By Sharon Terlep

Procter & Gamble Co. has spent years searching for a

smash-hit new product. Now the maker of Tide detergent and Gillette

razors hopes bug spray will break the drought.

The Cincinnati consumer-products giant is rolling out a line of

household insecticides safe for pets and people. The brand, called

Zevo, offers bug-killing sprays and an indoor trap for winged

insects. P&G hopes to eventually expand into safer topical and

outdoor bug killers.

It is the first creation to hit stores from P&G's

four-year-old Ventures unit, which seeks new business opportunities

and has become more important to P&G as the company works to

woo consumers increasingly drawn to niche and online-only

brands.

"People are stuck with this inevitable trade-off of, 'How do I

get rid of bugs without doing harm to my family?' " said Patrick

Kraus, Zevo marketing director, explaining the appeal to P&G of

getting into insecticides. "There's a tension there."

Zevo will go up against S.C. Johnson & Son Inc.'s Raid brand

sprays, which control nearly half the U.S. market and cost about

one-third as much. A 20-ounce can of Raid ant killer costs $4.27

online at Home Depot; a 10-ounce can of Zevo costs $6.97.

The difference is in the warning label. Children and pets should

stay away from surfaces treated by Raid, including the version

marked as safe for children and pets, according to Raid cans. Zevo

requires no such warning, Mr. Kraus said, because it uses a

chemical benign to humans and animals that targets a receptor found

only in insects' nervous systems.

S.C. Johnson said its products go through extensive risk

assessment and safety and efficacy testing. "When used according to

label directions, consumers can use all S.C. Johnson products with

confidence," the company said.

P&G acquired the spray technology from Envance Technologies,

a Morrisville, N.C.-based chemical company, which remains involved

in developing new products. A decade ago, P&G executives

decided against buying the same technology because the company felt

insecticide didn't fit its portfolio.

Zevo's other product, a box which uses ultraviolet light to draw

insects into a sticky cartridge that traps and kills them, came

from a pair of entrepreneurs who sold it to P&G in 2017. The

company didn't disclose financial terms of either deal.

Zevo products went on sale in Target Corp. stores this spring.

P&G started selling the box online in 2017, and began selling

the sprays online and in Home Depot last year.

Pest control, including topical, household and outdoor products,

is a $1.3 billion industry in the U.S., which has increased 6% over

the past four years, according to Nielsen. Raid has 49% of the U.S.

market, followed by Spectrum Brand Holdings Inc.'s Hot Shot brand

with 14% share, according to Euromonitor.

Breaking Raid's hold on the industry will be tough, especially

because people generally buy insecticides at home-improvement

retailers such as Home Depot and Lowe's, where P&G doesn't have

the same cachet, SunTrust analyst Bill Chappell said.

"S.C. Johnson has some pretty sharp elbows and a lot invested in

the space," he said. "It sounds great but do they have the pull

where the product is bought, and is the message something people

are really dying for?"

Beyond the U.S., demand for insecticides is growing quickly,

particularly in China, P&G's Mr. Kraus said. While S.C. Johnson

dominates its home market, the company's share of the $8.7 billion

global home insecticides market is 27%, according to Euromonitor.

Much of P&G's research focuses on critters living in overseas

markets.

For P&G, the Zevo rollout marks a different way of doing

business. For years, the company has struggled with bureaucracy

that often slowed and complicated product development. Its latest

billion-dollar business, Tide Pods, was released in 2012.

"We had to change the culture internally," said Leigh Radford,

general manager of the P&G Ventures unit. "It is about taking

the complexity out of the decision-making process -- a decision

should not take more than 24 hours."

P&G sales have picked up this year following price increases

on staples from diapers to toilet paper, and an internal

reorganization amid the company's proxy fight with activist

investor Nelson Peltz, who now sits on the company's board. Ms.

Radford said P&G's big business units have begun to integrate

some of Ventures' strategies.

Where roughly 200 people worked on one of P&G's last big

breakthroughs, the Swiffer mops, the Zevo team is 20 people, about

half of whom are working on other projects. Ventures works on

developing products in categories in which P&G has no

products.

Zevo began as an online-only brand, allowing the company to

quickly and directly glean consumer feedback. And rather than

building up a lab and hiring scientists, P&G rented space from

the nearby University of Cincinnati and tapped its entomologists

for bug expertise.

Gary Stibel, chief executive of New England Consulting Group,

said he recommended to P&G that it acquire the technology a

decade ago. It would have been a good investment then, he said, and

still is. "Nobody wants their pet to get sick," he said, "because

they are licking something off the floor."

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

July 08, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

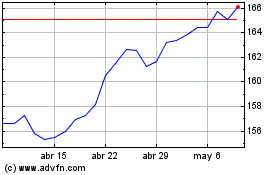

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

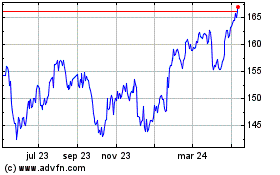

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024