Euro Mixed After ECB Minutes

11 Julio 2019 - 3:51AM

RTTF2

The euro was trading mixed against its major opponents in the

European session on Thursday, after minutes from the European

Central Bank's recent monetary policy meeting showed that Governing

Council was determined to ease monetary policy further in case of

adverse contingencies through restarting asset purchase program and

lowering policy rates.

In the light of low inflation, there was broad agreement that it

was important for the Governing Council to demonstrate its

determination to act by adjusting its monetary policy stance at the

current meeting, and to further prepare for adverse contingencies

in the period ahead, the minutes from the monetary policy meeting

held on June 5 and 6 showed.

"Considering the outlook and risks for the external environment,

members highlighted the ongoing weakness in global trade, and

concern was expressed about more pervasive and prolonged

uncertainties in the external environment and their adverse impact

on the global growth outlook for some time to come."

With regard to the weakening of the economic outlook and the

muted inflation developments, the extension of the calendar element

of the forward guidance on interest rates was widely seen as

appropriate, it said.

Consequently, the expected timing of an ECB policy rate

"lift-off" had shifted out substantially, with some

market-perceived chance of rate cuts, it added.

Final data from Destatis showed that Germany's consumer price

inflation accelerated as initially estimated in June.

Consumer prices advanced 1.6 percent year-on-year in June,

faster than the 1.4 percent increase in May.

The currency showed mixed trading against its major counterparts

in the Asian session. While it dropped versus the yen and the

franc, it was steady against the pound. Against the greenback, it

rose.

The euro bounced off to 121.95 against the yen and held steady

thereafter. This follows an early 3-day low of 121.62 hit at 11:00

pm ET. The euro-yen pair was valued at 122.02 when it ended deals

on Thursday.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary activity declined in May after rebounding in

the previous month.

The tertiary activity index fell 0.2 percent month-on-month in

May, reversing a 0.8 percent rise in April. Economists had expected

a 0.1 fall.

After rising to a 6-day high of 1.1281 against the greenback at

11:15 pm ET, the euro eased slightly around 6:00 am ET and moved

sideways since then. At yesterday's close, the pair was worth

1.1251.

The euro slipped to a 2-day low of 0.8969 against the pound from

yesterday's closing value of 0.8995. The euro is seen finding

support around the 0.88 region.

Data from the Royal Institution of Chartered Surveyors showed

that UK house price balance improved unexpectedly in June as buyers

for property increased for the first time since late 2006.

The house price balance rose to -1 percent in June from -9

percent in the previous month. The score was forecast to fall to

-12 percent.

The euro that closed Wednesday's trading at 1.1131 against the

franc depreciated to near a 2-week low of 1.1105. On the downside,

1.09 is possibly seen as the next support level for the euro.

Looking ahead, U.S. monthly budget statement for June is due in

the New York session.

Federal Reserve Chairman Jerome Powell will testify on the

Semiannual Monetary Policy Report before the Senate Banking

Committee in Washington DC at 10:00 am ET.

At 1:30 pm ET, Federal Reserve Governor Randal Quarles will

deliver a speech about financial regulation and monetary policy at

an event hosted by the Bipartisan Policy Center in Washington

DC.

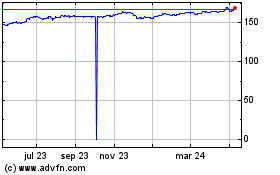

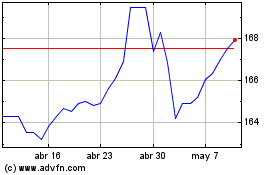

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024