 2017

GBP'000 GBP'000

Horse Hill Development Ltd ("Horse Hill") - 683

---------- ---------

The above loan outstanding was included within trade and other

receivables, Note 9. The loan to Horse Hill has been made in

accordance with the terms of the investment agreement whereby it

accrues interest daily at the Bank of England base rate and is

repayable out of future cashflows.

During the year, the Company sold its full investment in Horse

Hill, and included therin was the novation of the loan to the

purchaser. The Company received GBP150,001 in cash compensation for

the loan balance of GBP943,000 at the date of novation. The

effective loss on the transfer of the loan has been included within

the net calculation of the realised gain on sale of the equity

investment.

Key Management Personnel

The key management personnel are considered to be the Directors.

There remuneration is included in Note 4 to the accounts. There is

no other management compensation to be disclosed.

17. Events after the end of the reporting period

There are no events after the end of the reporting period to

disclose.

18. Ultimate Controlling Party

There is not considered to be an ultimate controlling party of

the company.

19. Posting of Accounts

The Report and Accounts for the year ended 31 December 2018 will

be posted to shareholders and uploaded to the Company's website in

due course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SFFFEMFUSEDI

(END) Dow Jones Newswires

May 16, 2019 08:45 ET (12:45 GMT)

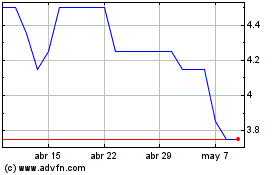

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024