Struggling Beauty Giant Coty to Restructure Operations -- Update

01 Julio 2019 - 9:19AM

Noticias Dow Jones

By Sharon Terlep

Cosmetics and fragrance giant Coty Inc. said it would

restructure its operations and take a $3 billion write-down on the

multibillion-dollar beauty business it acquired nearly three years

ago from Procter & Gamble Co.

Coty, whose products include OPI nail polish and CoverGirl

makeup, said Monday it struck a deal with creditors to provide

enough funding to carry out a restructuring plan that will downsize

staffing and product offerings while reorganizing the business into

distinct geographic units.

The company, which is controlled by European investment firm JAB

Ltd., has struggled with weak sales and executive turnover. Coty

expects to book $600 million in restructuring costs over several

years but didn't say how many jobs would be affected.

"Clearly we are under performing, we want to close the

performance gap." Coty CEO Pierre Laubies said in an interview.

"The way to turn around is to start quickly and build

progressively."

As part of the plan, Coty will move its management to Amsterdam

from London, which is closer to the company's main markets and a,

"cost efficient and tax stable location," Coty said in a

statement.

Job cuts will reduce costs by about $200 million a year,

representing roughly 10% of Coty's fixed costs, Chief Financial

Officer Pierre-André Terisse said. As of June 2018, Coty had about

20,000 full-time employees though it announced a restructuring

program in August 2018.

Coty has been weighed down by the $12 billion purchase in 2016

of P&G beauty brands. The company has said the brands were in

worse shape than Coty anticipated when agreeing to the deal and

have continued to decline as consumers shift away from mass-market

brands sold in drugstores.

The merger, completed in 2016, gave Coty more than 40 brands

from P&G like CoverGirl, Max Factor and Clairol to better

compete against other conglomerates.

Mr. Laubies said that despite the challenges he believes the

P&G acquisition was the right move for Coty in the long

run.

While Coty's luxury and professional divisions have performed

solidly, the consumer beauty unit, which comprised nearly half of

Coty's revenue, has continued to decline. Camillo Pane resigned

abruptly last fall as chief executive and was replaced by Mr.

Laubies, who previously ran European coffee company Jacobs Douwe

Egberts.

Mr. Laubies said Coty needs to stop losses and cut costs before

it can realistically focus on new products and growth. Immediate

priorities, he said, are cost cutting, reorganizing the company's

corporate structure and improving Coty brands' performance at

retailers.

"Our goal right now is not to gain market share but to stop the

erosion, " he said. In the near term the company will set more

modest forecasts, he said.

While Coty's mass-market brands have suffered as consumers shift

toward higher-end and niche brands, years of neglect and

mishandling have been bigger issues, Mr. Laubies said. "Our

performance is much lower" than the overall market, he said.

Wells Fargo analyst Joe Lachky said the goals seem ambitious,

adding, "Coty remains a long-term turnaround story and we note that

turnarounds never happen in a straight line."

JAB has run Coty since buying a perfume business sold by Pfizer

Inc. in 1992. The firm moved in February to boost its Coty stake to

60% from 40% by offering to buy $1.75 billion additional shares.

The move came after Coty shares had fallen sharply over the

previous year.

While JAB has become a consumer-goods powerhouse after a string

of acquisitions that gave it brands like Keurig Dr Pepper, Krispy

Kreme and Pret a Manger, Coty's purchase of the P&G brands has

been problematic. In addition to switching CEOs, a senior JAB

partner resigned as Coty's chairman last year.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

July 01, 2019 10:04 ET (14:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

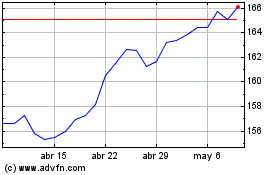

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

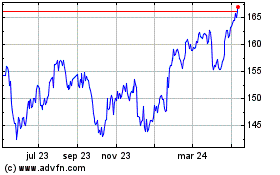

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024