Global Stocks Waver as Gold and Bitcoin Soar

25 Junio 2019 - 5:49AM

Noticias Dow Jones

By Will Horner -- U.S. stock futures fell and Treasury yields neared 2%

-- Gold rallied and government bond yields slipped

-- Bitcoin reached a one-year high and gold rallied to record

for the year

European stocks followed Asian indexes marginally lower Tuesday

as investors turned to haven assets such as Treasurys and gold.

U.K. stocks were among the worst performers in Europe, with the

FTSE 100 sliding 0.2% on a day that saw the benchmark Stoxx Europe

600 index largely unchanged. One of the few bright spots for

investors was in Capgemini and smaller rival Altran Technologies:

the stocks soared after the French companies agreed to merge,

sending Altran shares up almost 22% while Capgemini advanced

7.5%.

Meanwhile, gold prices jumped 1.1% to their highest level this

year before trading at $1433.40 a troy ounce. The precious metal

has gained 13% so far in 2019.

Bitcoin also extended its gains, reaching a record for the past

year as it again crossed the $11,000 threshold. The world's most

popular cryptocurrency has soared 35% this month, boosted in part

by the unveiling of Facebook Inc.'s Libra digital currency for

mainstream users last week.

In Asia, Japan's Nikkei was down 0.4%, the Hang Seng in Hong

Kong slipped 1.2% and China's benchmark Shanghai composite fell

0.9%.

Assets perceived by investors to be safer stores of wealth

strengthened, with U.S. government bonds and gold both rising.

The yield on the 10-year U.S. Treasury note, which falls as the

price rises, dipped to 2.014%, from 2.021% on Monday. Gold prices

climbed 1.1% to $1,435.05 a troy ounce.

U.S. stock futures were also lower following a quiet session

Monday. Dow Jones Industrial Average and S&P 500 futures were

both down 0.2%.

Investors this week have largely held back from making big moves

as their focus has shifted to the G-20 summit in Japan due to begin

on Friday. A planned meeting between President Trump and Chinese

President Xi Jinping at the summit is seen as a potentially crucial

moment in the trade dispute between the two nations. The skirmish

has roiled markets this year and threatened to further weaken the

global economy, which has already shown signs of flagging after a

long period of expansion.

"Prudence is still justified because obviously the bar is quite

high for a truce between the U.S. and China on tariffs at this

week's G-20," said Kenneth Broux, a senior strategist at Société

Générale . "The danger is of course that everything ends in

acrimony and the whole moves of the past week or so reverse if the

U.S. decides to raise tariffs to 25% on the remaining $300 billion

[of Chinese goods]."

The WSJ Dollar Index, which tracks the dollar against a basket

of its peers, was broadly flat.

Elsewhere in commodities, oil prices were mixed with global

benchmark Brent crude shedding 0.2% to $64.07 a barrel, while U.S.

benchmark West Texas Intermediate was up 0.1% at $57.95.

(END) Dow Jones Newswires

June 25, 2019 06:34 ET (10:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

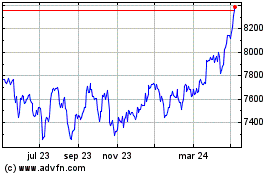

FTSE 100

Gráfica de índice

De Mar 2024 a Abr 2024

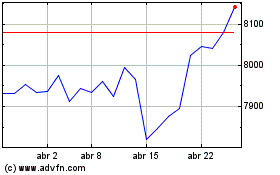

FTSE 100

Gráfica de índice

De Abr 2023 a Abr 2024