Euro Falls On Trade Uncertainty

27 Junio 2019 - 10:20PM

RTTF2

The euro declined against its major counterparts in the Asian

session on Friday, as investors became cautious ahead of the highly

anticipated meeting between U.S. President Donald Trump and Chinese

President Xi Jinping amid uncertainty over progress in talks to

resolve the stalemate.

Sentiment faded White House economic adviser Larry Kudlow

maintained his threat to impose new tariffs on Chinese goods if

talks do not end in progress at the Group of 20 summit in Japan

starting today.

Kudlow also said there are no preconditions set for the

U.S.-China trade meeting.

The Wall Street Journal had reported Thursday that China

President Xi Jinping is expected to present the U.S. trade

coalition with a set of terms, including the lifting of ban on the

sale of U.S. technology to Huawei before Beijing will settle the

trade dispute.

Flash inflation figures from euro area are due at 5:00 am ET.

Inflation is seen unchanged at 1.2 percent in June.

The euro edged lower to 1.1361 against the greenback, from a

high of 1.1376 seen at 8:15 am ET. The next possible support for

the euro is seen around the 1.12 level.

The European currency slipped to a 2-day low of 122.28 against

the yen, from yesterday's closing value of 122.54. The euro is seen

finding support around the 120.00 region.

The euro that ended Thursday's deals at 1.1103 against the franc

dropped to a 2-day low of 1.1083. On the downside, 1.09 is possibly

seen as the next support level for the euro.

The euro declined to a weekly low of 1.4880 against the loonie,

compared to 1.4886 hit late New York Thursday. Further downtrend

may take the currency to a support around the 1.46 region.

The common currency drifted lower to more than a 2-week low of

1.6204 against the aussie, after rising to 1.6242 at 9:45 pm ET. If

the euro slides further, it may find support around the 1.60

level.

The euro slipped to 1.6948 against the kiwi, its lowest since

June 6. At Thursday's close, the pair was worth 1.6969.

Continuation of the euro's downtrend may see it challenging support

around the 1.27 mark.

On the flip side, the euro traded in a narrow range against the

franc, with the pair moving between 0.8973 and 0.8976.

Looking ahead, U.K. GDP data for the first quarter and Eurozone

flash consumer inflation for June are due in the European

session.

In the New York session, Canada GDP data for April and

industrial product price index for May, U.S. personal income and

spending data for the same month and University of Michigan's final

consumer sentiment index for June will be featured.

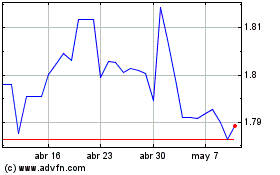

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024