TIDMTHS

RNS Number : 8280E

Tharisa PLC

09 July 2019

Tharisa plc

(Incorporated in the Republic of Cyprus with limited

liability)

(Registration number HE223412)

JSE share code: THA

LSE share code: THS

A2X share code: THA

ISIN: CY0103562118

('Tharisa' or the 'Company')

Production report for the quarter ended 30 June 2019

Overall production improvement sets up a strong finish

Salient features for the quarter ended 30 June 2019

-- Quarterly improvement in reef tonnes mined and milled up 2.0% and 5.4% respectively

-- Stripping ratio at 8.3 (m(3) :m(3) ) with pit redesign substantially completed

-- Platinum Group Metals ('PGM') recovery at 82.1% with PGM production of 34.1 koz

-- Chrome recovery at 65.5% with chrome production up 8.2% to 334.0 kt

-- Investment in fleet capacity demonstrating volume capability

and availability to meet future targets

-- Karo Mining has completed the first phase of its drilling campaign on time and within budget

Commenting on the production results, Tharisa CEO Phoevos

Pouroulis, said:

"The improvement in key production metrics sets the mine up for

a strong finish to the 2019 financial year and good momentum in to

2020. The pit redesign, which has been largely completed, and our

ability to move tonnage ensures that we develop a sustainable and

viable large-scale open pit operation, capable of producing volume

output for the years ahead. The changes we made in the past

quarters with regards to mining fleet improvement and pit

optimisations will benefit us into the future."

Safety

Safety is one of Tharisa's core values and the Company continues

to strive for zero harm at its operations. An LTIFR of 0.22 per 200

000-man hours worked was recorded at the end of the quarter.

Production update

The production update for the quarter ended 30 June 2019 is as

follows:

Quarter Quarter Quarter Quarter Nine Nine

ended ended on quarter ended months months

30 Jun 31 Mar movement 30 Jun ended ended

2019 2019 % 2018 30 Jun 30 Jun

2019 2018

------------ -------- ----------- ------------ -------- -----------

Reef mined kt 1 155.4 1 132.9 2.0 1 244.1 3 378.9 3 695.3

m(3)

Stripping ratio : m(3) 8.3 7.4 12.2 8.0 7.5 8.1

Reef milled kt 1 207.3 1 145.0(*) 5.4 1 291.2 3 544.8(*) 3 888.6

PGM flotation

feed kt 889.1 850.3 4.6 929.7 2 640.7 2 825.3

PGM rougher feed

grade g/t 1.45 1.46 (0.7) 1.54 1.48 1.53

PGM recovery % 82.1 85.5 (4.0) 85.6 81.2 84.0

6E PGMs produced koz 34.1 34.0 0.3 39.5 101.7 116.5

Average PGM contained

metal basket

price US$/oz 1 064 1 048 1.5 947 1 033 922

Average PGM contained

metal basket

price ZAR/oz 15 297 14 694 4.1 11 947 14 690 11 721

Cr(2) O(3) ROM

grade % 17.8 18.0 (1.1) 18.2 18.1 18.1

Chrome recovery % 65.5 62.9 4.1 67.8 62.4 66.5

Chrome yield % 27.7 27.0 2.6 29.1 26.7 28.5

Chrome concentrates

produced (excluding

third party) kt 334.0 308.7 8.2 376.3 948.1 1 108.8

Metallurgical

grade Kt 259.4 232.6 11.5 281.1 725.5 840.0

Specialty grades kt 74.6 76.1 (2.0) 95.2 222.6 268.8

Third party chrome

production kt 59.1 60.3 (2.0) 59.6 171.6 165.8

Metallurgical

grade chrome

concentrate contract US$/t

price CIF China 174 162 7.4 193 166 193

Metallurgical

grade chrome

concentrate contract ZAR/t

price CIF China 2 525 2 268 11.3 2 477 2 361 2 449

Average exchange

rate ZAR:US$ 14.4 14.2 1.4 12.6 14.2 12.7

----------------------- ------------ -------- ----------- ------------ -------- ----------- --------

