Activist Wants Sony to Spin Off Semiconductors -- WSJ

14 Junio 2019 - 2:02AM

Noticias Dow Jones

By Patrick Thomas

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 14, 2019).

Daniel Loeb's activist hedge fund has Sony Corp. back in its

sights and is pushing the Japanese electronics and entertainment

company to spin off its semiconductor business.

Third Point LLC said in a letter to investors Thursday that

Sony's stock is undervalued and that the company's portfolio needs

to be less complex. Third Point said it has invested $1.5 billion

in building its position in Sony.

The hedge fund said Sony should also consider selling its stakes

in insurer Sony Financial Holdings Inc., health-care services firm

M3 Inc., manufacturer Olympus Corp. and streaming music service

Spotify Technology SA.

"We believe the proceeds of these divested stakes should be

invested in long-term growth or capital return to shareholders,"

Third Point said in its letter.

Mr. Loeb's push marks the second time in six years his $15

billion hedge fund has targeted the company. He tried to rally

shareholder support for a spinoff of the company's movie and music

assets in 2013.

Third Point had about a 7% stake in Sony in 2013, but the

company rejected its proposal and Third Point sold its stake in

2014.

But in a turn from its prior position, Third Point said Sony's

gaming, music and pictures segments would become its core following

a spinoff of its semiconductor unit.

Third Point said in its letter that its semiconductor division,

a business that includes image sensors for smartphones, should be a

stand-alone, Japan-listed company and has the potential to be a $35

billion unit within five years.

"Sony's legacy electronics assets are no longer the drag on

profitability that they were six years ago and will be a meaningful

cash flow contributor to New Sony," the hedge fund said in the

letter. "We first invested in Sony in 2013 because we believed it

was inexpensive due to inadequate investor disclosure, excessive

debt, an overly complex corporate structure, and consistent losses

in its consumer electronics segment."

Third Point praised Sony's Hollywood studio, saying Sony

Pictures remains one of the few independent film studio franchises

not owned by a major telecom or media distribution company, such as

Comcast Corp., AT&T Inc. and Walt Disney Co.

A representative of Sony declined to comment.

Sony said last month it would spend Yen200 billion ($1.85

billion) to buy back its stock during the current fiscal year,

which ends March 31. And while Third Point is pushing for a

breakup, Sony executives said last month they are looking at ways

of creating stronger links within its business, especially content,

intellectual property and direct-to-consumer services.

Sales of Sony's PlayStation consoles, which have been a key

sales driver for more than two decades, have slowed in the past six

months.

The company also said last month it could join with longtime

console system rival Microsoft Corp. on cloud and game-streaming

technology.

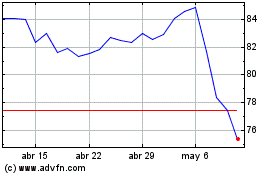

Sony's shares trading in Tokyo are down 3% over the past year,

while its U.S.-traded shares have fallen 0.3% over the past 12

months.

Write to Patrick Thomas at Patrick.Thomas@wsj.com

(END) Dow Jones Newswires

June 14, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Sony (NYSE:SONY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Sony (NYSE:SONY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024