Senators Pressure TD Bank to Pay Victims of Stanford Ponzi Scheme

18 Junio 2019 - 3:01PM

Noticias Dow Jones

By Andrew Scurria

U.S. senators from Louisiana urged Toronto-Dominion Bank to

compensate victims of R. Allen Stanford's Ponzi scheme over the

bank's "knowing assistance" in his $5 billion fraud.

Republican Sens. John Kennedy and Bill Cassidy accused TD Bank

in a Friday letter of abandoning small investors who lost their

nest eggs when Stanford International Bank Ltd., a TD Bank

customer, was exposed as a fraud and collapsed in 2009.

Despite being named in long-running lawsuits in the U.S. and

Canada, TD Bank and other Stanford financial partners haven't

reached settlements with court-appointed liquidators charged with

digging up money for victims. The senators alleged that TD Bank

"aided and abetted" Stanford's banking outside the U.S. and knocked

the institution for expanding its U.S. footprint in the years since

while holding out on settling litigation and paying

restitution.

A TD Bank spokesman declined to comment. Mr. Stanford's U.S.

clients were largely clustered in Texas and Louisiana, though his

far-flung financial empire also stretched to Latin America, the

Dutch Caribbean and Switzerland.

"We demand that TD Bank stop its obstructionist conduct, engage

in a meaningful effort to put an end to this decade-long debacle

and provide restitution to the Stanford victims without further

delay," the senators said in their letter to TD Bank Chief

Executive Greg Braca. "Regulatory intervention should not be

necessary for Stanford's victims to receive the justice they

deserve."

Stanford investors since 2009 have gotten back a fraction of

what they lost and far less than the recoveries for victims of

Bernard Madoff's Ponzi scheme, which collapsed months before Mr.

Stanford's.

While some of the disparity is because of a lack of brokerage

insurance for Stanford victims, the fraud also stands out for

having generated no meaningful settlement from financial

institutions that allegedly turned a blind eye to criminal

activity.

JPMorgan Chase & Co., which provided Mr. Madoff's primary

bank account for moving stolen funds, paid $2.6 billion in a

settlement with federal authorities and acknowledged responsibility

for failing to stop the fraud.

Billions of dollars in investor funds flowed into TD Bank from

Stanford's depositors over the years but weren't invested to

produce the returns that TD Bank knew were being promised,

according to lawyers for Mr. Stanford's victims and hedge funds

holding claims in the receivership.

A complaint they filed last month also targeted HSBC Bank PLC,

Bank of Houston, Trustmark National Bank, and Société Générale

Private Banking, all of which had ties to Mr. Stanford's financial

empire.

In addition to the lawsuit, those investors have lobbied

lawmakers, met with Securities and Exchange Commission Chairman Jay

Clayton and pressed for the return of frozen overseas assets,

according to people familiar with the matter.

Since Mr. Stanford's arrest and the collapse of Stanford

International Bank in 2009, what remains of his far-flung financial

operation has been wound down by lawyers and consultants in Antigua

and Dallas, where court-appointed liquidators have sold assets,

sued alleged beneficiaries of the fraud and distributed proceeds

across roughly 18,000 victims.

The Dallas receiver, Ralph Janvey, has recovered roughly $573

million through last month, according to court records. After

subtracting professional fees and other expenses, Mr. Janvey has

been authorized to distribute $232 million to victims, or roughly

4.5 cents on the dollar.

That number is expected to rise when the receiver hands out the

proceeds from a $63 million settlement with law firm Proskauer Rose

LLP over past work for Stanford. But an appeals court has also tied

up other settlement money recently that was earmarked for

distribution.

Last month, the U.S. Court of Appeals for the Fifth Circuit

rejected a $65 million settlement involving insurance companies

linked to Stanford, taking issue with deal terms that barred others

from asserting claims against the carriers. On Monday, the panel

also held up a potential $125 million judgment against Colorado

billionaire Gary Magness, a Stanford client who allegedly received

stolen funds before the fraud collapsed, while he pursues a defense

against the judgment.

Mr. Stanford is serving a 110-year prison sentence in central

Florida after his 2012 conviction on 13 felony counts.

Write to Andrew Scurria at Andrew.Scurria@wsj.com

(END) Dow Jones Newswires

June 18, 2019 15:46 ET (19:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

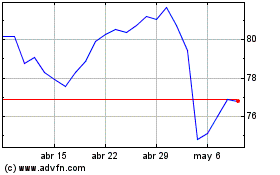

Toronto Dominion Bank (TSX:TD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Toronto Dominion Bank (TSX:TD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024