(*) includes the processing of 23.1 kt and 99.0 kt of

commissioning tails through the processing plants for the quarter

ended 31 March 2019 and nine months ended 30 June 2019

respectively

Mining

Reef tonnes mined continued to improve at the Tharisa Mine with

an increase of 2.0% as compared to the previous quarter, to 1 155.4

kt mined. Additional material available to the mine resulted in

total reef tonnes milled increasing by 5.4% to 1 207.3 kt in the

quarter, bringing total tonnes mined to 3 378.9 kt and total tonnes

milled to 3 544.8 kt for the year to date. The mine recorded a

pleasing 12.2% improvement in stripping ratio, up from 7.4 m(3)

:m(3) in the March quarter to 8.3 m(3) :m(3) in the June quarter

under review. As part of the ongoing pit redesign, the mine moved

an additional 470 000 Mm(3) of in-pit material during the quarter

to optimise the pit. When included in the stripping ratio

calculation, the total waste volume moved by the mining fleet in

the second quarter achieved a ratio of 9.7 m(3) :m(3) as compared

to 9.4 m(3) :m(3) in Q2. The Tharisa Mine is continuing to create

flexibility which will result in improvements to the reef mix

thereby improving plant feed grades.

Processing

PGM production increased by 0.3% to 34.1 koz (6E basis) over the

previous quarter and recoveries were maintained at 82.1%. The

slight decrease compared to the previous quarter being due to the

MG reef horizon mix into the plant differing as a result of the

planned mining.

Chrome concentrate production increased by 8.2% to 334.0 kt,

with recoveries improving by 4.1% to 65.5% compared to the previous

quarter. Of the total chrome concentrates produced, 259.4 kt were

metallurgical grade, an improvement of 11.2% versus the previous

quarter and 74.6 kt were speciality grade, versus 76.1 kt in the

previous quarter,

The chrome production for the quarter from the Lonmin K3 chrome

plant was 59.1 kt compared to 60.3 kt in the previous quarter.

Market update

The average PGM contained metal basket price for the third

quarter was US$1 064/oz (ZAR15 297/oz), an increase of 1.5% in US$

terms from the last quarter and 4.1% in ZAR terms.

The average chrome price received, while slightly up in the June

quarter at US$174/t compared to US$162/t in the March quarter, is

showing a downward trend on a nine month basis at US$166/t, with

current spot around US$140/t. This compared to an average of

US$193/t for the comparable nine month period in financial year

2018.

New Business

Karo Mining Holdings Limited has completed the first phase of

its drilling campaign on time and within budget, measuring a total

of 30 km of diamond core drilling over 206 holes. Preliminary

resource data will be available in November 2019.

Tharisa has completed the value engineering and front-end

engineering work undertaken on the data used in the Definitive

Feasibility Study for the Vulcan Plant. This, together with input

from engineering and cost consultants will be presented to the New

Business Development Committee of the Tharisa Board for

approval.

Outlook

Tharisa's FY2019 production guidance remains unchanged.

The above information has not been reported on or reviewed by

Tharisa's auditors.

Paphos, Cyprus

09 July 2019

JSE Sponsor

Investec Bank Limited

Investor relations contacts:

Daniel Thöle / Ilja Graulich

+27 61 400 2939 / +27 83 604 0820

Financial PR contacts:

Bobby Morse / Augustine Chipungu

+44 020 7466 5000

tharisa@buchanan.uk.com

Broker contacts:

Peel Hunt LLP (UK Joint Broker)

Ross Allister / James Bavister / David McKeown

+44 207 7418 8900

BMO Capital Markets Limited (UK Joint Broker)

Jeffrey Couch / Thomas Rider

+44 020 7236 1010

Berenberg (UK Joint Broker)

Matthew Armitt / Detlir Elezi

+44 20 3207 7800

Nedbank Limited (acting through its Corporate and Investment

Banking division) (RSA Broker)

Shabbir Norath

+27 11 295 6575

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLRPMJTMBBMBJL

(END) Dow Jones Newswires

July 09, 2019 04:28 ET (08:28 GMT)

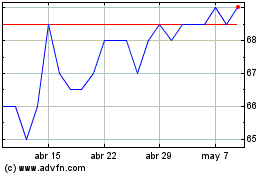

Tharisa (LSE:THS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tharisa (LSE:THS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024